You spoke, and we listened: you love social media benchmarks.

Thanks to your overwhelming interest in the Social Media Industry Benchmark Report the last few years, we’re back with the most comprehensive version yet that surveys more than 1,800 of the most engaging brands and companies to dig into what’s behind their social media success.

The Benchmarks:

We’ve got the most important metrics across 12 top industries from January–December 2018: Alcohol, Fashion, Food & Beverage, Health & Beauty, Higher Ed, Home Decor, Hotels & Resorts, Influencers, Media, Nonprofits, Retailers, and Sports Teams.

This report has everything you need to know to benchmark your social media success on Facebook, Twitter, and Instagram against your competitors across these 12 (!) major industries. We also feature tons of insights about how social media engagement has changed over the last year for these industries so you can improve and adapt your strategy in 2019.

In addition to the social stats you’ve come to know and love, like channel insights, best post types, and more, we also added two new industries (Alcohol and Retail) this year and dug into Twitter hashtags.

Now, let’s get benchmarking.

Social Media Benchmark Methodology

To spot trends and identify social media benchmarks, we focused our analysis on the top three channels for brands: Facebook, Instagram, and Twitter. We used Rival IQ to dig deep into engagement rates, posting frequency, post types, and hashtags.

We define engagement as measurable interaction on social media posts, including likes, comments, favorites, retweets, shares, and reactions. Engagement rate is calculated based on all these interactions divided by total follower count.

We expanded our list this year to 12 top industries (industries with an * are new this year):

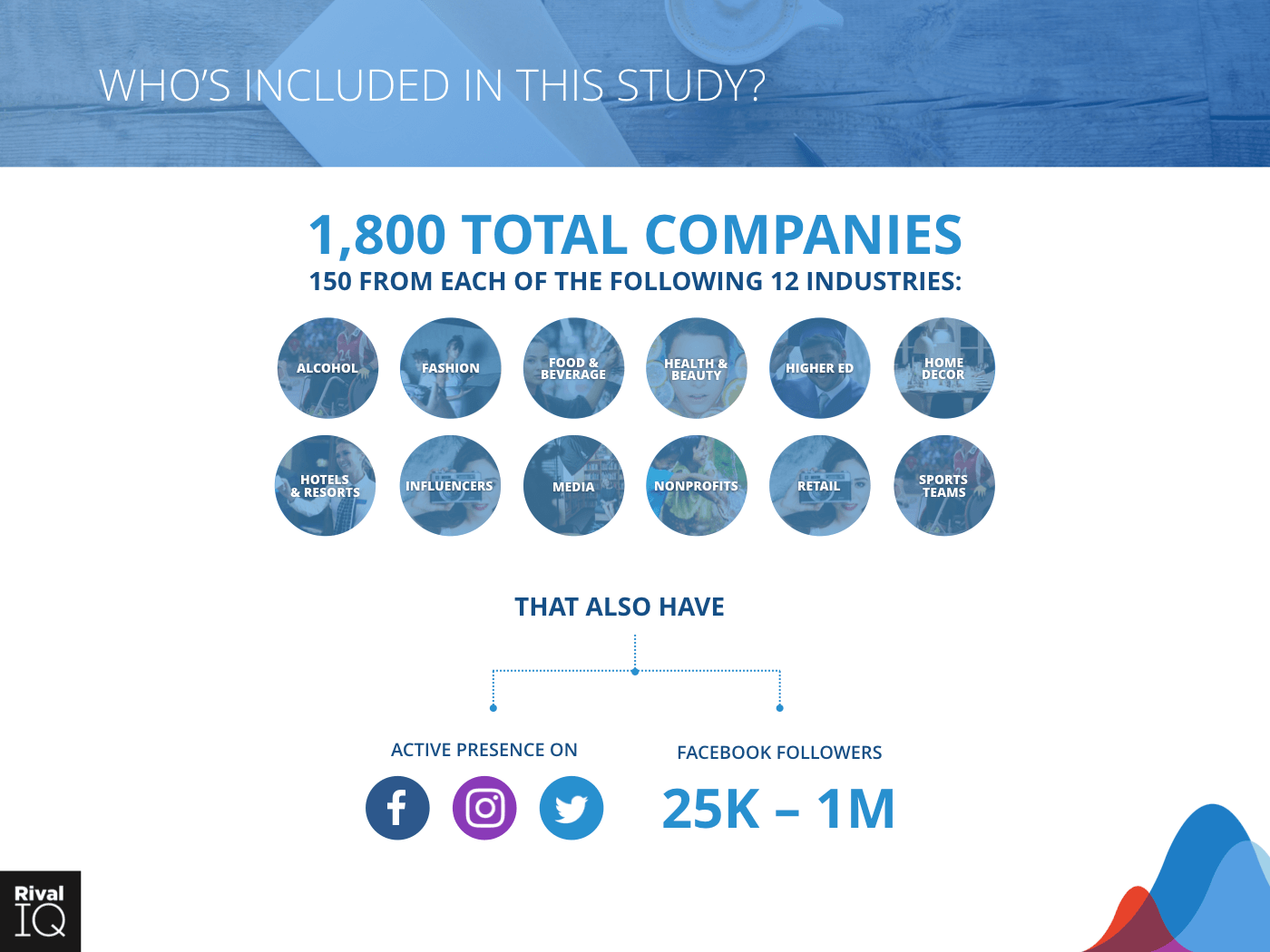

The makeup of the 2019 Social Media Industry Benchmark Report

Within this report, we provide a representative sample of national and international companies in each industry by selecting 150 companies at random from each industry from our database of over 150,000 companies. Companies selected had active presences on Facebook, Instagram, and Twitter as of January 2018, and had Facebook fan counts between 25,000 and 1 million as of the same date.

We used median performance from the companies selected for each industry to compile the data for this report.

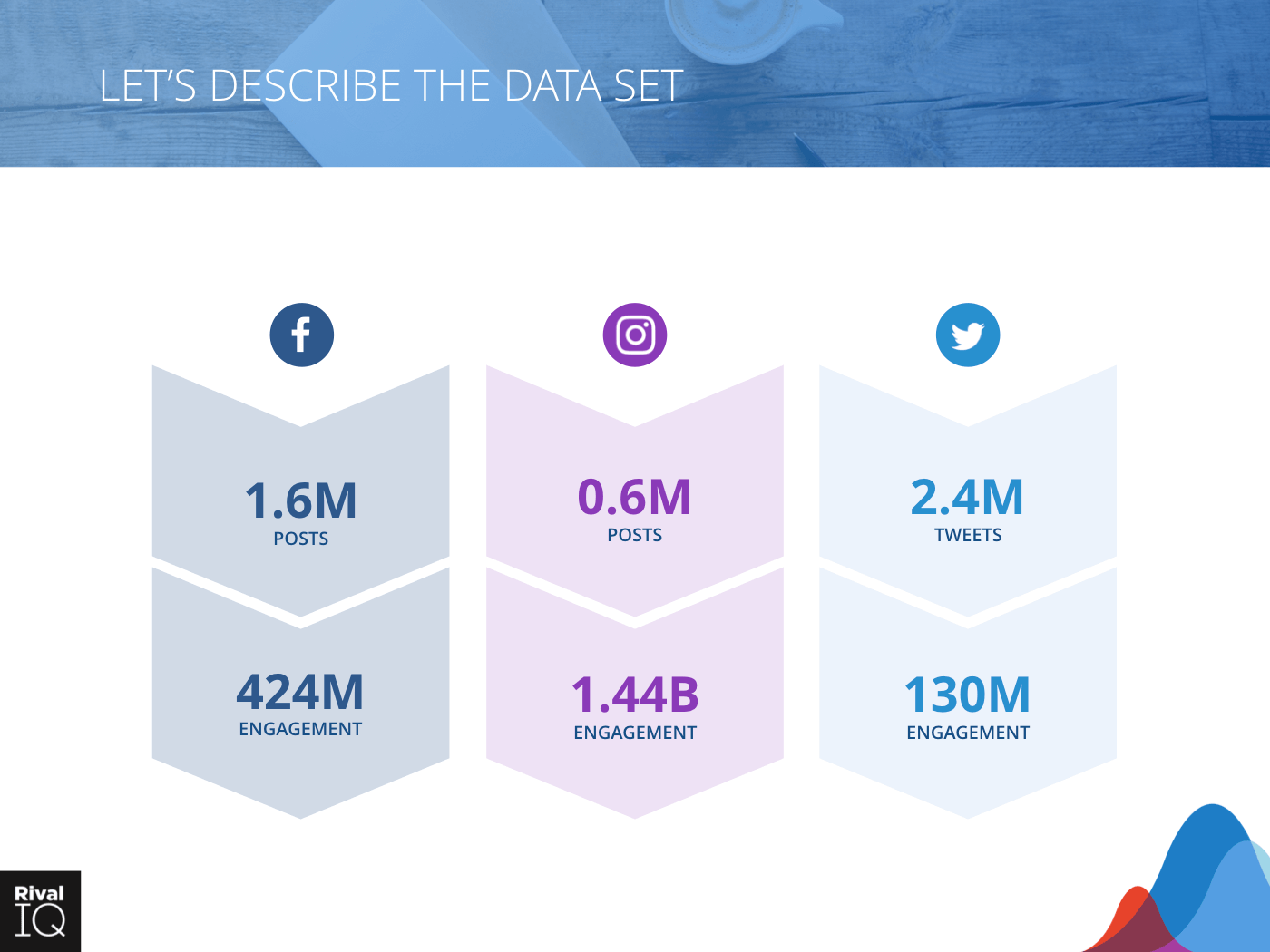

Post and engagement counts for Facebook, Instagram, and Twitter

Why do we benchmark?

Social media success is about so much more than getting the most comments or profile clicks: it’s about increasing engagement while also growing or maintaining the percentage of your audience that engages as you grow your audience.

We purposely focus this study on engagement rate instead of “vanity metrics” like follower counts because we know savvy social marketers want to know how they’re doing in relation to their competitors. Why? Because benchmarks are relative.

We dive deep for all the main industries with tons of different social media stats, and include a wide variety of companies in each industry to make sure you’re comparing your performance to true median performance.

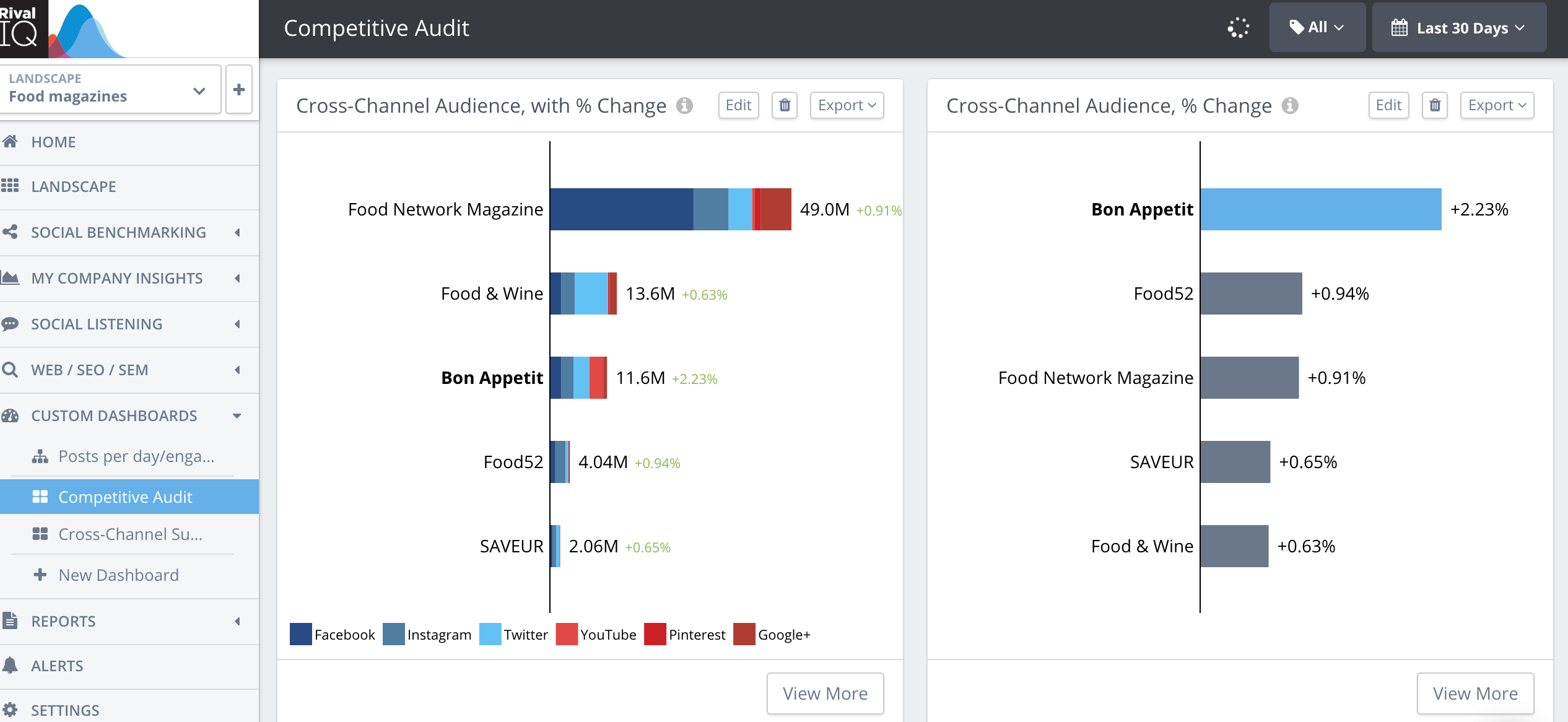

Once you’ve had a chance to read through the report, you can compare your social media performance live using our Explore landscapes. These interactive reports feature live social media benchmarks and metrics from a sample of companies from each industry represented in this study, like hashtag performance, top post types, and so much more on Facebook, Instagram, and Twitter.

If you’re still hungry for more benchmarking, run a free Head-to-Head report to see how you measure up to both your competition and against social media benchmarks represented in this study.

(Oh, and if you’re a Rival IQ customer or in a trial, you can pop those stats right into your Rival IQ account for even more comparisons.)

The metrics that matter

We’re firm believers in the power of engagement rate per post because it controls for post volume and audience size, and because this metric is relied on across the marketing world as the one to beat.

With that core metric in mind, we measured how each industry’s engagement rate stacked up against posting frequency, post media types, hashtags, and so much more for a true sense of social performance.

Here are a few of the most important social media benchmarks and metrics covered in this study:

- Posts per day

- Posts per week

- Engagement rate

- Top hashtags by engagement rate on

Instagram and Twitter

In addition to our social media industry breakdowns, we also compare all the industries together so you can see how things shake out across the board. If you’re having a tough time on Facebook this year, use these all-industry graphs to see if other industries are feeling the burn too (spoilers: they are).

Quick note: the truest measure of your social content’s resonance would be engagement divided by unique reach (the count of unique people who saw your content) or impressions (the number of times your content was displayed). Unfortunately, due to Facebook, Instagram, and Twitter API restrictions, we aren’t able to include this particular stat.

Grab the full report free.

Download the report nowAll-Industry Social Media Benchmarks

All-Industry: Facebook

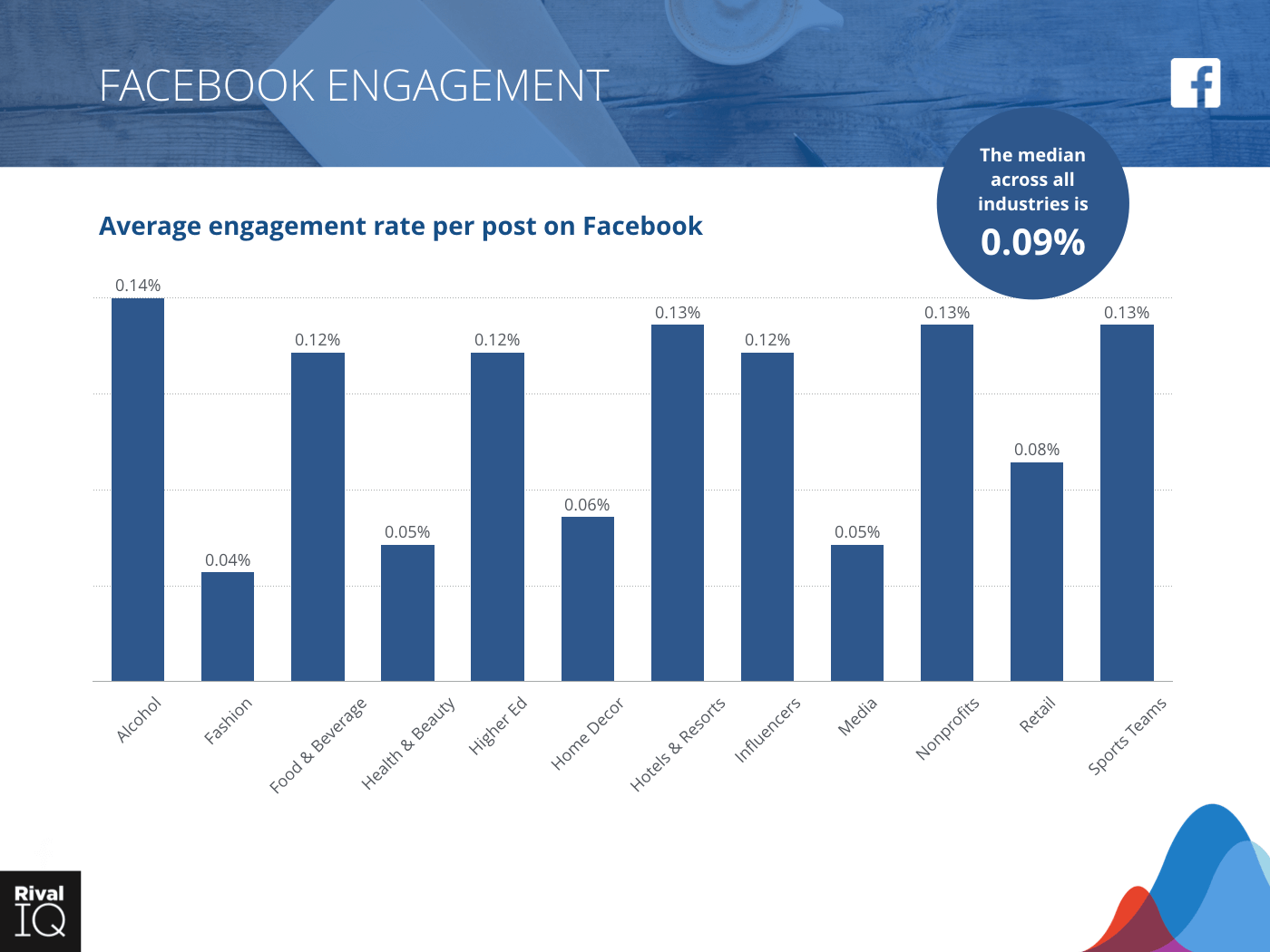

Average Facebook engagement rate per post, all industries

Every industry saw a dramatic decline in Facebook engagement rate this year, and for many, that meant less than half than last year’s engagement. The median last year was 0.16%, a number that no industry median reached this year.

It’s worth noting that 2018 marked a change in Facebook’s algorithm that promised to display more content from friends and family and less from brands in the News Feed. With this change, it’s no surprise that Facebook engagement took a dip across all industries this year.

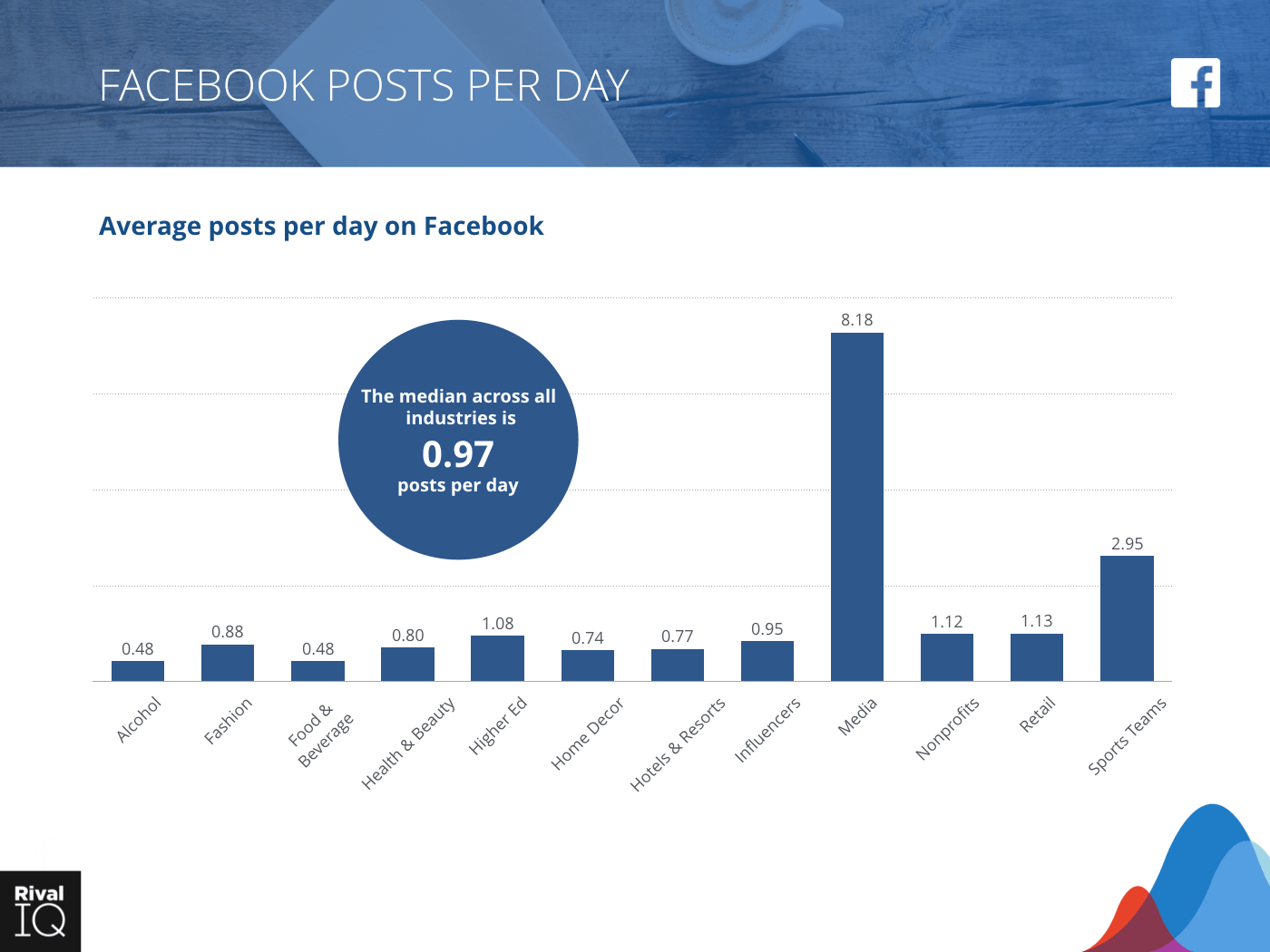

Average Facebook posts per day, all industries

Due in part to this algorithm shift, brands aren’t seeing as much of a return on their organic activity and have reduced their output accordingly. Media and Sports Teams are still the most frequent posters on this channel.

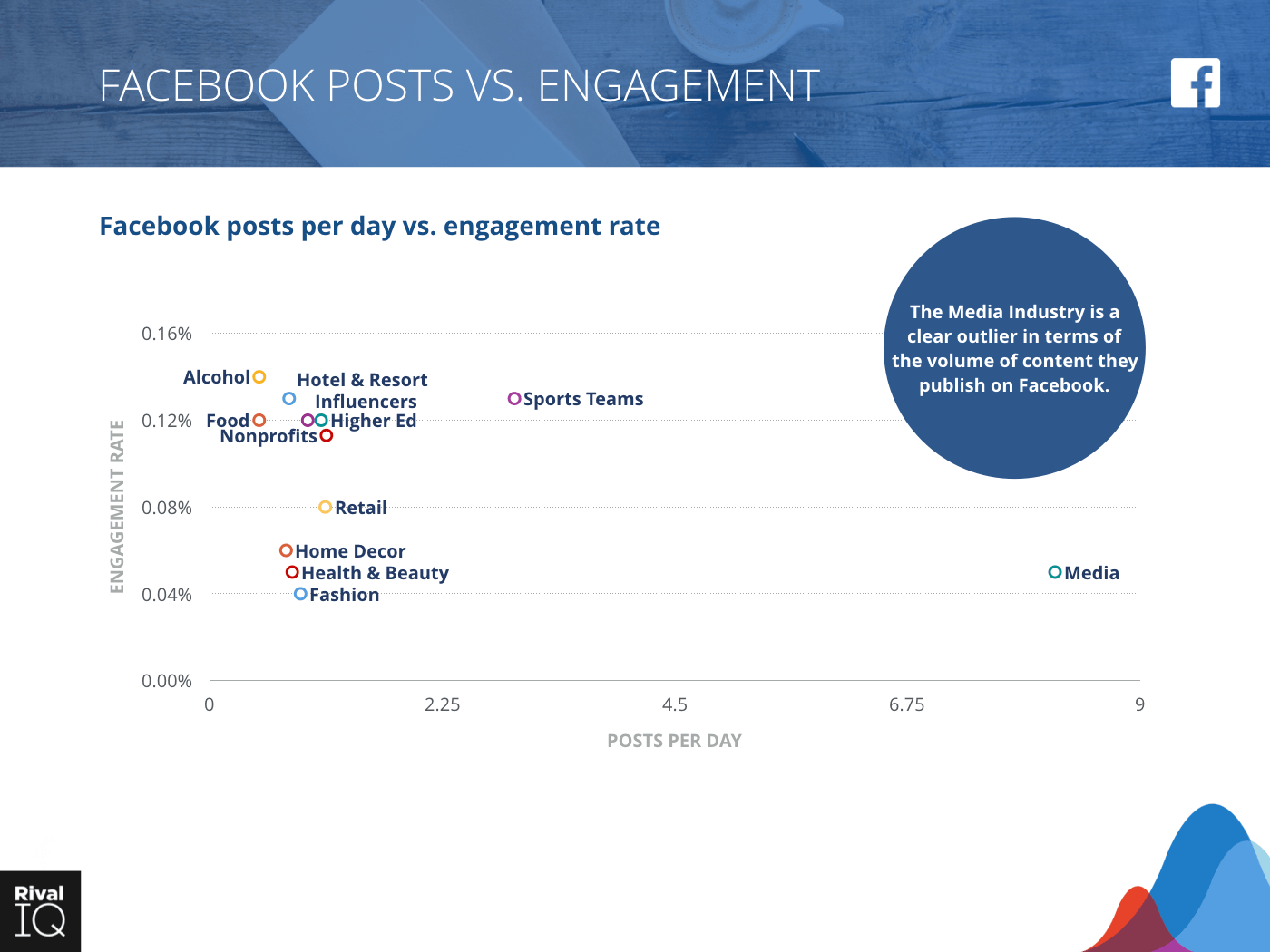

Facebook posts per day vs. engagement rate per posts, all industries

Some of the most infrequent posters (Alcohol, Food & Beverage, and Hotels & Resorts) top the engagement charts, while posting frequency outlier Media is near the bottom.

All-Industry: Instagram

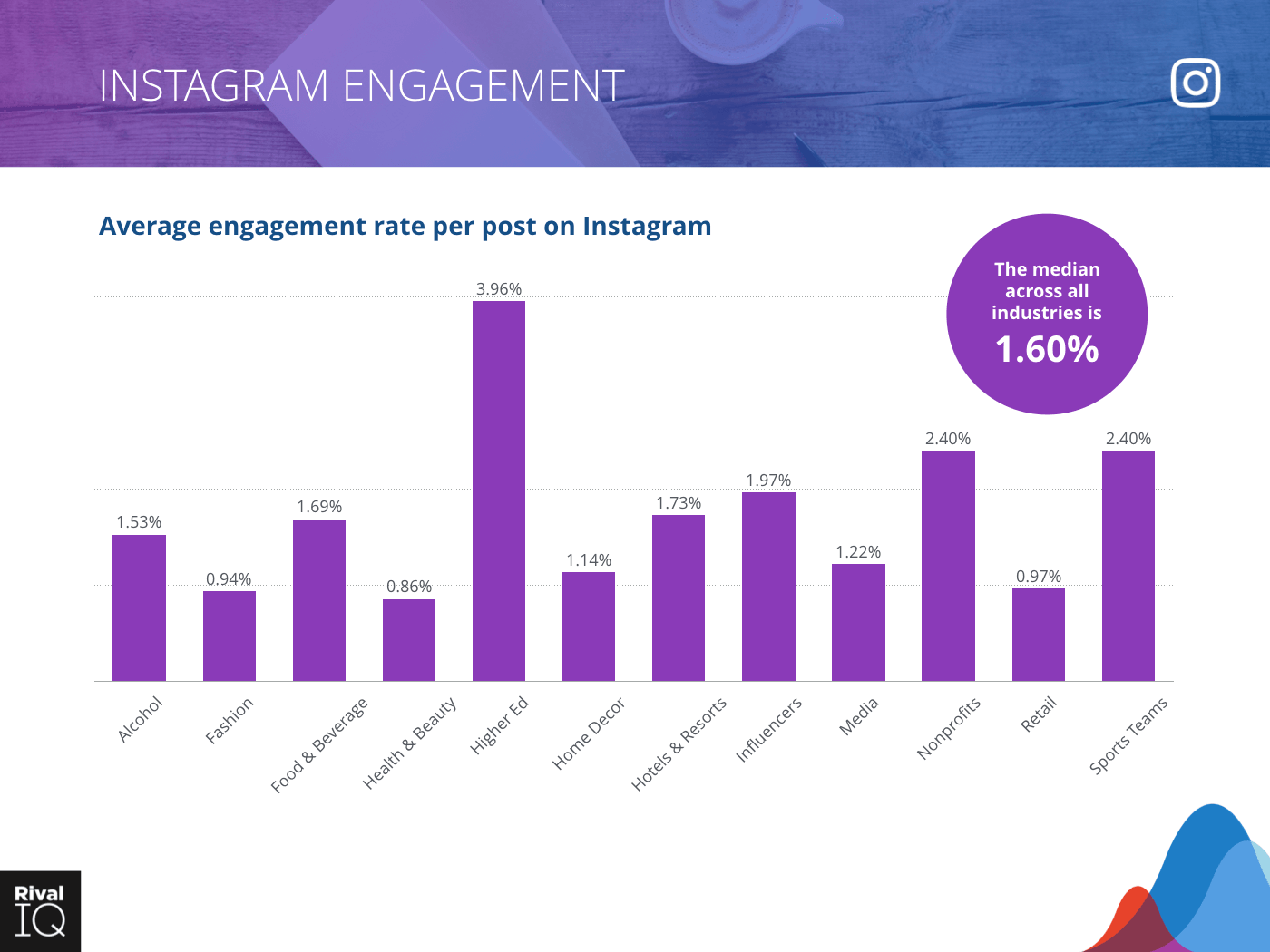

Instagram average engagement rate per post, all industries

Higher Ed dramatically outperformed other industries on Instagram again, while brands in other industries saw a slight drop: last year’s median engagement rate was 1.73%.

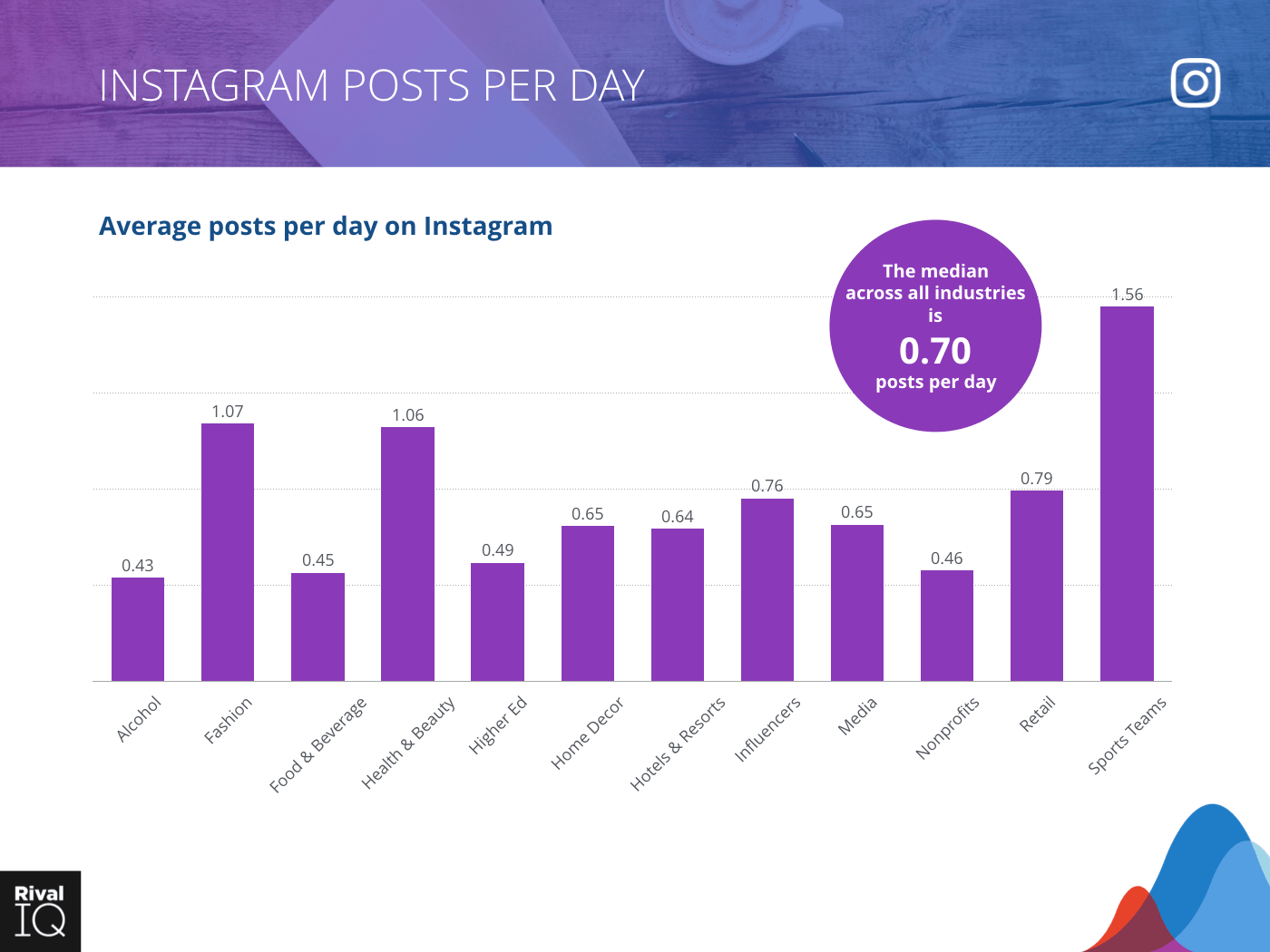

Instagram posts per day, all industries

Brands across the board maintained (but didn’t increase) their Instagram posting frequency in place this year. Sports Teams still led in frequency, but the median hardly charged at all.

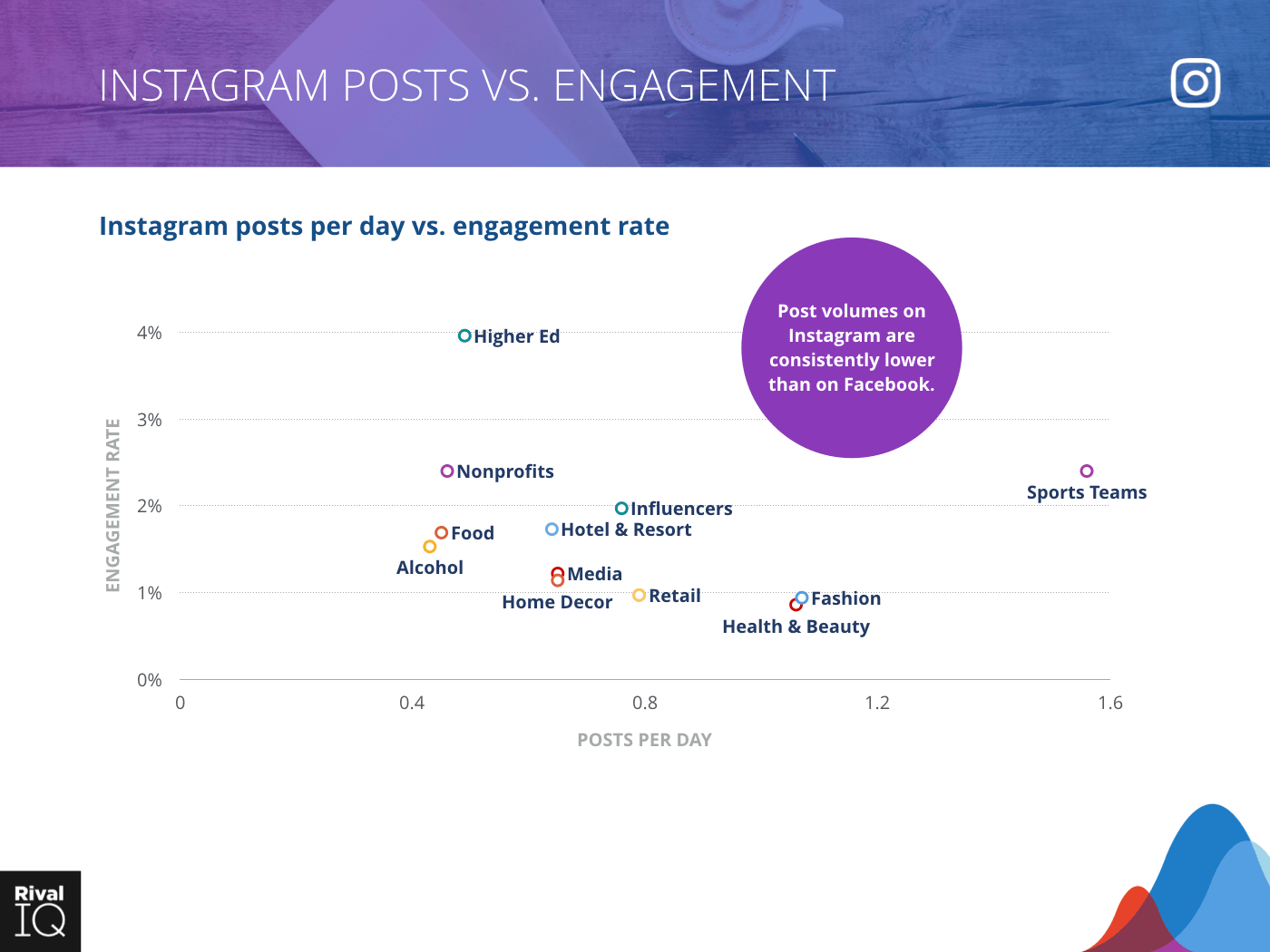

Instagram posts per day vs. engagement rate, all industries

More isn’t necessarily better on Instagram (or anywhere else, really): with the exception of Sports Teams, the industries with the highest per-post engagement rates post less often.

See how you stack up against your biggest Instagram competition.

Run a free Head-to-Head ReportAll-Industry: Twitter

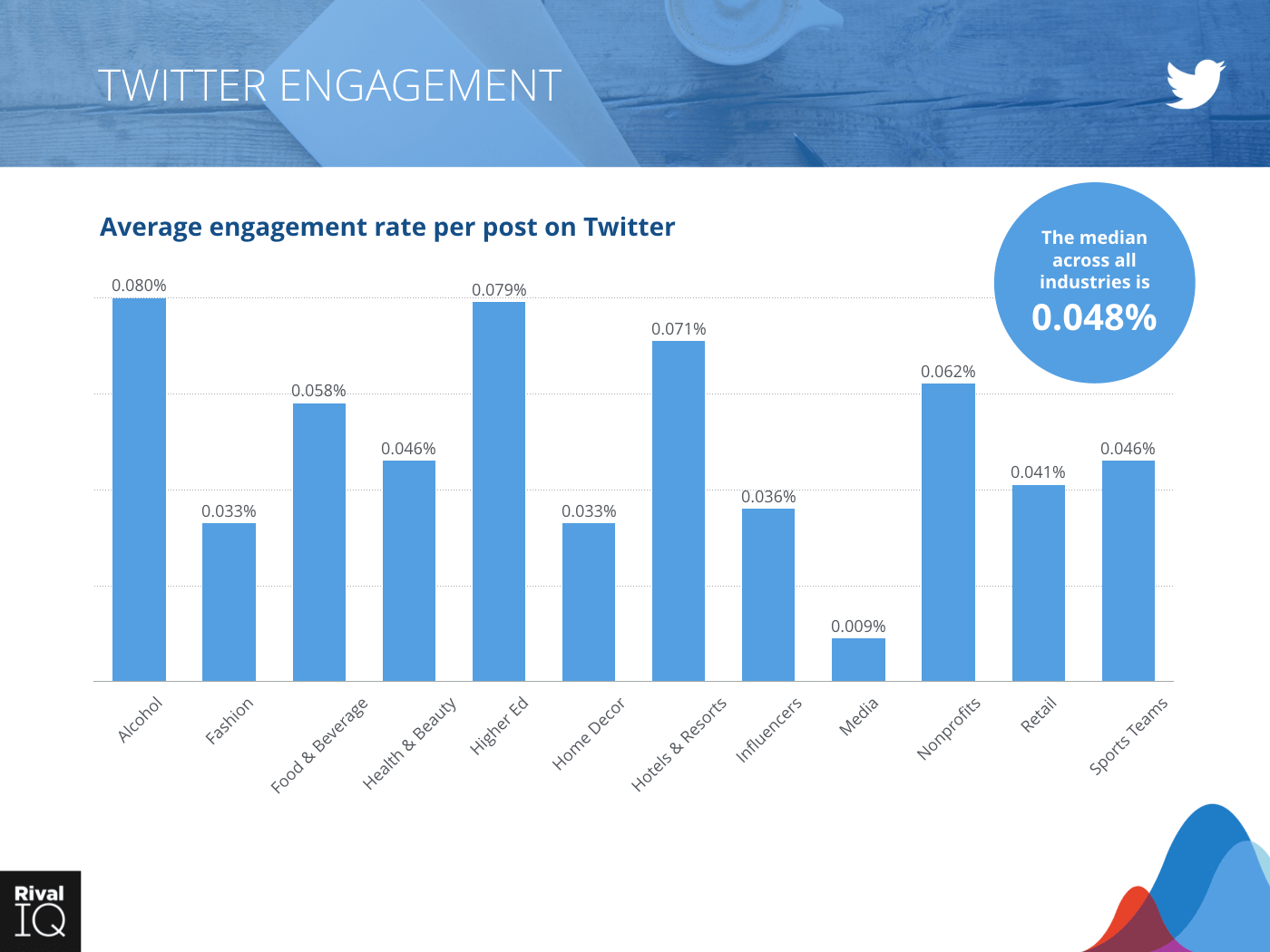

Twitter engagement remained consistent this year, with Higher Ed and Alcohol leading the pack and Media lagging far behind.

The average brand in our study posted about 25% less than the previous year, though companies in Media and Sports Teams continue their relentless pace again this year.

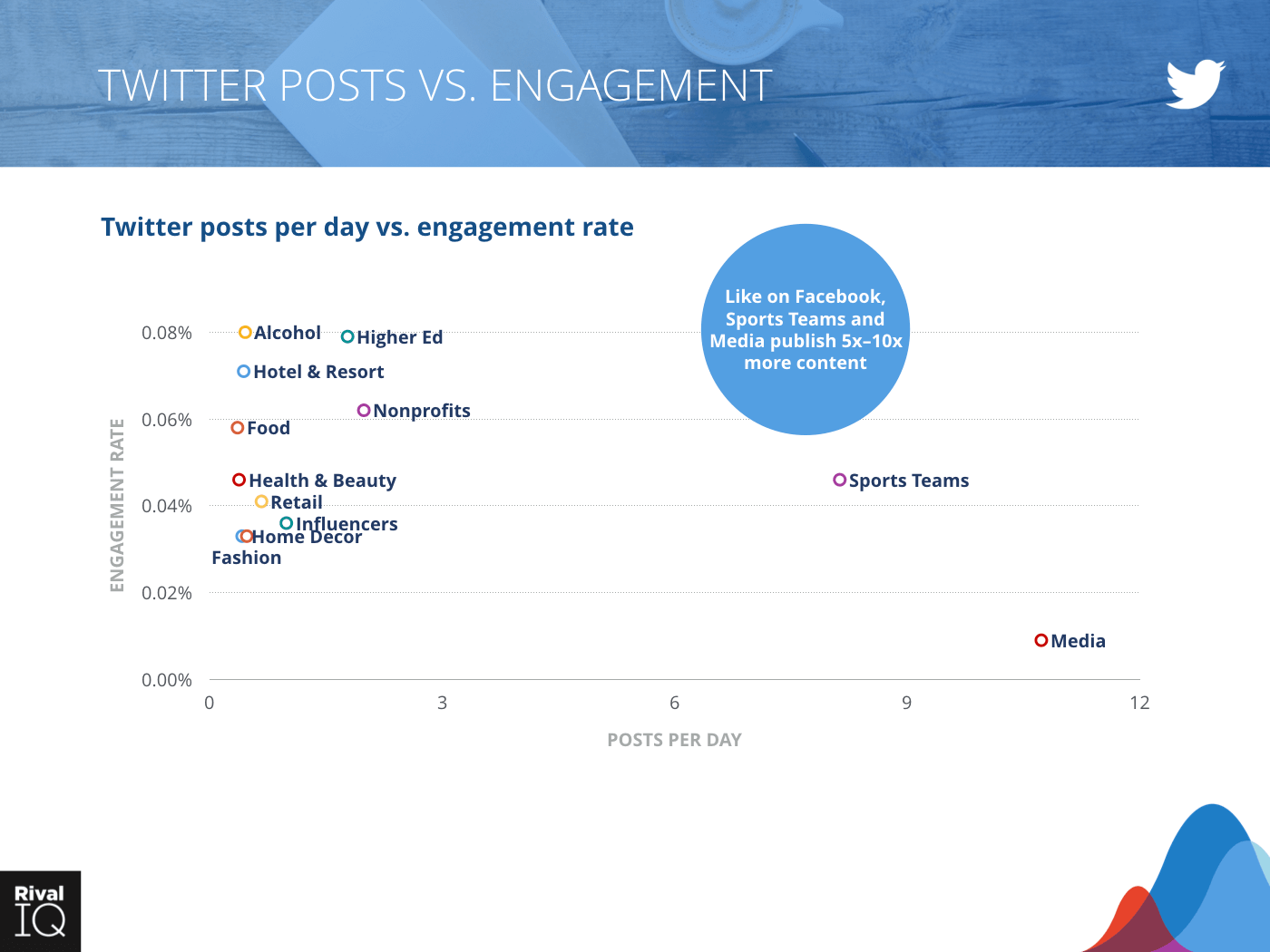

Twitter posts per day vs. engagement rate, all industries

There is no correlation between median posting frequency and engagement. Sports Teams manage to maintain average engagement while posting almost 9 times a day. Sports fans clearly love to engage with their teams on Twitter.

Industry Snapshot: Alcohol

Cheers to beer/wine/spirits brands for capturing attention on notoriously tricky Facebook and Twitter, with winning engagement on both channels.

A few ways Alcohol brands can keep up the pace:

- With photos and videos performing so well on Facebook and Twitter, there’s lots of room for Alcohol brands to take a bite out of the Instagram apple.

- While these brands boast high engagement, their post frequency was below average.

Overview of all benchmarks, Alcohol

Notable Alcohol brands in our random sampling include Tito’s Handmade Vodka, Night Shift Brewing, Stone Brewing, Blue Chair Bay Rum, Founder’s Brewing, and Buffalo Trace.

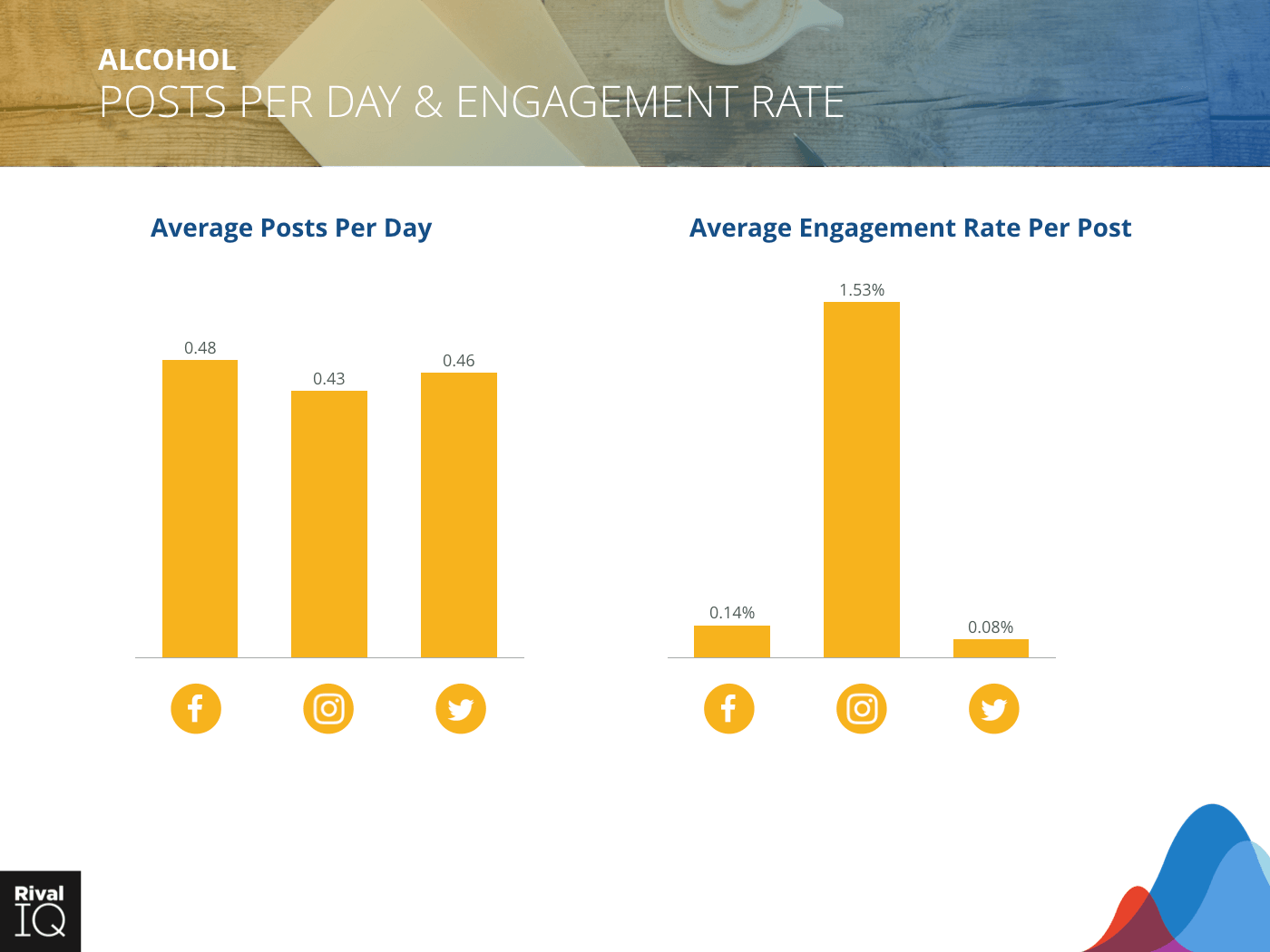

Posts per day and engagement rate per post across all channels, Alcohol

Every industry in this study sees their highest engagement on Instagram, but Alcohol brands should raise a glass for their performance on Facebook and Twitter (while angling for more consistent posts on Instagram).

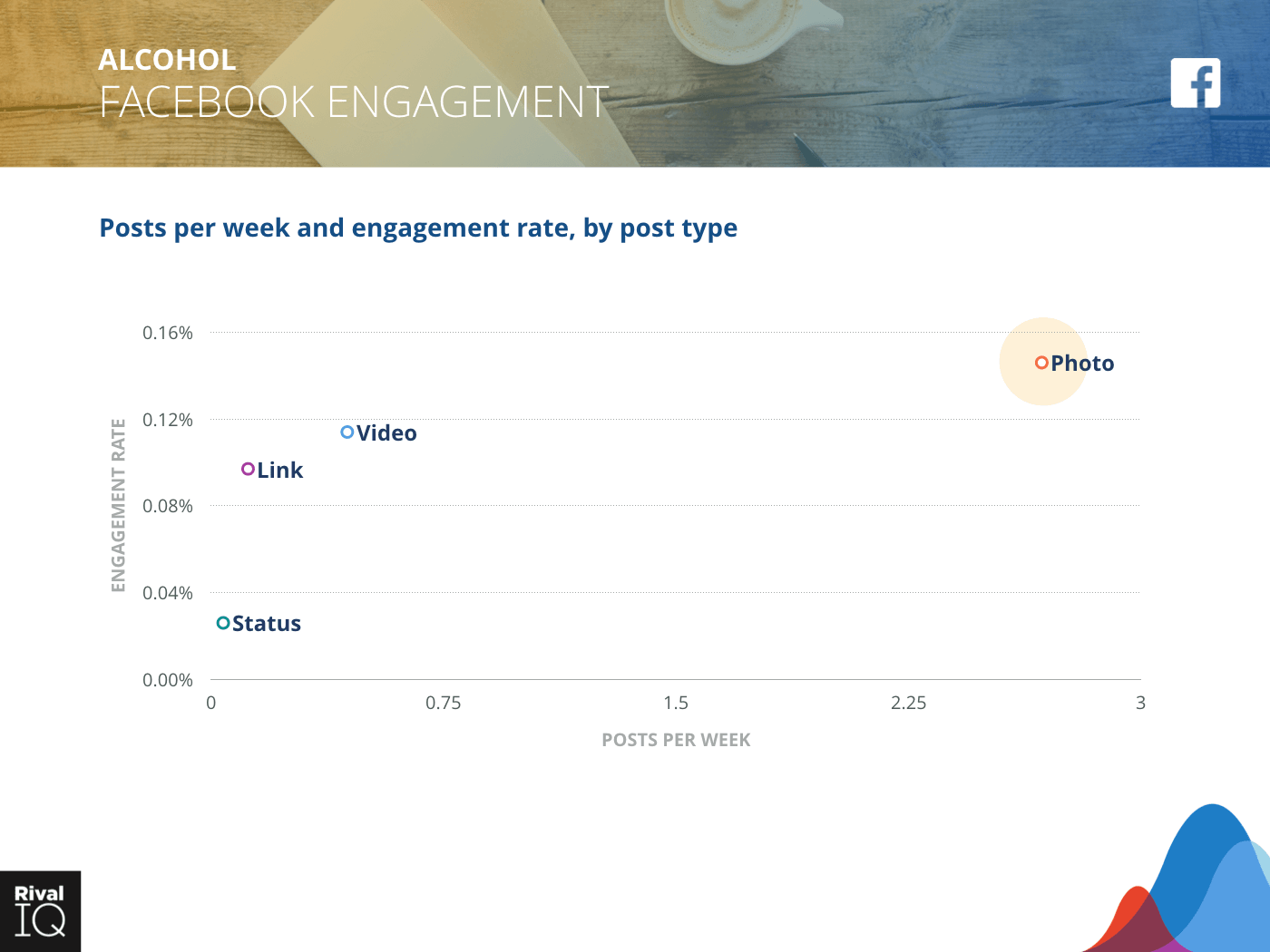

Facebook posts per week and engagement rate by post type, Alcohol

No surprises here that visual post types engage more Alcohol followers on Facebook. These brands are paying close attention to their highest-performing post type (photos) and concentrating their posts where it matters.

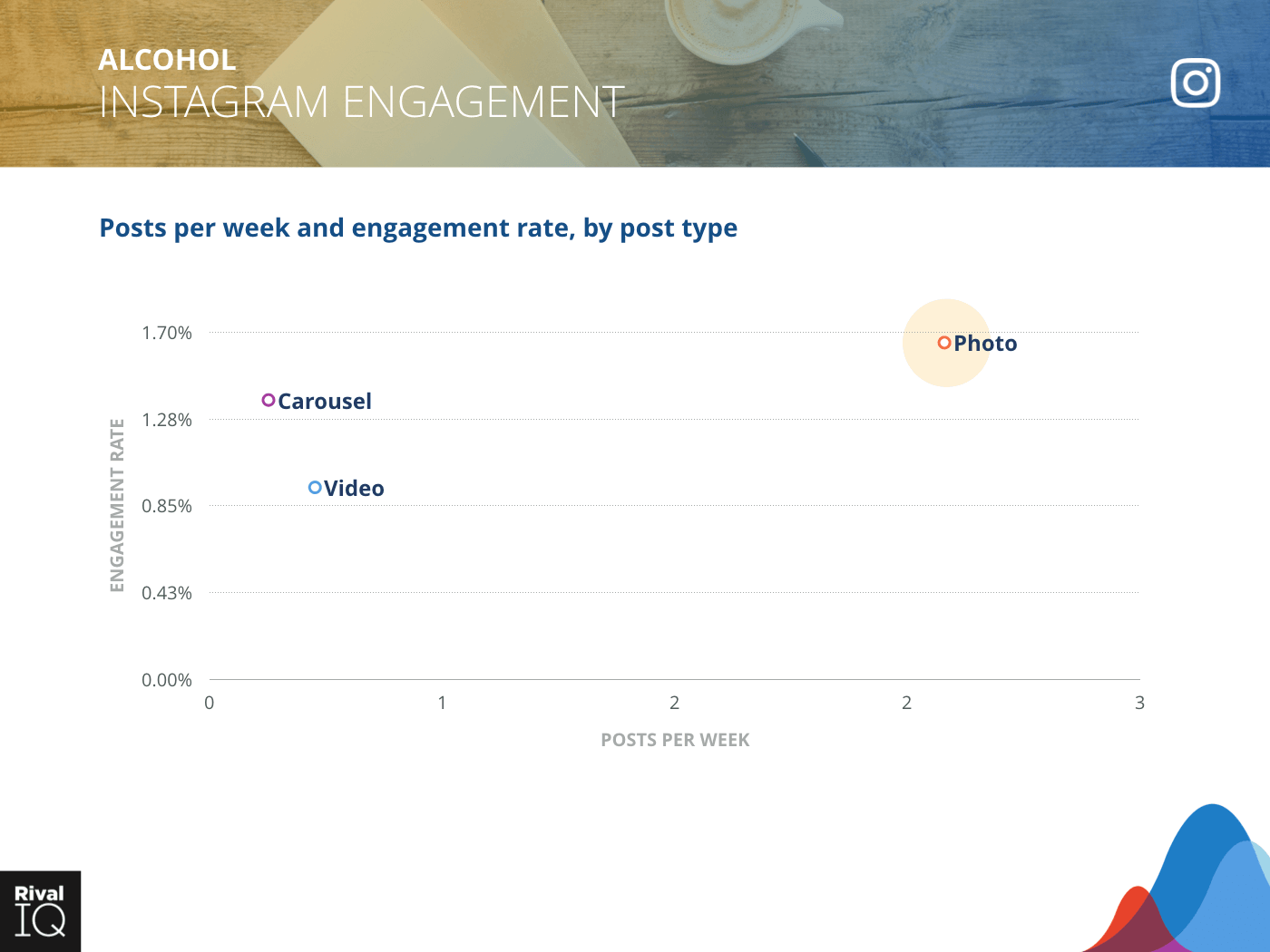

Instagram posts per week and engagement rate by post type, Alcohol

As for many other brands on Instagram, photos are out in front for Alcohol brands, but there’s more opportunity to integrate carousels into their social strategy in the coming year.

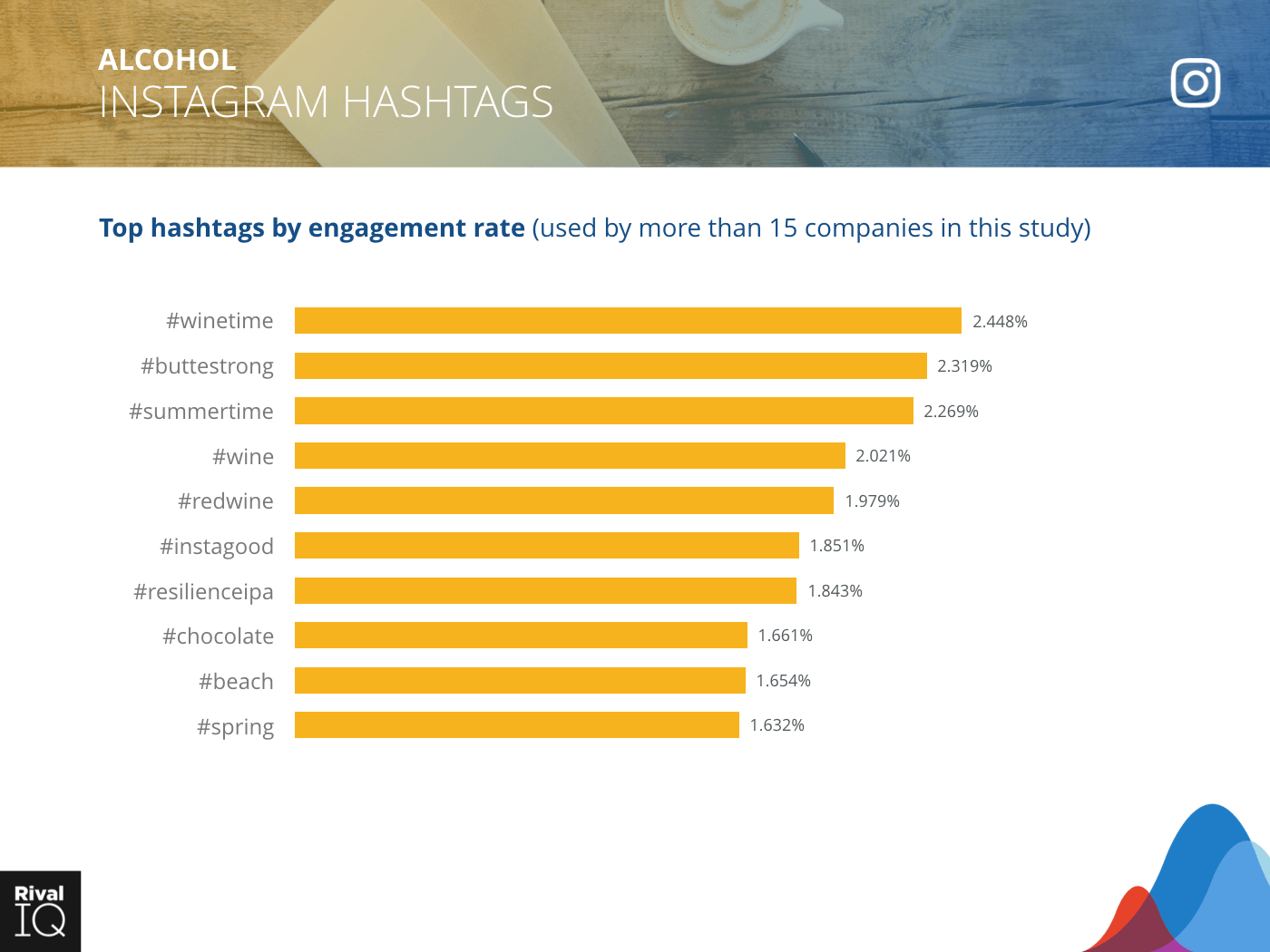

Top Instagram hashtags by engagement rate, Alcohol

Alcohol brands are all about industry-specific hashtags on Instagram, along with reminders about where and when their products are best enjoyed.

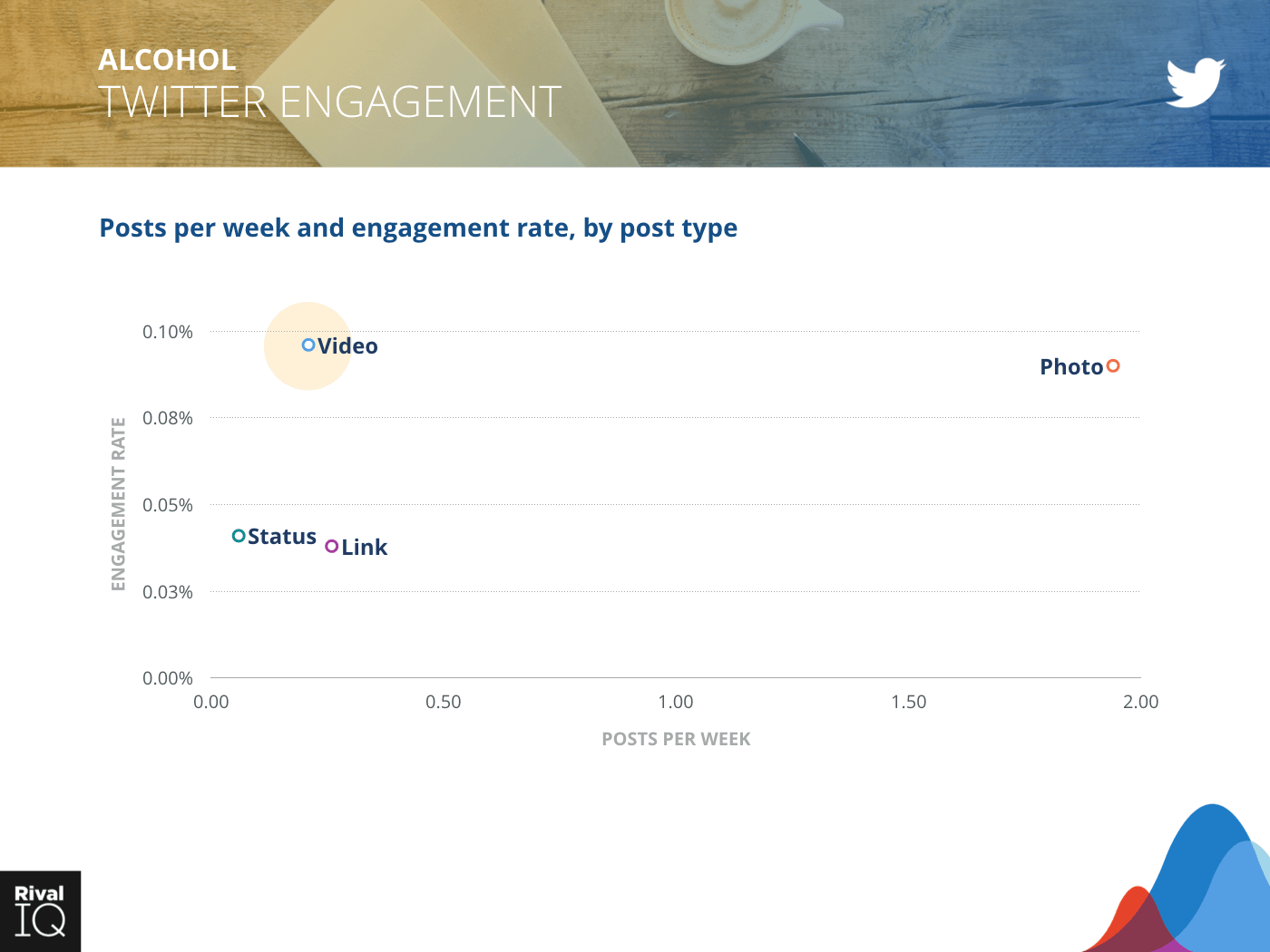

Twitter posts per week and engagement rate, Alcohol

As the top-performing industry on Twitter, Alcohol brands have Twitter’s elusive engagement recipe cracked, and it seems a key component of success on this channel is visual post types like photos and videos.

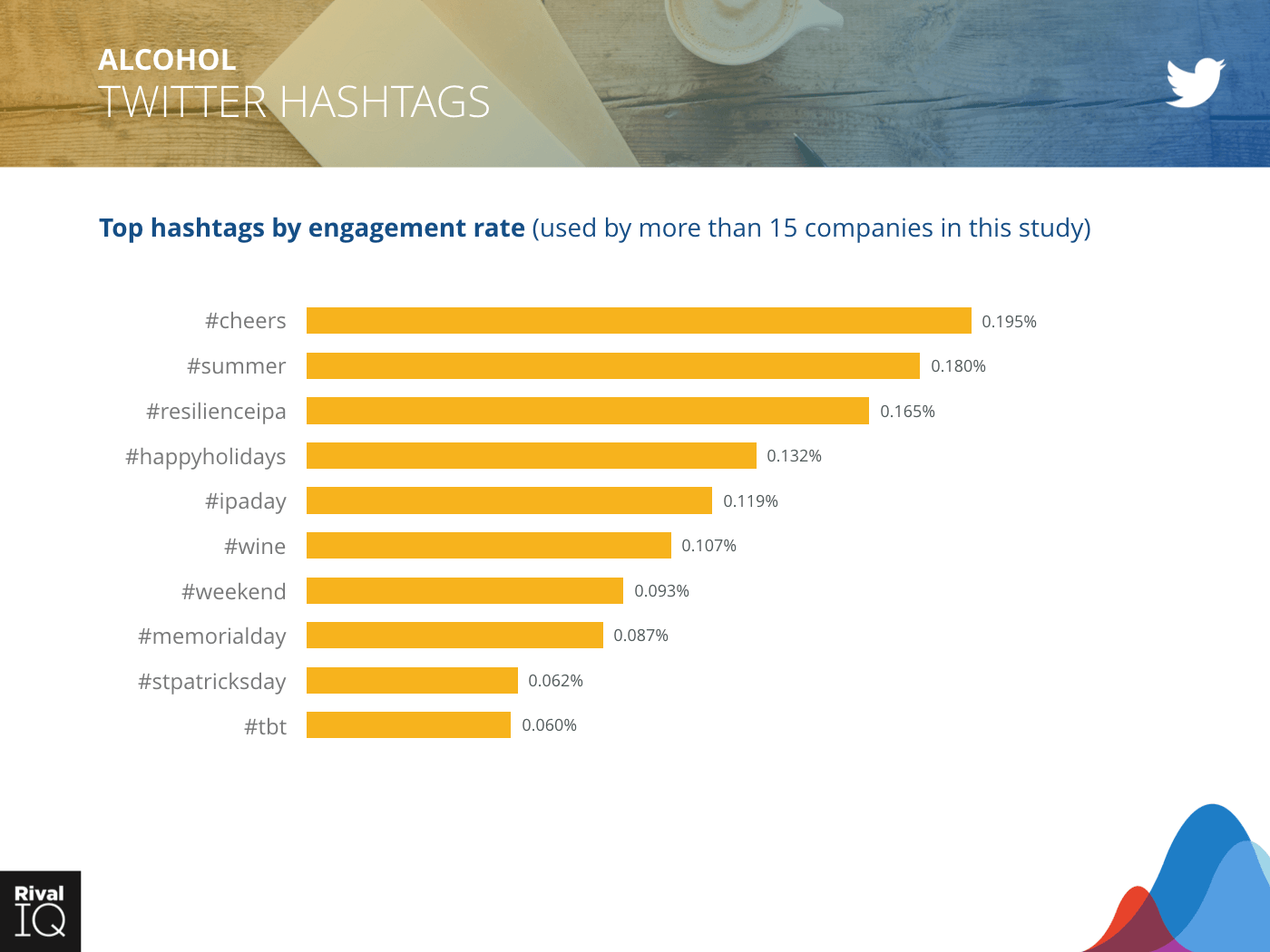

Top Twitter hashtags by engagement rate, Alcohol

Alcohol’s most successful Twitter hashtags diverge from their top Instagram hashtags, though #wine does well on both channels.

Industry Snapshot: Fashion

For the second year in a row, Fashion brands see their highest engagement on Instagram. Unfortunately, they’re below average for engagement on all three channels, suggesting they have some work to do to stay competitive.

Some suggestions for Fashion brands:

- Keep up with your strong photo game on Facebook and Instagram, and pay attention to high-performing videos on Twitter.

- Photos and carousels seriously outperform videos on Instagram.

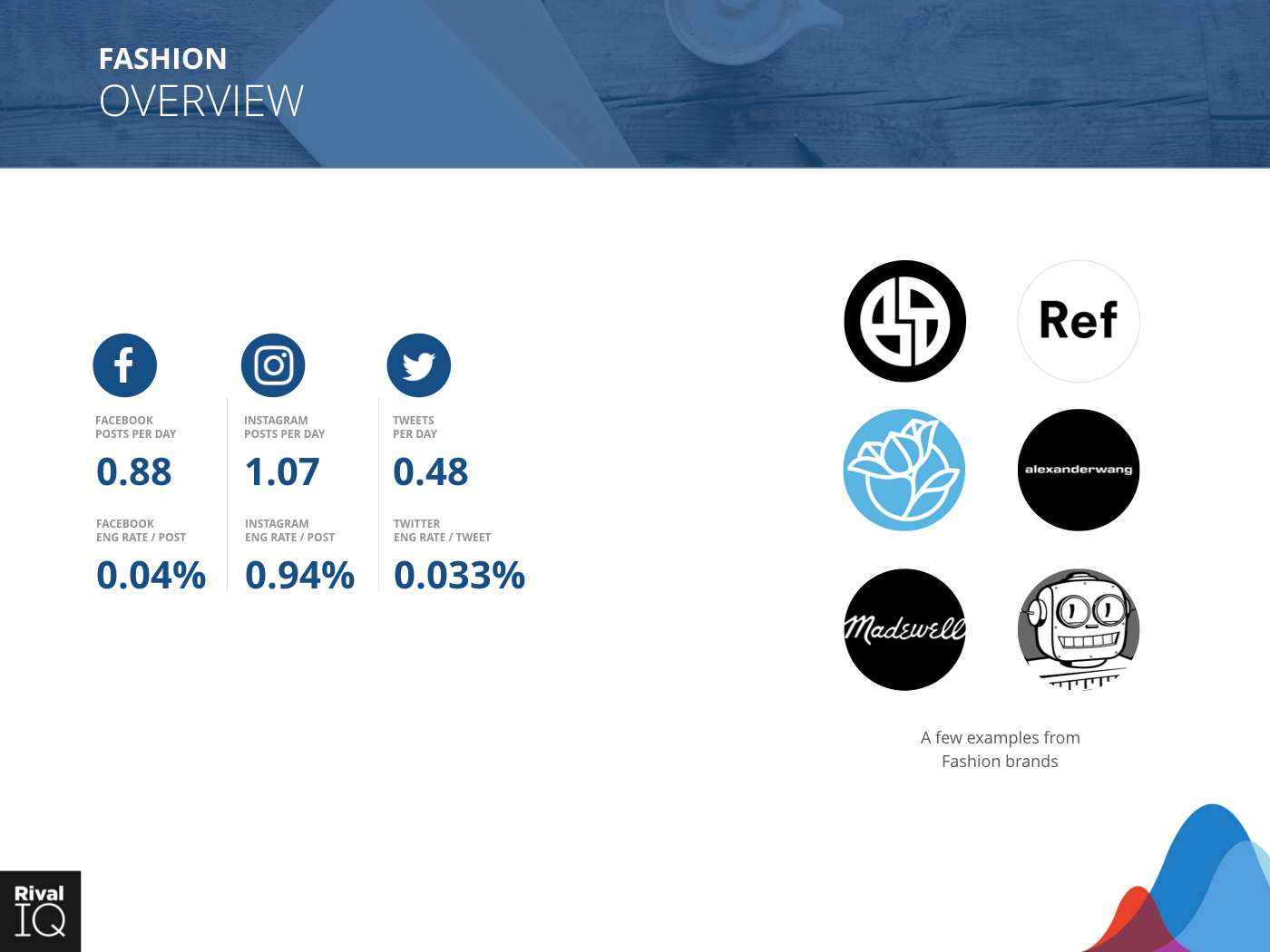

Overview of all benchmarks, Fashion

Notable Fashion brands in our random sampling include Berta Bridal, Reformation, Draper James, Alexander Wang, Madewell, and Qwertee.

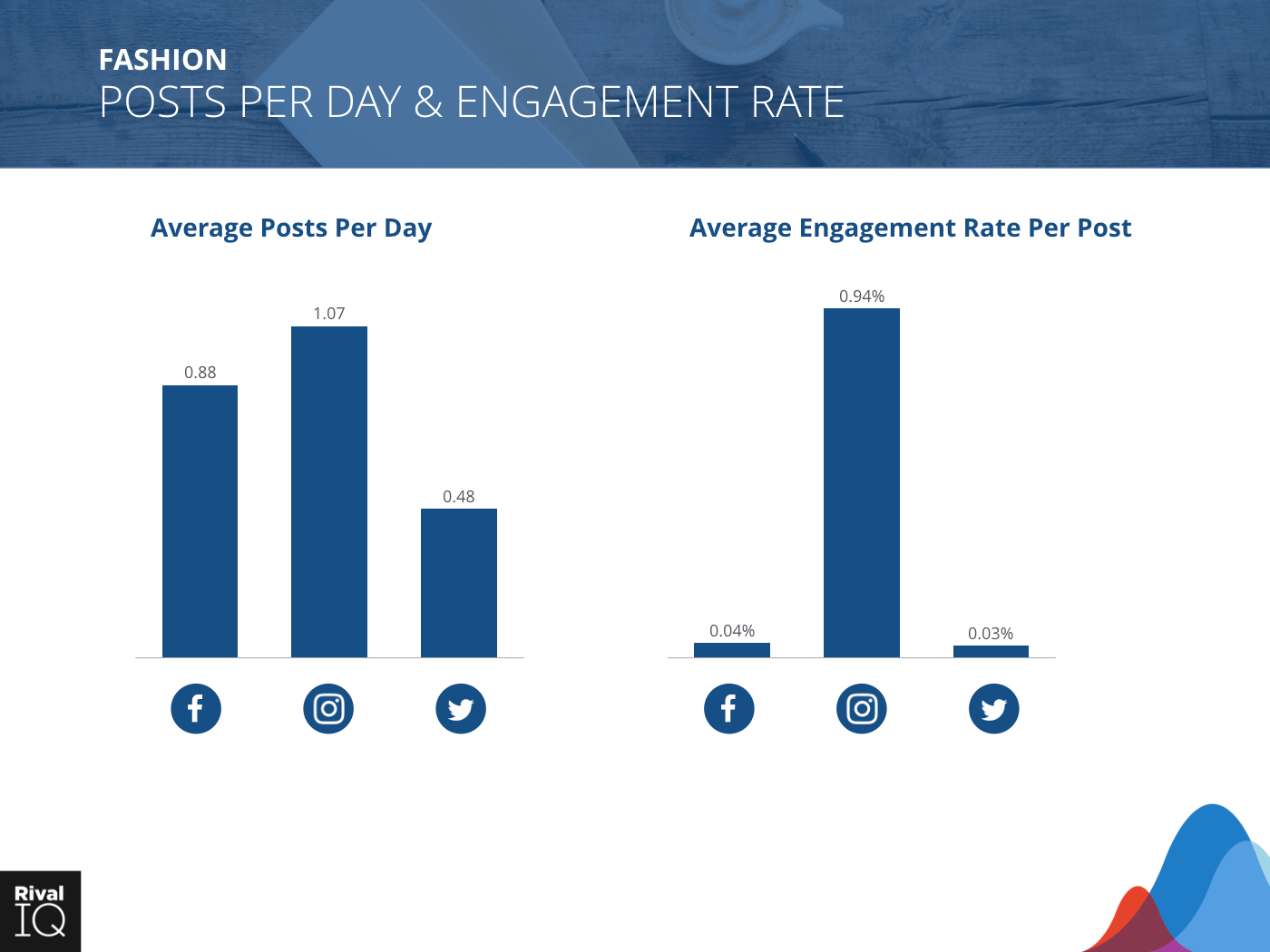

Posts per day and engagement rate for all channels, Fashion

Instagram engagement rates stayed consistent for Fashion brands this year on this quick-growing channel, suggesting Fashion brands have figured out what works for them.

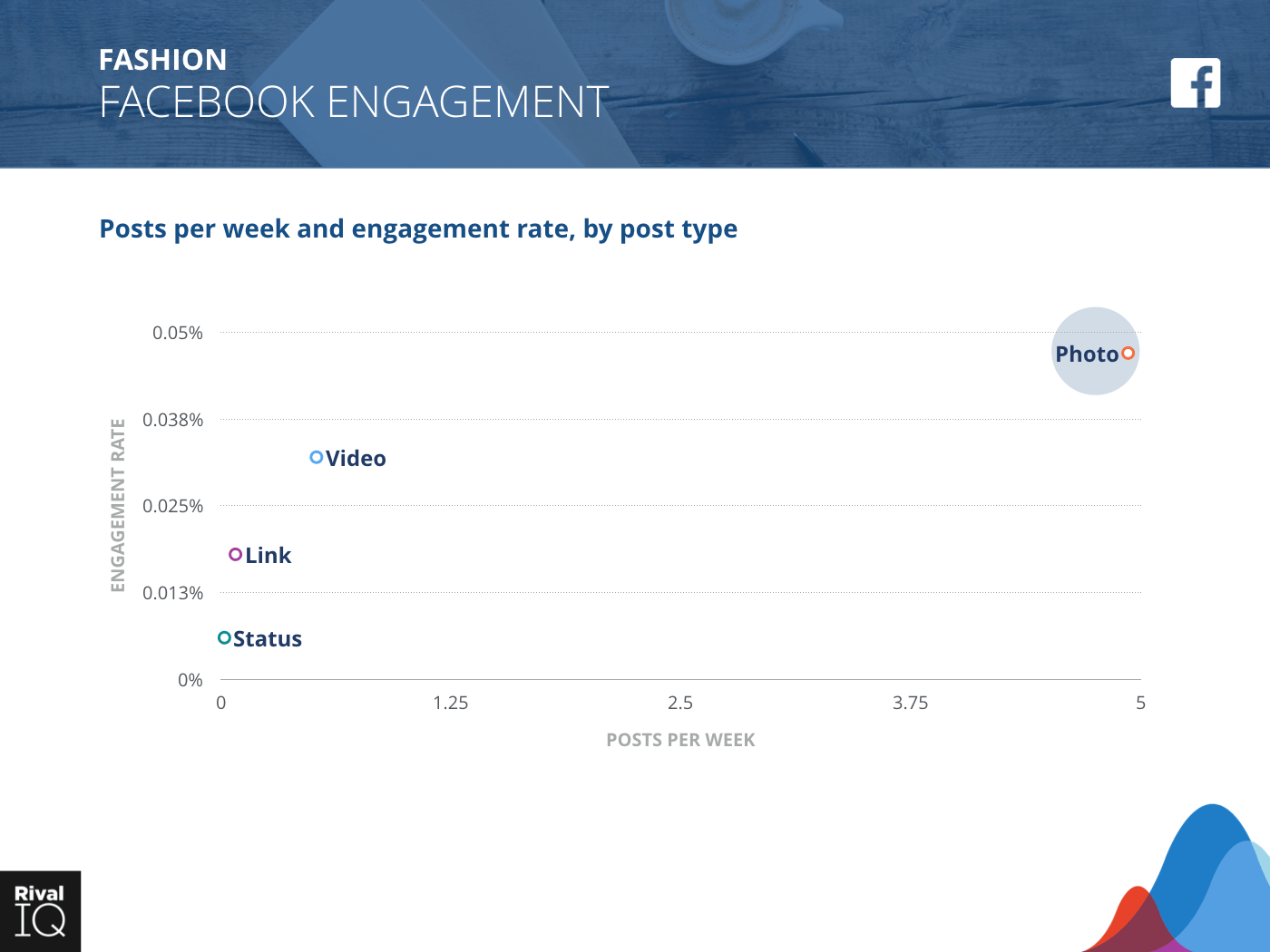

Facebook posts per week and engagement rate by post type, Fashion

Fashion brands and followers were all about videos last year, but photos have nearly twice the engagement this year. Fashion brands are posting photos most frequently to take advantage of that high engagement.

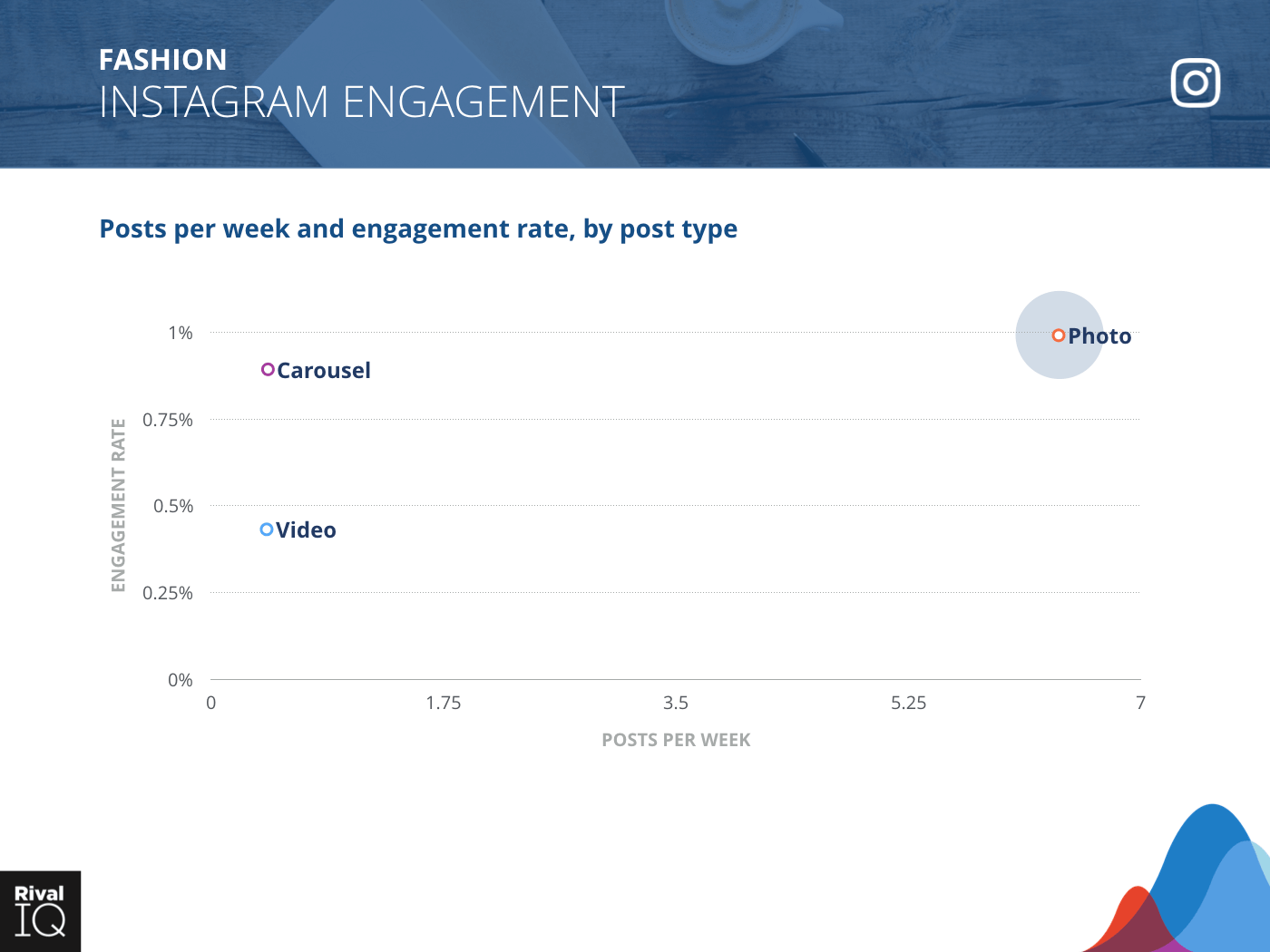

Instagram posts per week and engagement rate by post type

Fashion brands are posting more frequently than the average brand on this high-performing channel, but should think about trying to combine some of those photo posts into highly-engaging carousels.

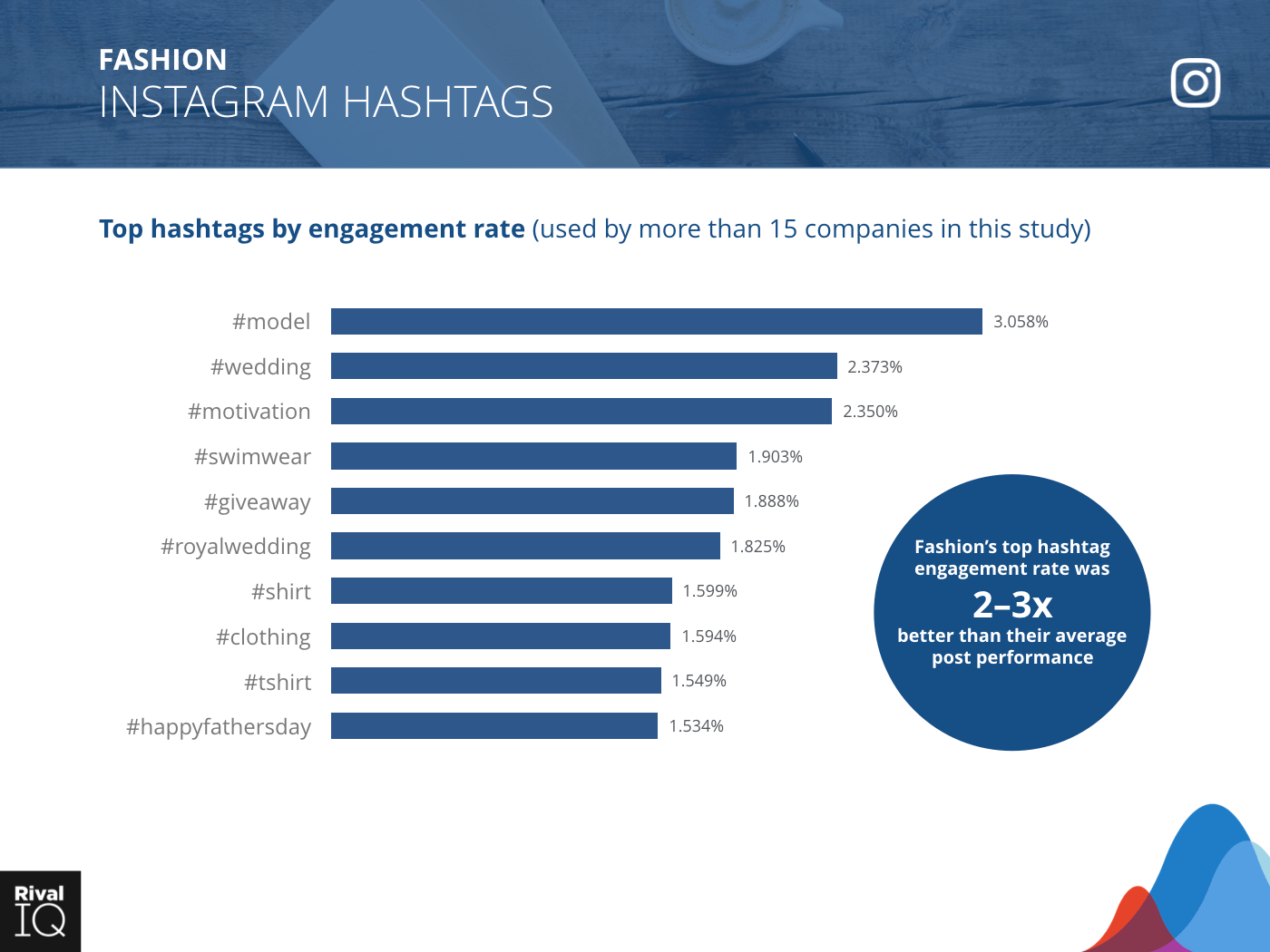

Top Instagram hashtags by engagement rate, Fashion

Fashion brands saw the lowest Instagram hashtag engagement rates last year of any industry, but are squarely in the middle of the pack now, suggesting a strategy tweak that’s paid off.

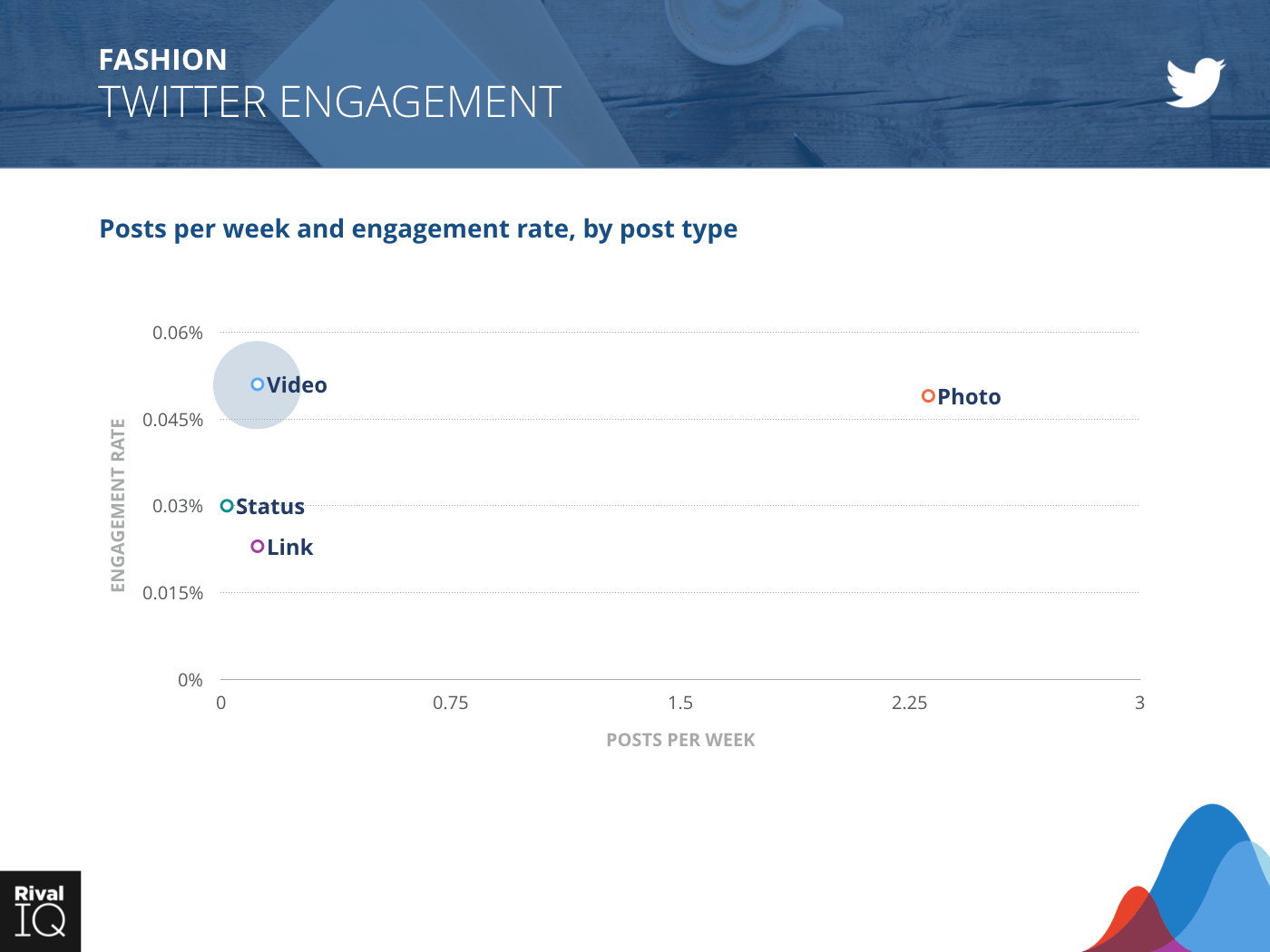

Twitter posts per week and engagement rate by post type, Fashion

Videos slightly outperformed photos for Fashion brands on Twitter but were posted infrequently, so Fashion brands could experiment more with this post type on Twitter.

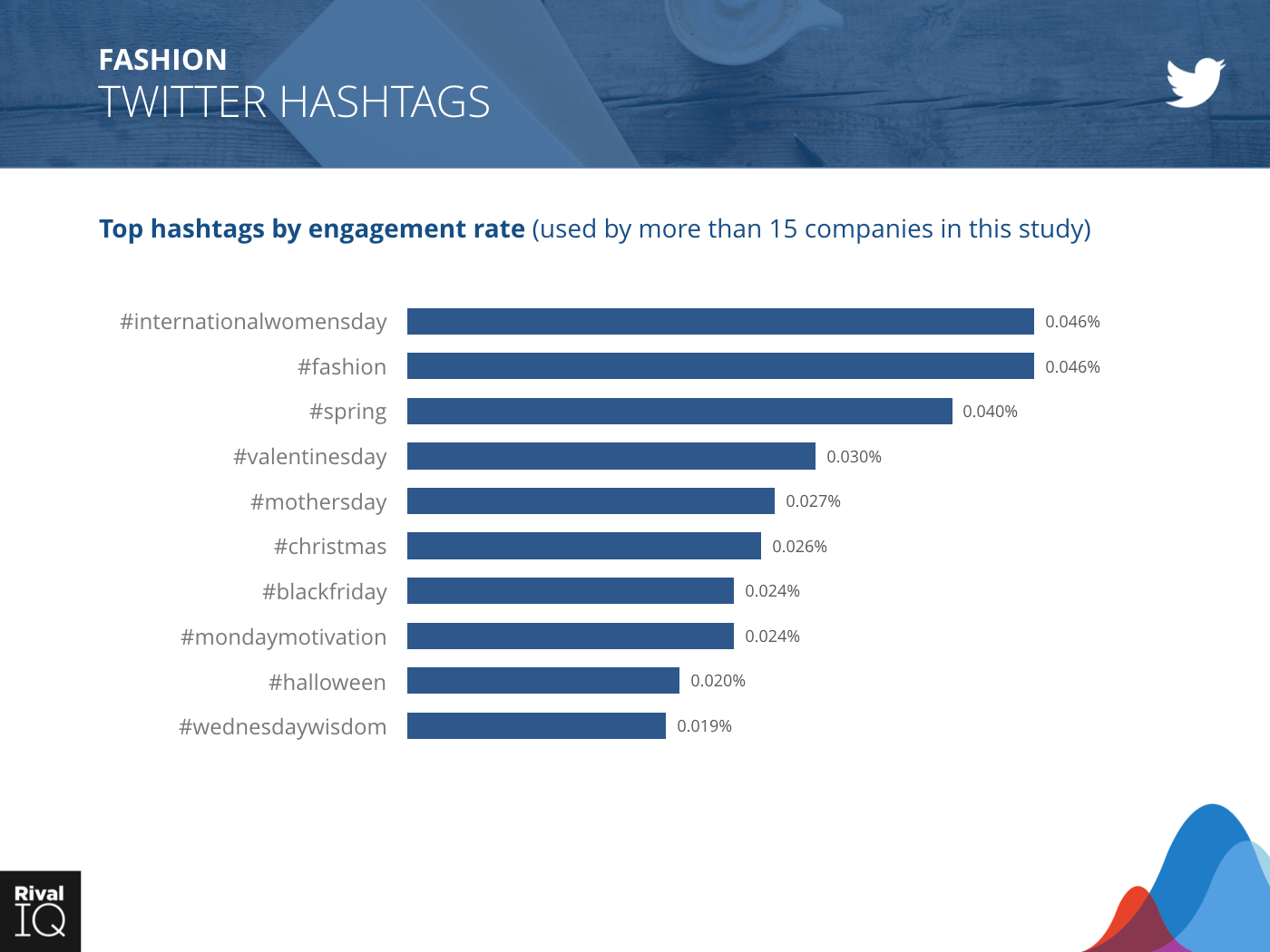

Top Twitter hashtags by engagement rate, Fashion

Top hashtags matter: their top three Twitter hashtags saw 1.5x the engagement than their average tweet, but hashtags 4–10 quickly dropped below average.

Industry Snapshot: Food & Beverage

Food & Beverage brands ran in the middle of the pack on all three social channels, which was a far cry from their high performance on Facebook and Twitter last year. However, their hashtag game was strong this year on both Instagram and Twitter.

Some ideas for improvement:

- Hashtags perform well, so keep an ear to the ground for high-performing food-related hashtags to use.

- Repurpose engaging video content across all channels.

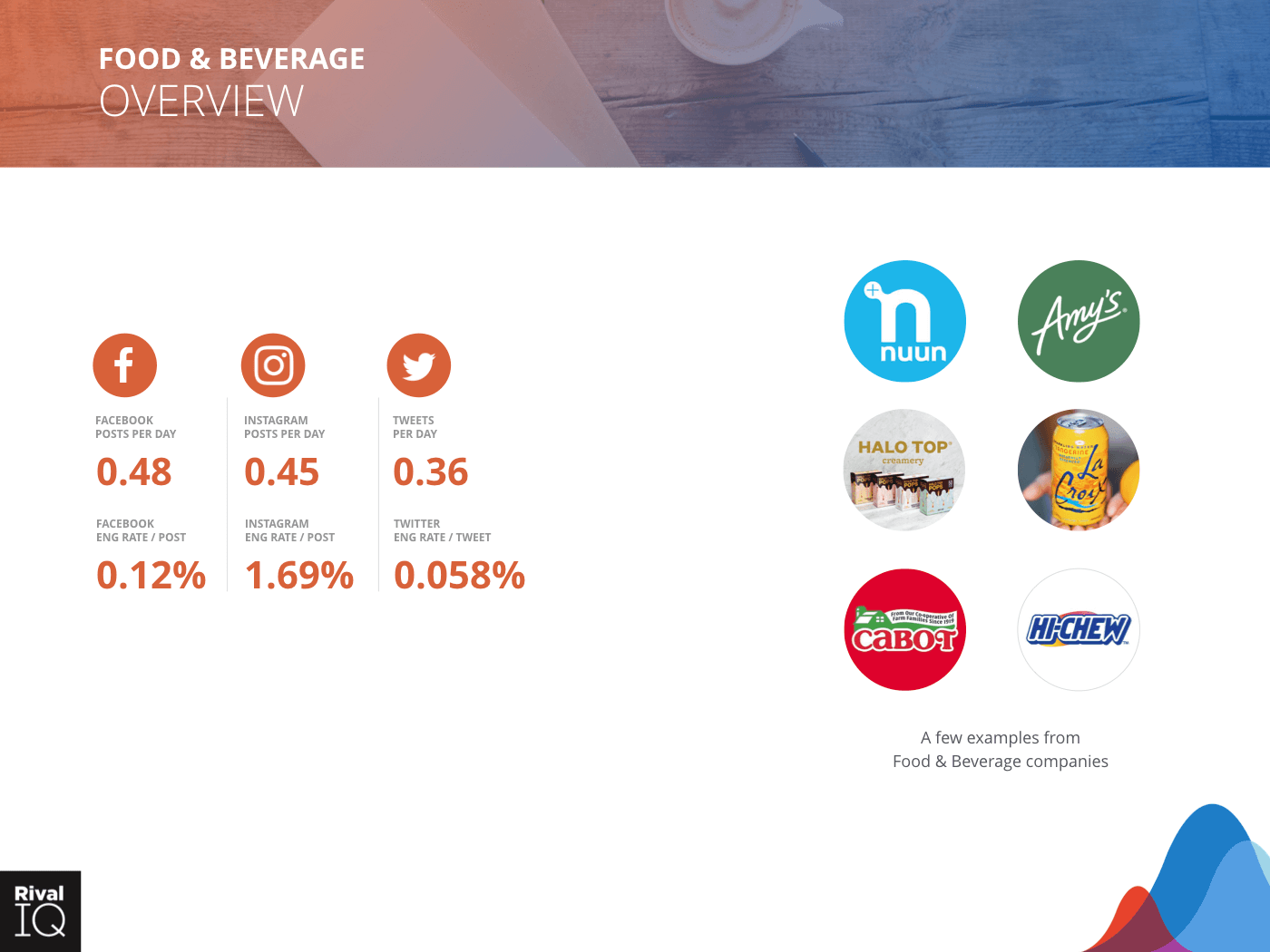

Overview of all benchmarks, Food & Beverage

Notable Food & Beverage brands in our random sampling include nuun, Amy’s Kitchen, Halo Top, La Croix, Cabot Creamery, and Hi-Chew.

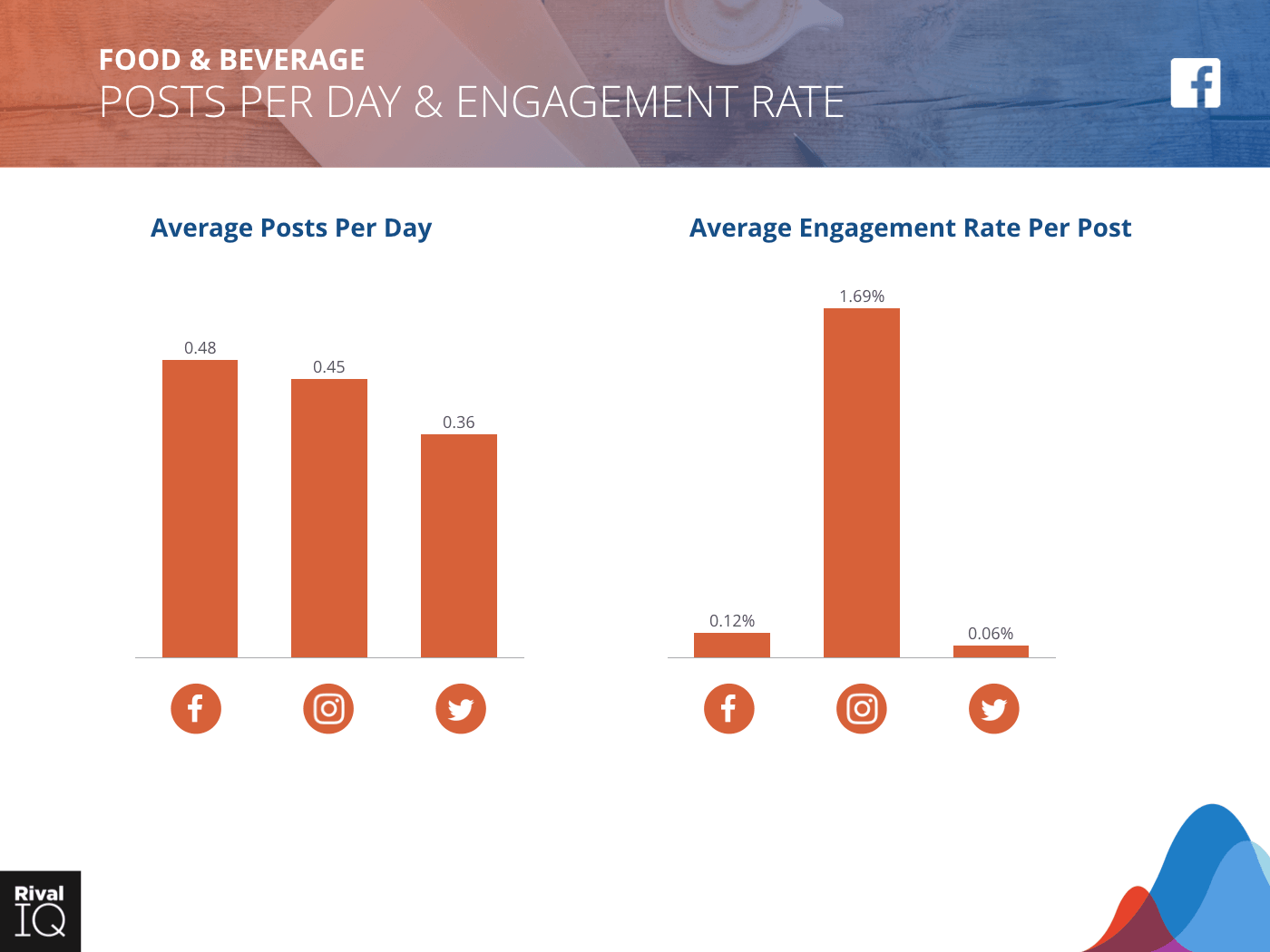

Posts per day and engagement rate across all channels, Food & Beverage

Food & Beverage brands are posting just as frequently as last year, but finding half the engagement on Facebook and Instagram.

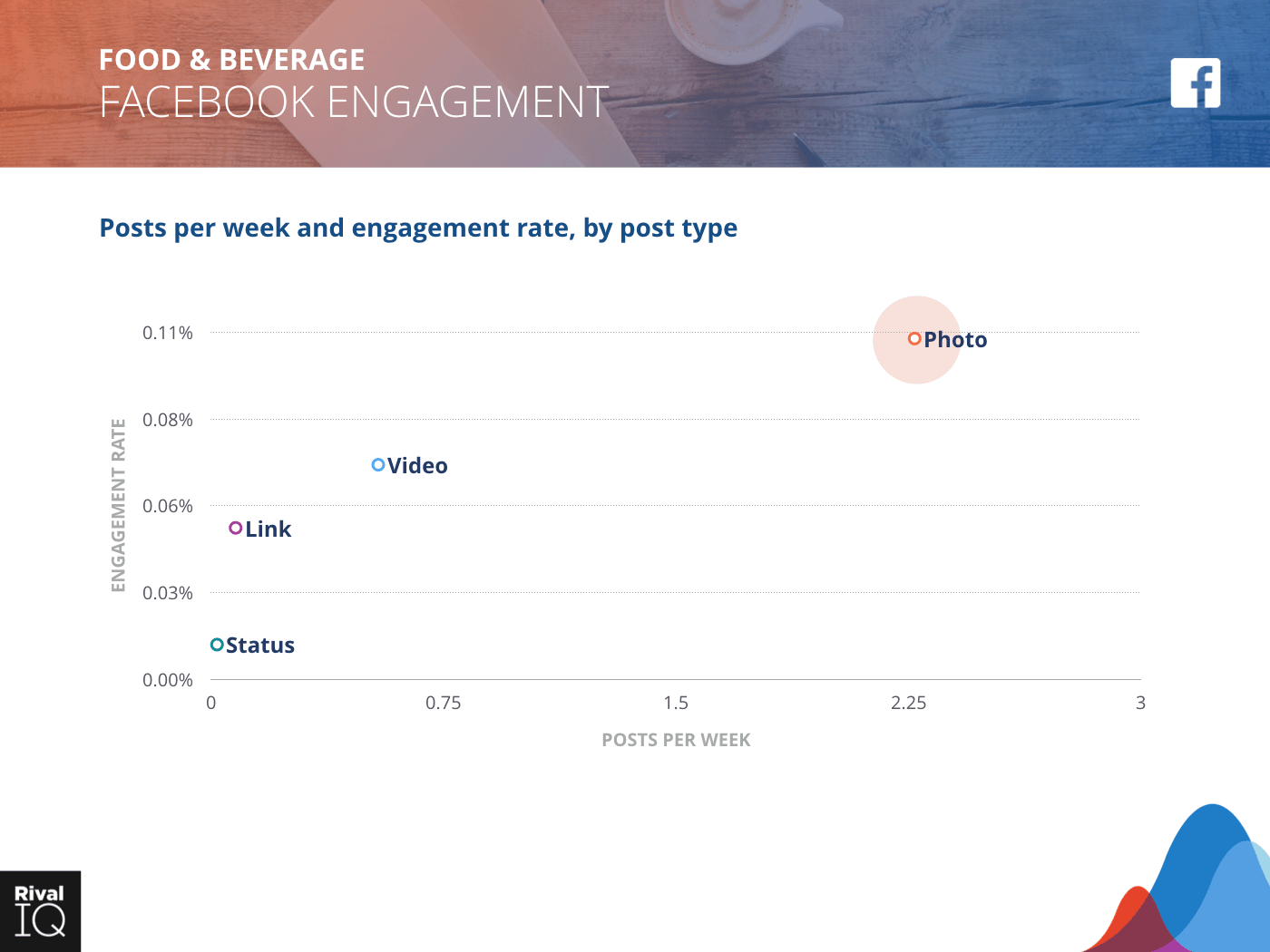

Facebook posts per week and engagement rate by post type, Food & Beverage

Consumers love Food & Beverage photos on Facebook, with the next most popular post type (video) garnering about half as much engagement per post.

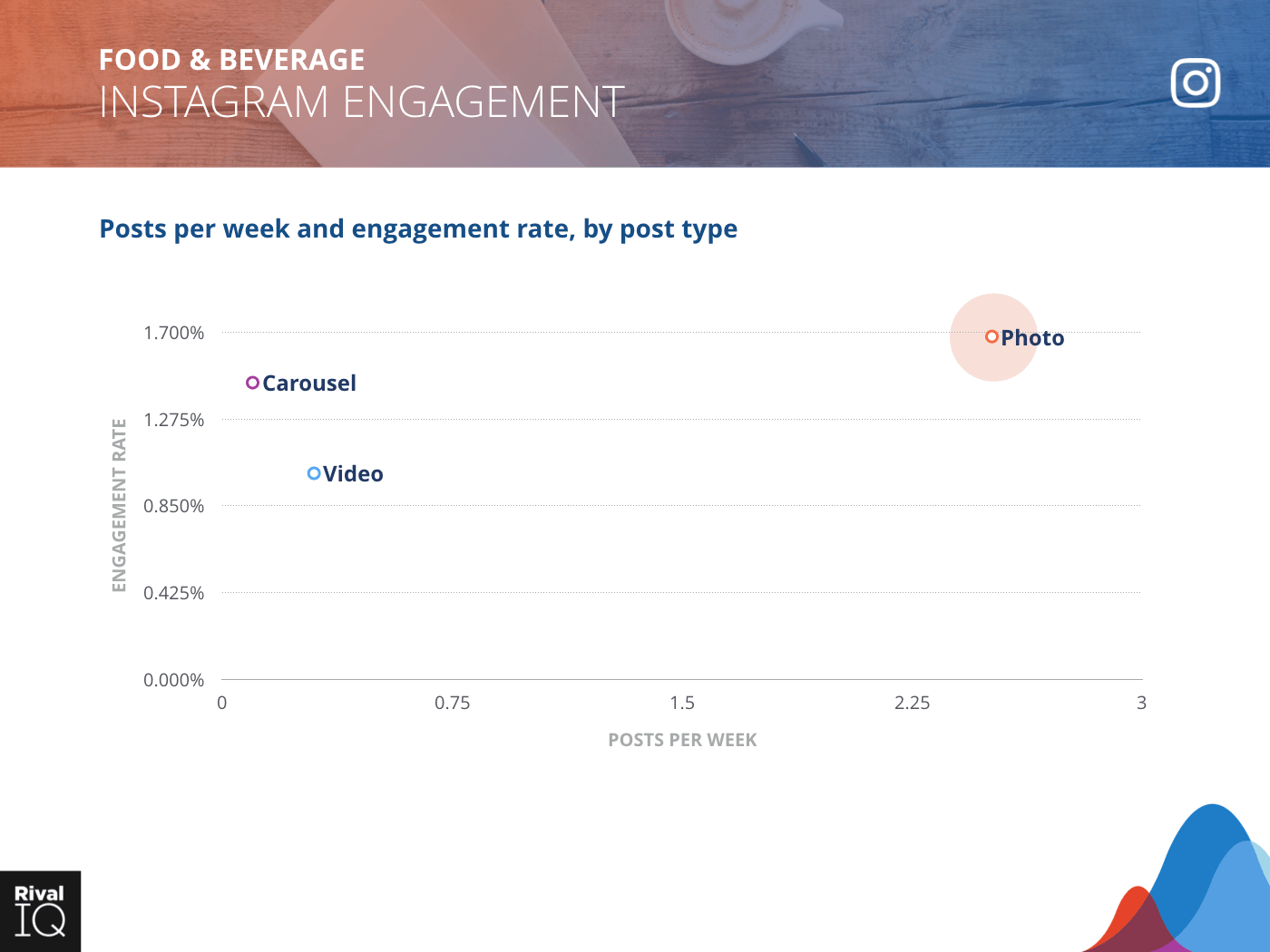

Instagram posts per week and engagement rate by post type, Food & Beverage

Food & Beverage brands’ Instagram engagement fell by more than half this year, so these brands should focus on photos and carousels (and leave videos behind) to stay competitive in their followers’ feeds.

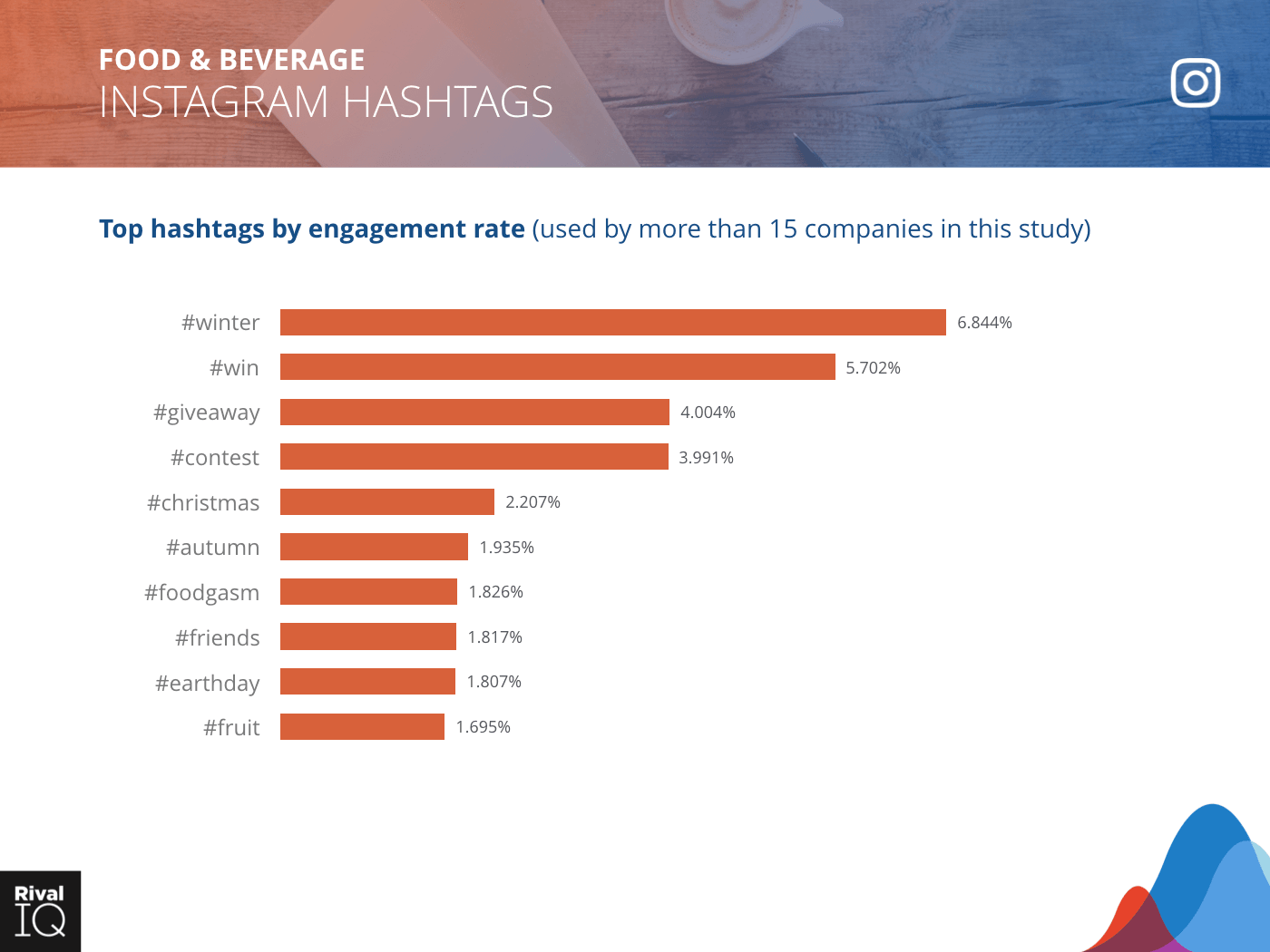

Top Instagram hashtags by engagement rate, Food & Beverage

Food & Beverage brands see some of the highest hashtag engagement on Instagram, especially when they post about contests and holidays.

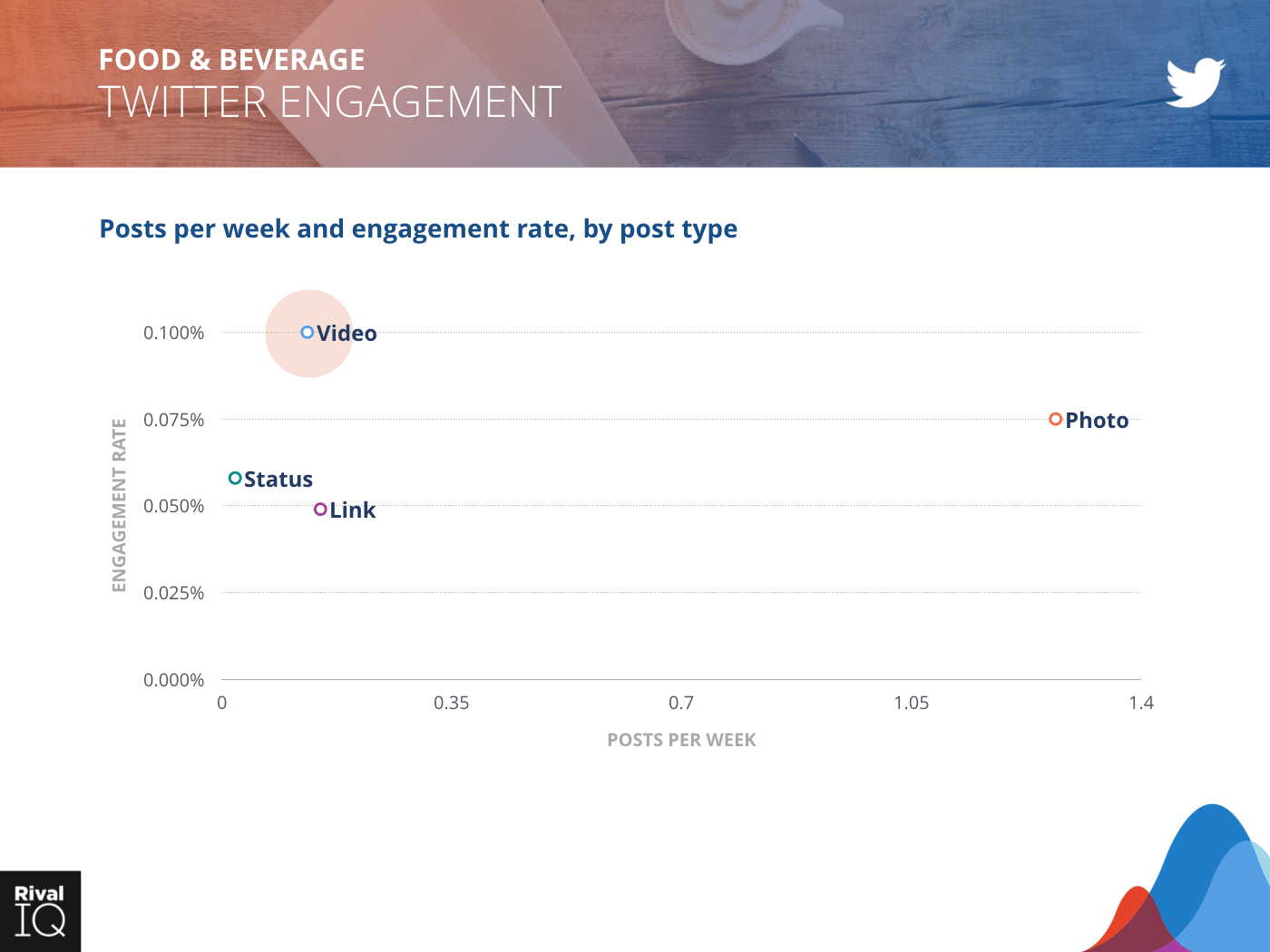

Twitter posts per week and engagement rate by post type, Food & Beverage

Video led to high engagement on Twitter, so Food & Beverages brands might want to think about repurposing video content from Facebook and Instagram for this channel.

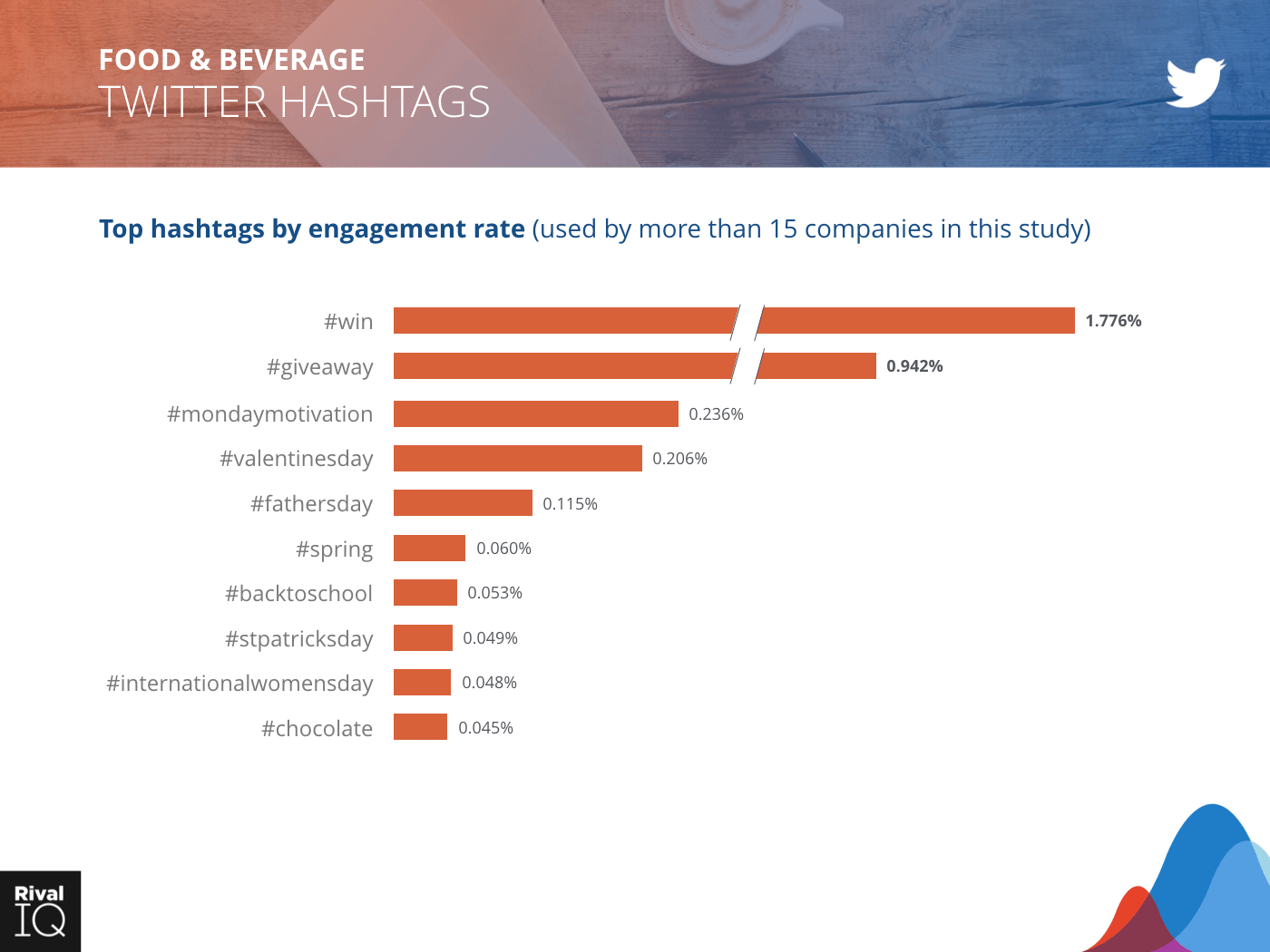

Top Twitter hashtags by engagement rate, Food & Beverage

Contest and giveaway hashtags blew the competition out of the water on Twitter, suggesting Food & Beverage followers are hungry for free stuff.

Industry Snapshot: Health & Beauty

For the third year in a row, Health & Beauty saw below average engagement across all social channels. Like many industries, these brands saw a huge dip in Facebook engagement this year.

Two opportunities for growth:

- Contest hashtags win the day, so look for more opportunities to engage your followers with giveaways.

- Videos perform well on Twitter, so look into upping your frequency on that channel.

Overview of all benchmarks, Health & Beauty

Notable Health & Beauty brands in our random sampling include derma e, Bath & Body Works, BOXYCHARM, Marc Jacobs Beauty, SalonCentric, and Milani.

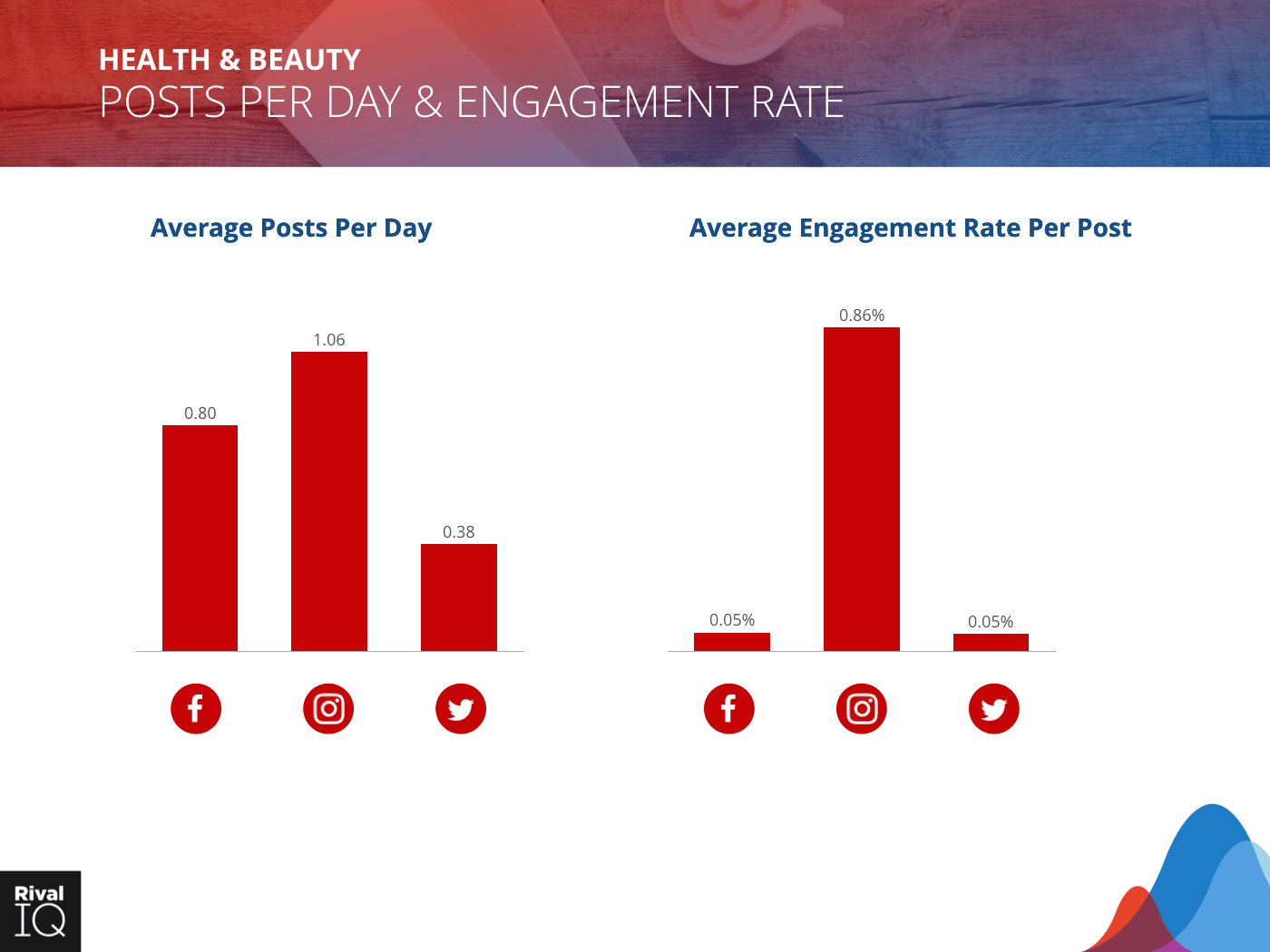

Posts per day and engagement rate across all channels, Health & Beauty

Health & Beauty are putting their efforts in the right spot with a focus on highly-engaging Instagram, especially since their engagement lags below average on Facebook and Twitter.

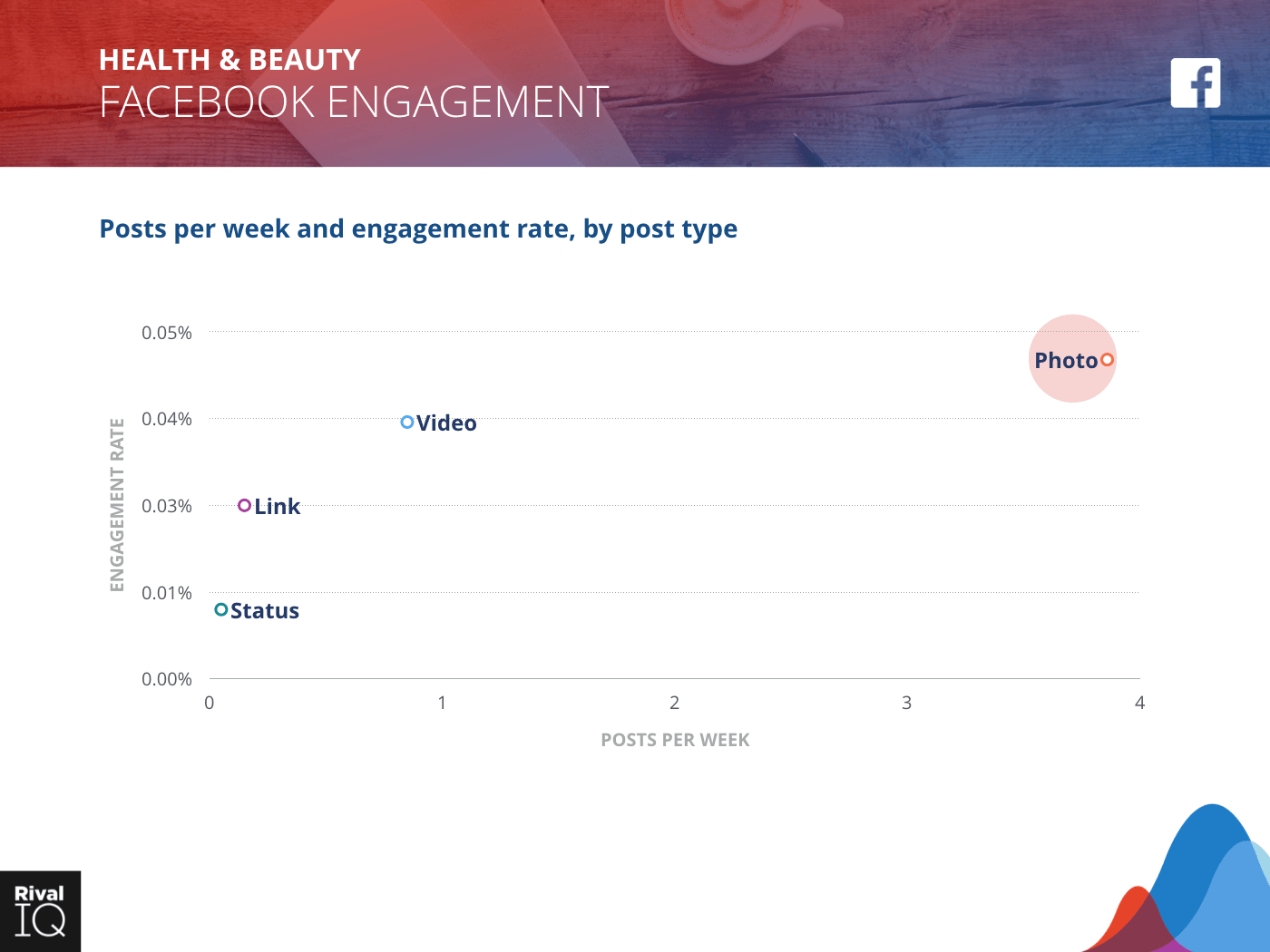

Facebook posts per week and engagement rate by post type, Health & Beauty

As in many industries, Facebook engagement is half of what it was last year. Health & Beauty brands are focusing on the right post types to boost their Facebook engagement: photo and video.

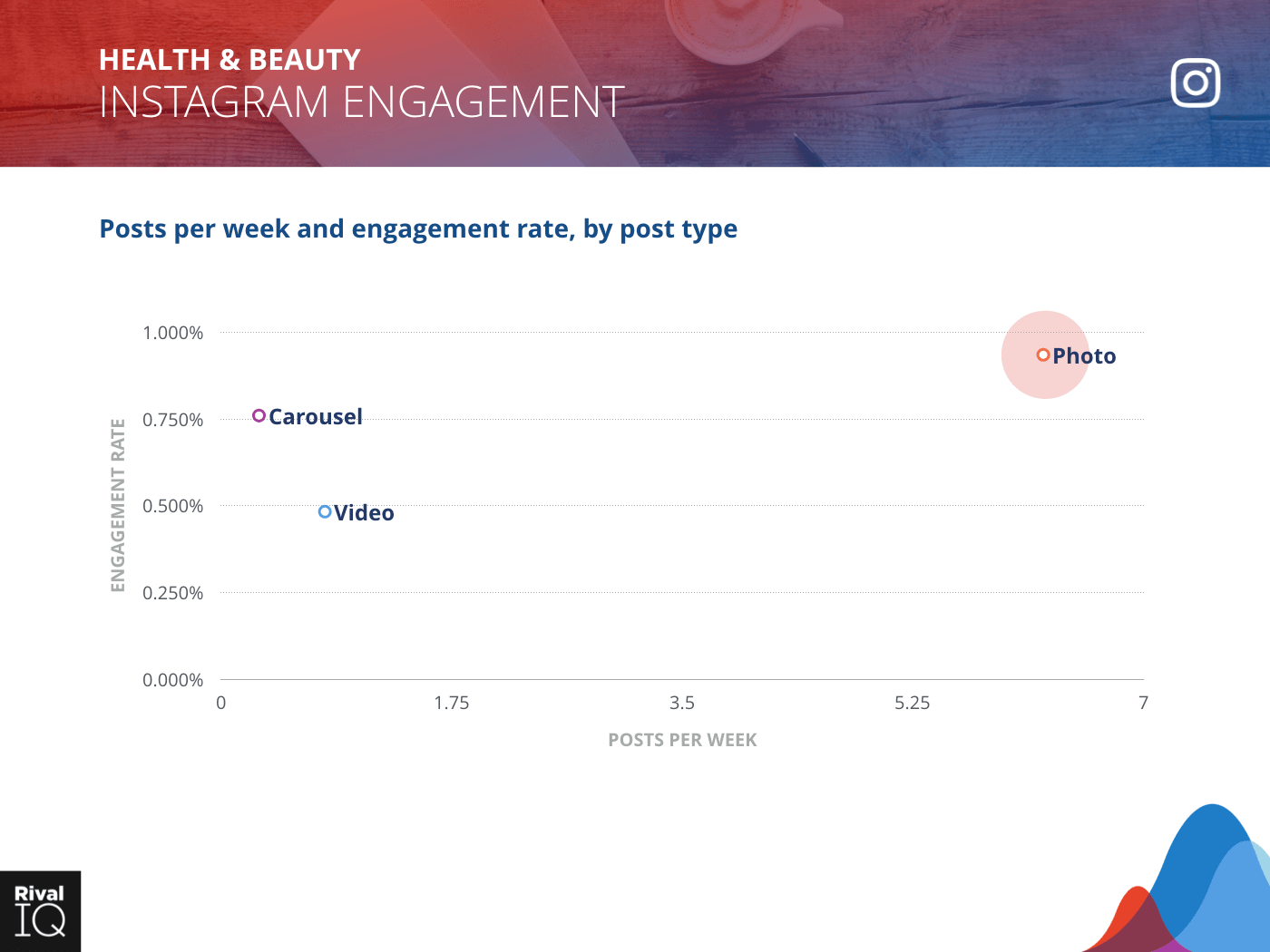

Instagram posts per week and engagement rate by post type, Health & Beauty

Health & Beauty brands are focusing on photo posts, which consistently perform above average for these brands.

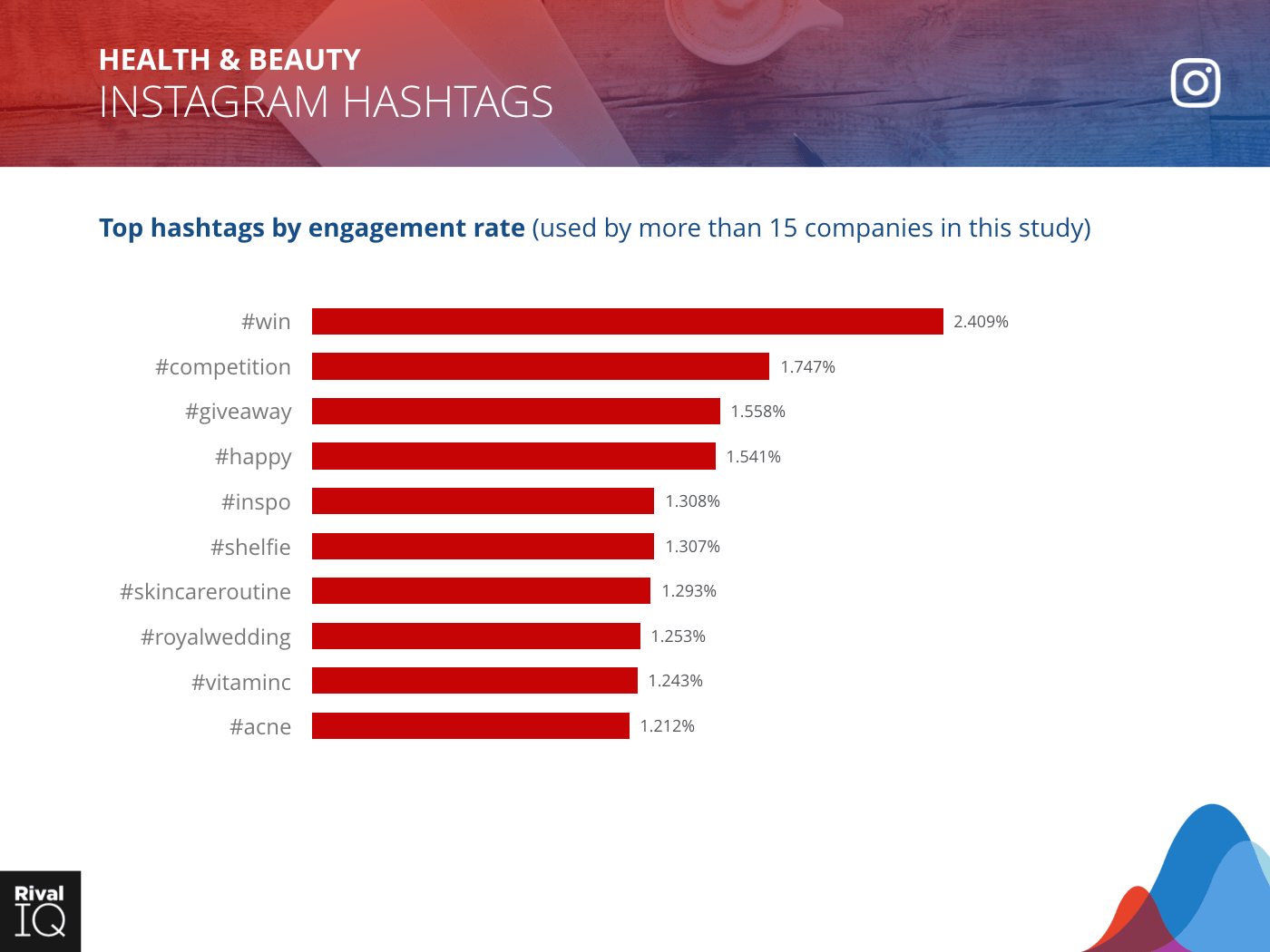

Top Instagram hashtags by engagement rate, Health & Beauty

As with many other brands, Health & Beauty followers are all about the giveaways when engaging with hashtags on Instagram.

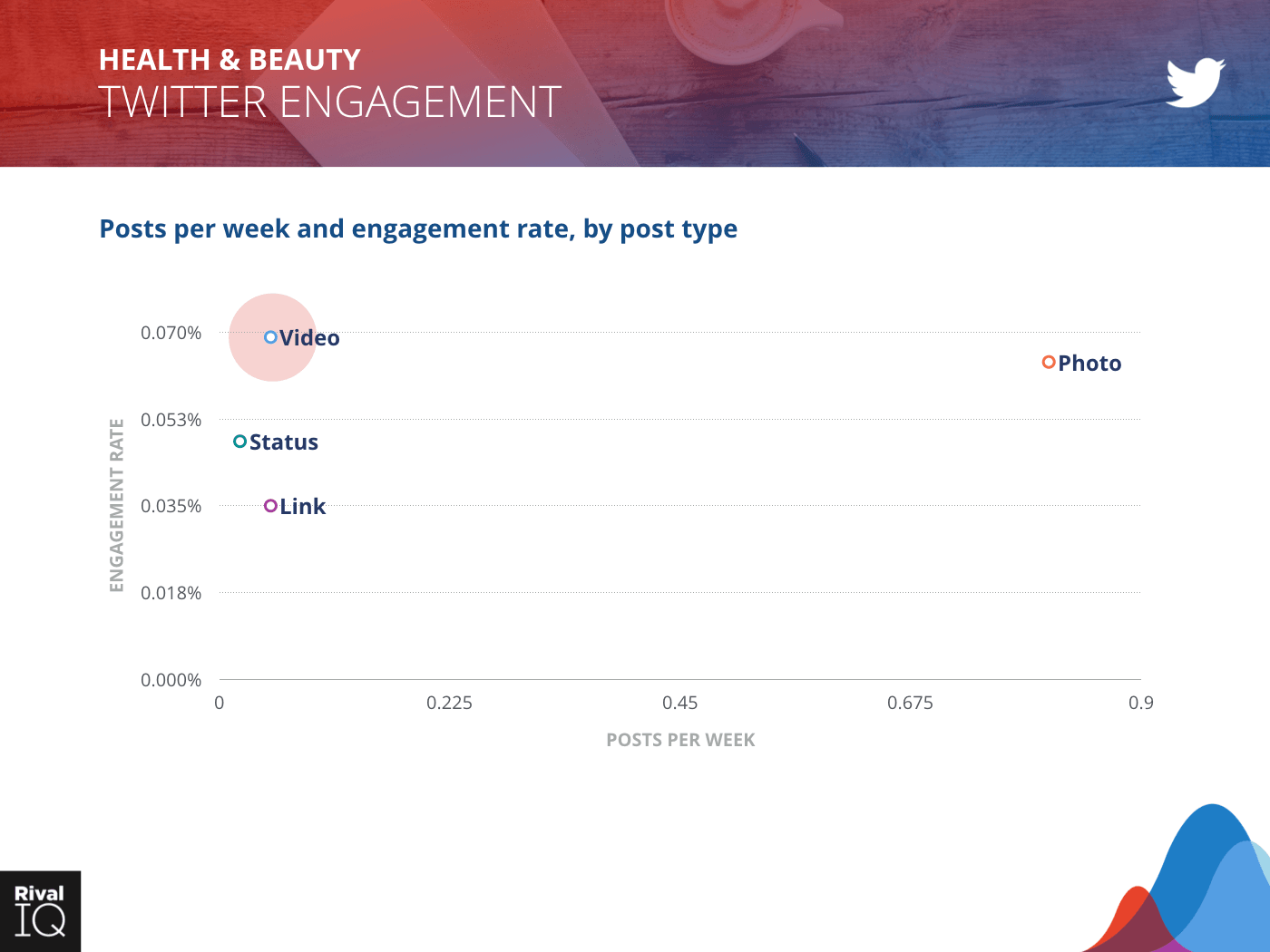

Twitter posts per week and engagement rate by post type, Health & Beauty

Lots of opportunity to post more videos on Twitter, where they engage well with followers and are underutilized.

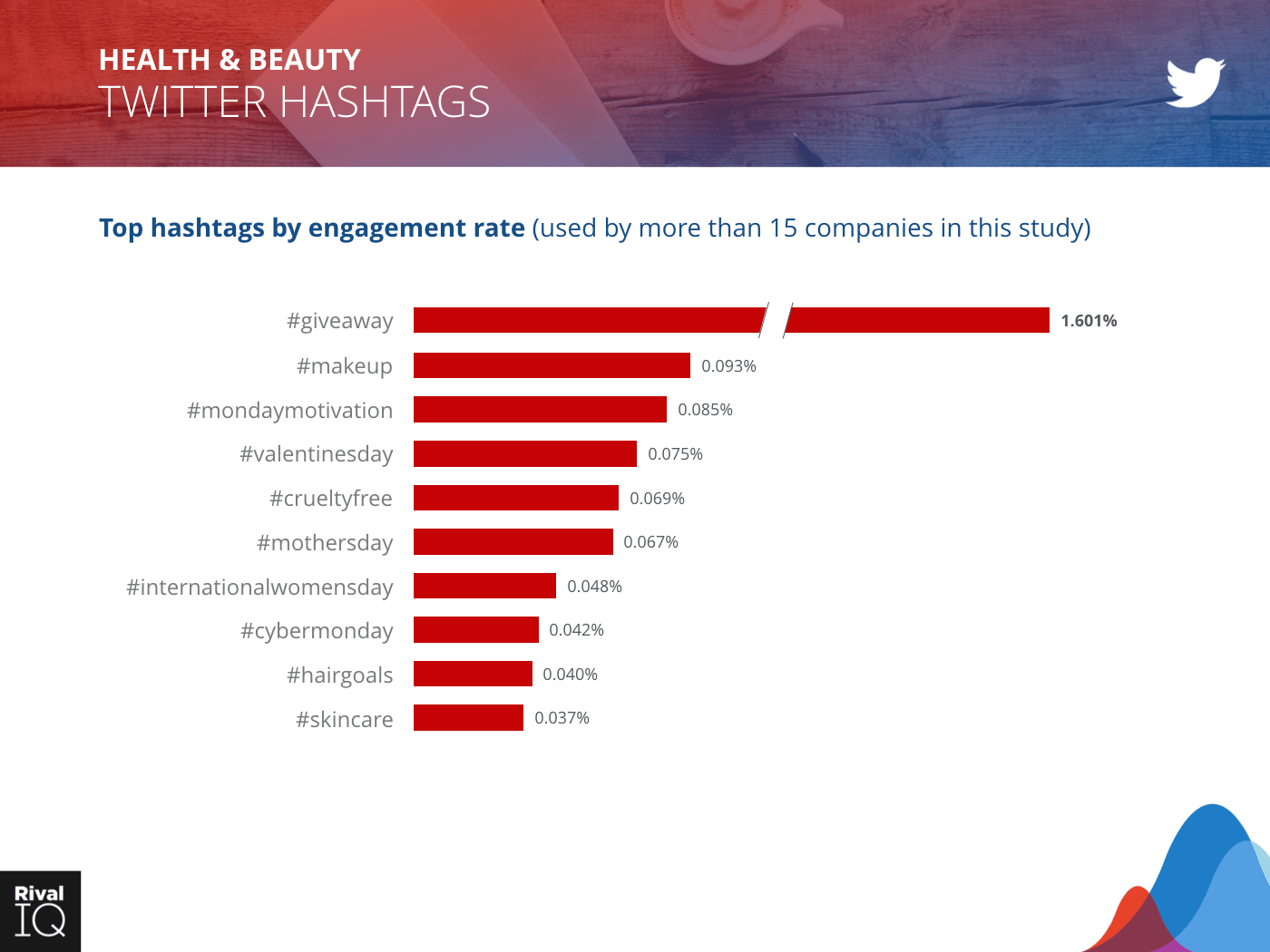

Top Twitter hashtags by engagement rate, Health & Beauty

The giveaway hashtag blew the competition out of the water for Health & Beauty brands on Twitter.

Bookmark your benchmarks with a free download.

Get the report nowIndustry Snapshot: Higher Ed

Higher Ed took the Instagram gold and the Twitter silver, proving that students, alums, and fans are all about the alma mater on social. Like every industry, these colleges and universities are suffering from less engagement on Facebook than last year.

Based on this study, there’s one opportunity to improve engagement rates:

- Stick with dogs, holidays, and photos on Instagram, and don’t be afraid of a few carousels.

- Try to up your video posts on Twitter, and ditch link posting.

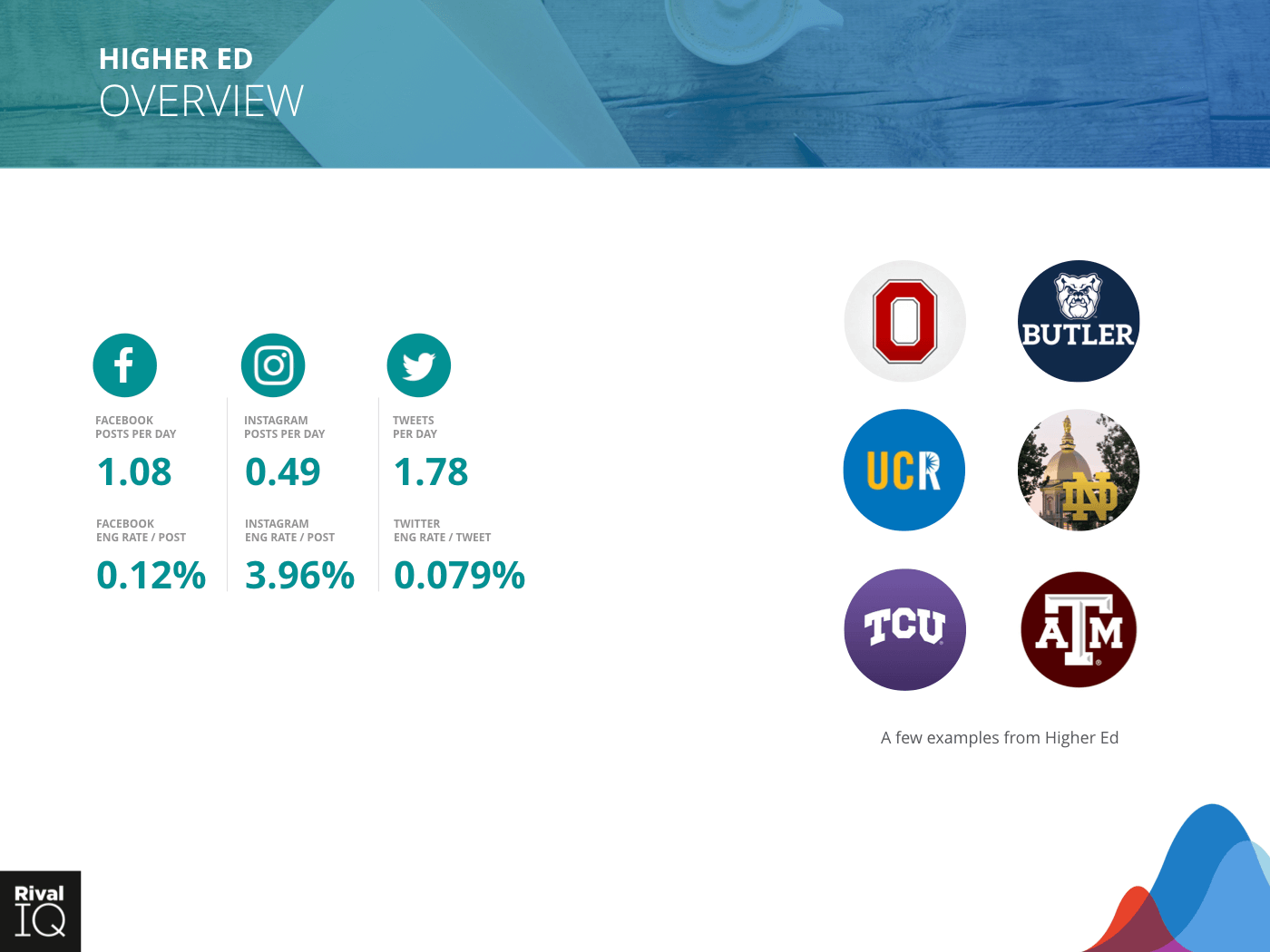

Overview of all channels, Higher Ed

Notable Higher Ed colleges and universities from our random sampling include Ohio State University, Butler University, UC Riverside, University of Notre Dame, Texas Christian University, and Texas A&M University.

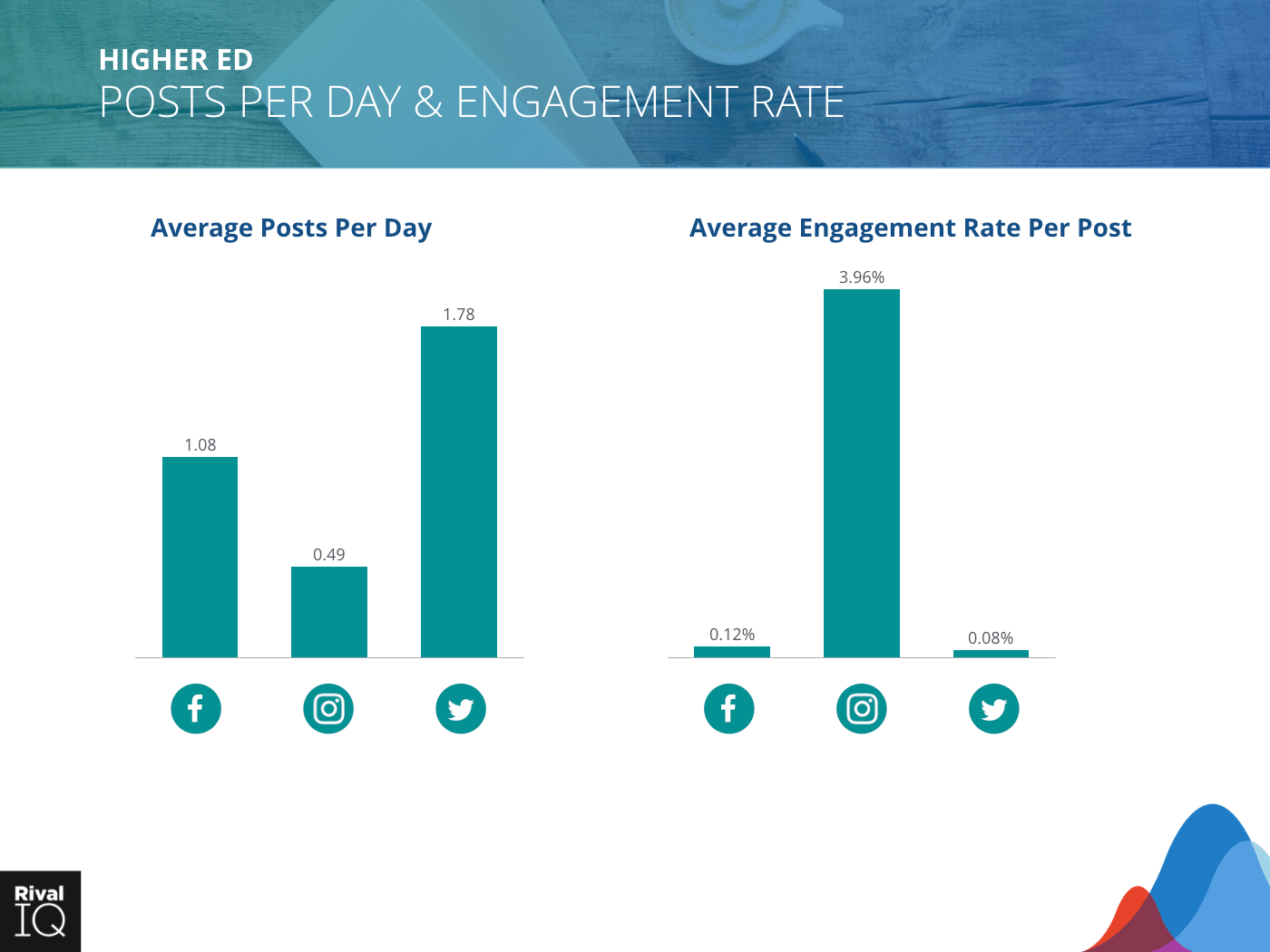

Posts per day and engagement rate across all channels, Higher Ed

Once again, Higher Ed is the runaway favorite on Instagram, proving they’re the industry to beat on social media’s most engaging social channel. Higher Ed could experiment with posting frequency to see if they can maintain this high engagement rate with more posts.

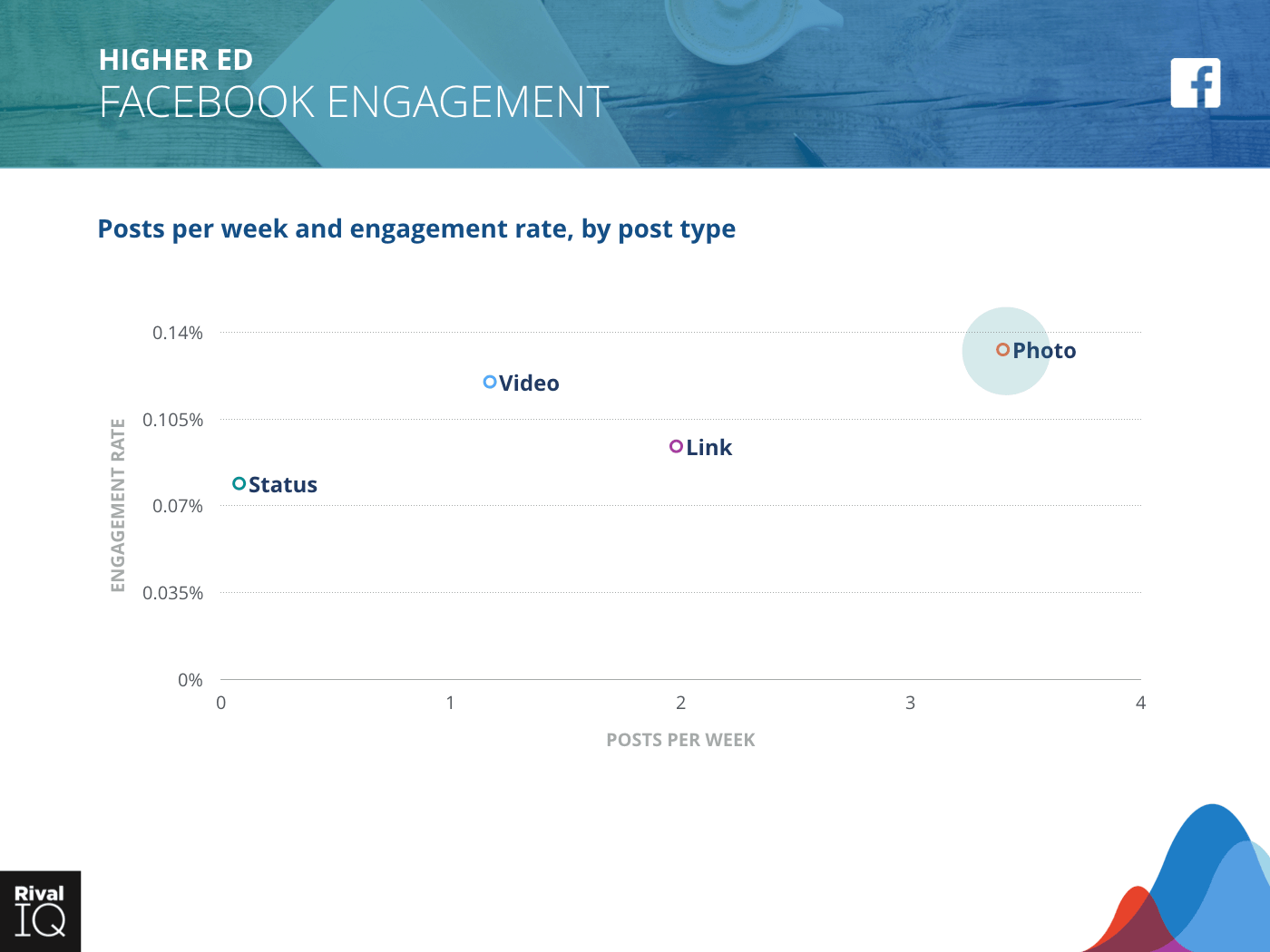

Facebook posts per week and engagement rate by post type, Higher Ed

As with many other industries, photos and videos drive the most engagement on Facebook for colleges and universities. Higher Ed is seeing above average engagement with links.

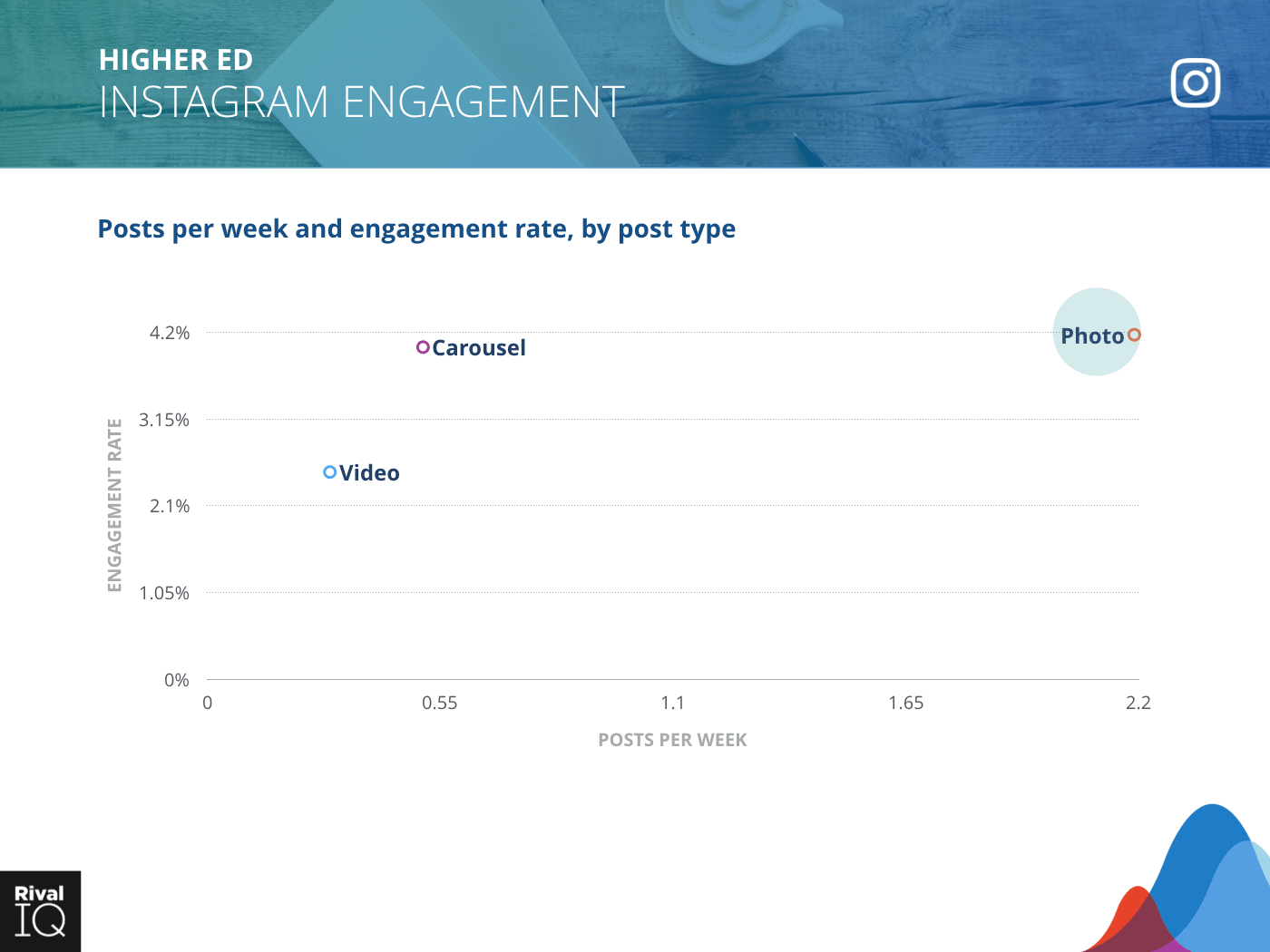

Instagram posts per week and engagement rate by post type, Higher Ed

Colleges and universities are making the most out of their high-performing Instagram post types, photos and carousels, while video engagement continues to lag.

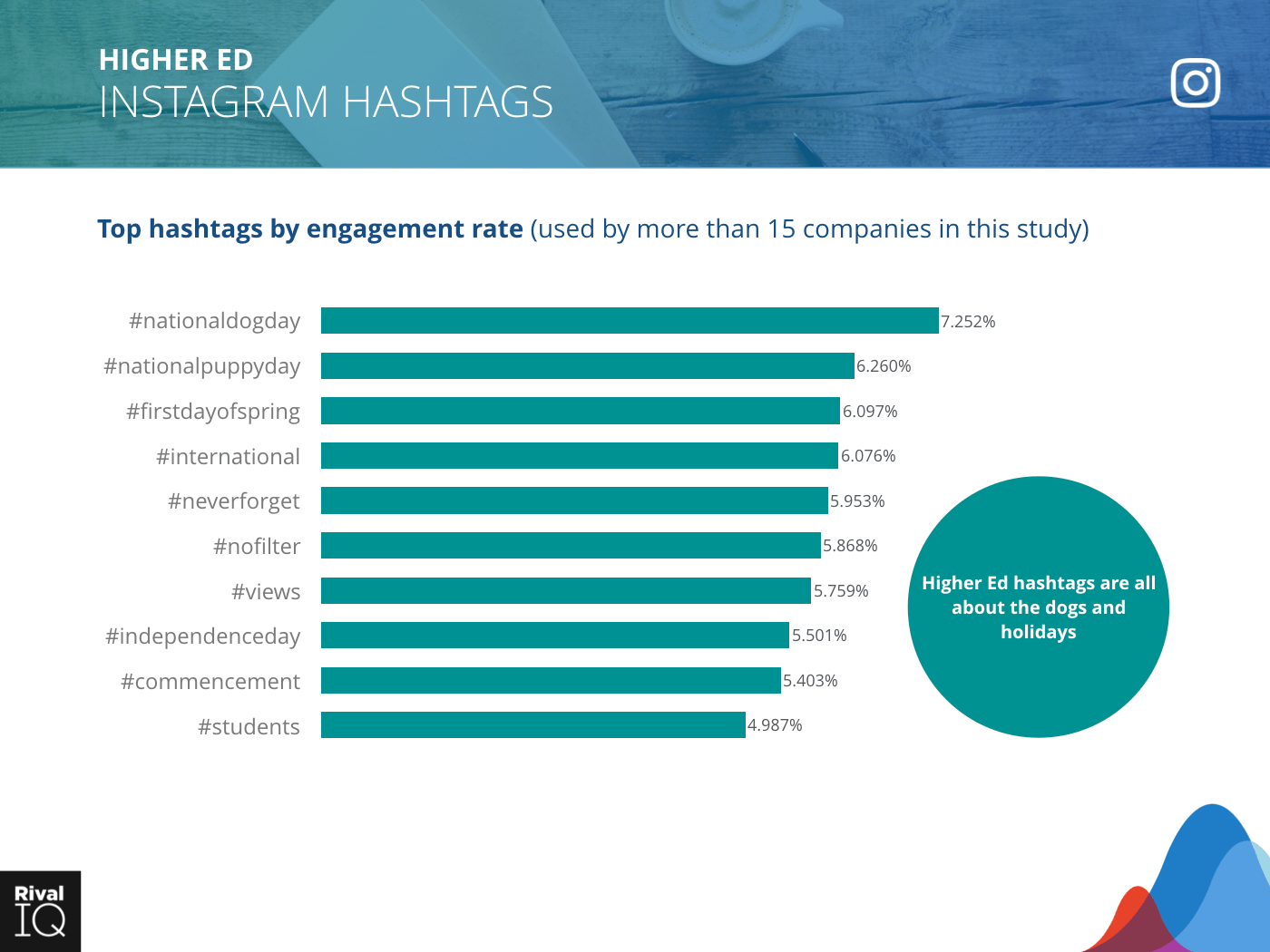

Top Instagram hashtags by engagement rate, Higher Ed

Higher Ed sees the highest Instagram hashtag engagement. Notably, none of these hashtags were top performers last year for colleges and universities.

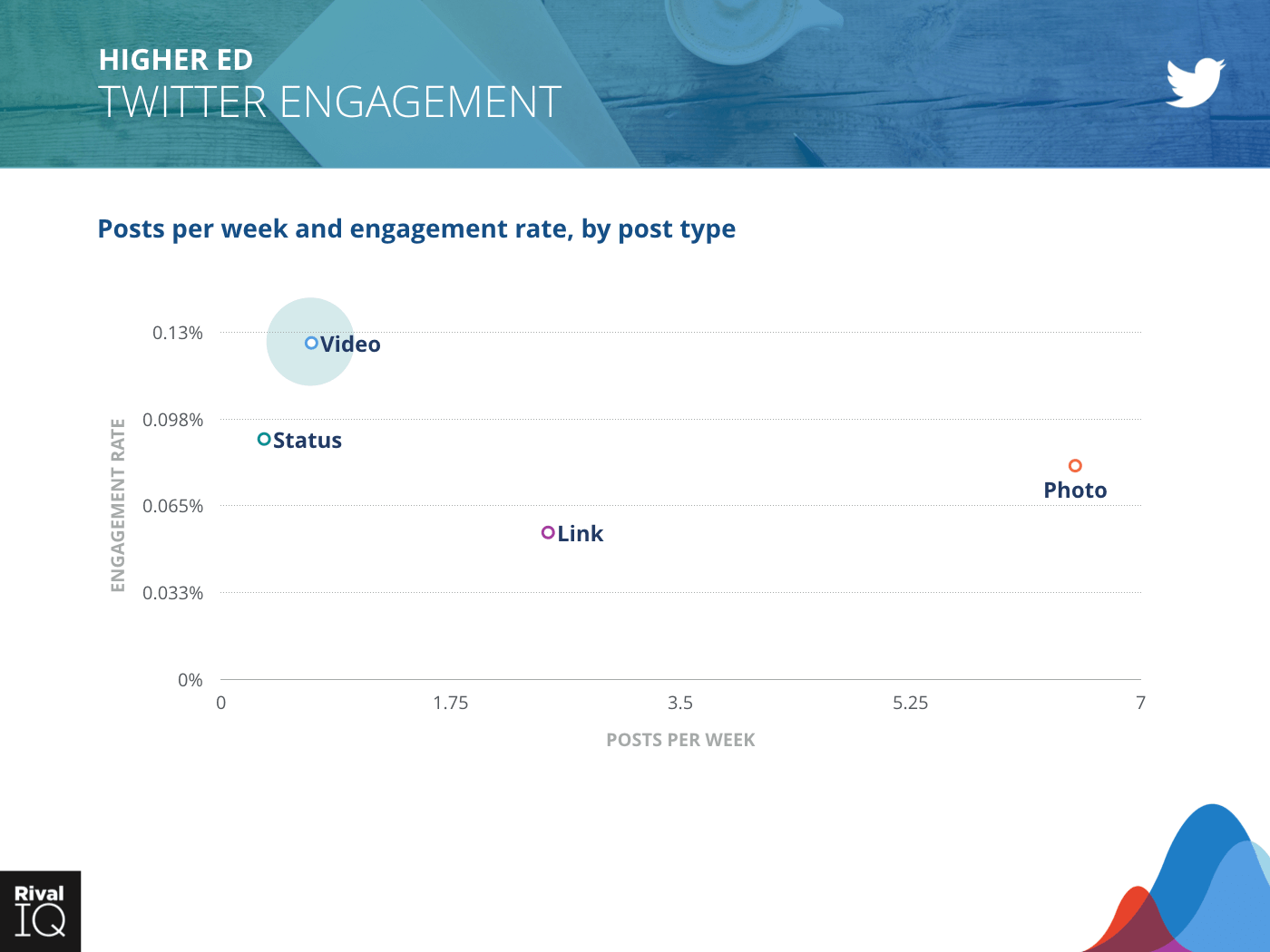

Twitter posts per week and engagement rate by post type, Higher Ed

Higher Ed stays competitive on Twitter, but might want to focus on experimenting with and increasing video output.

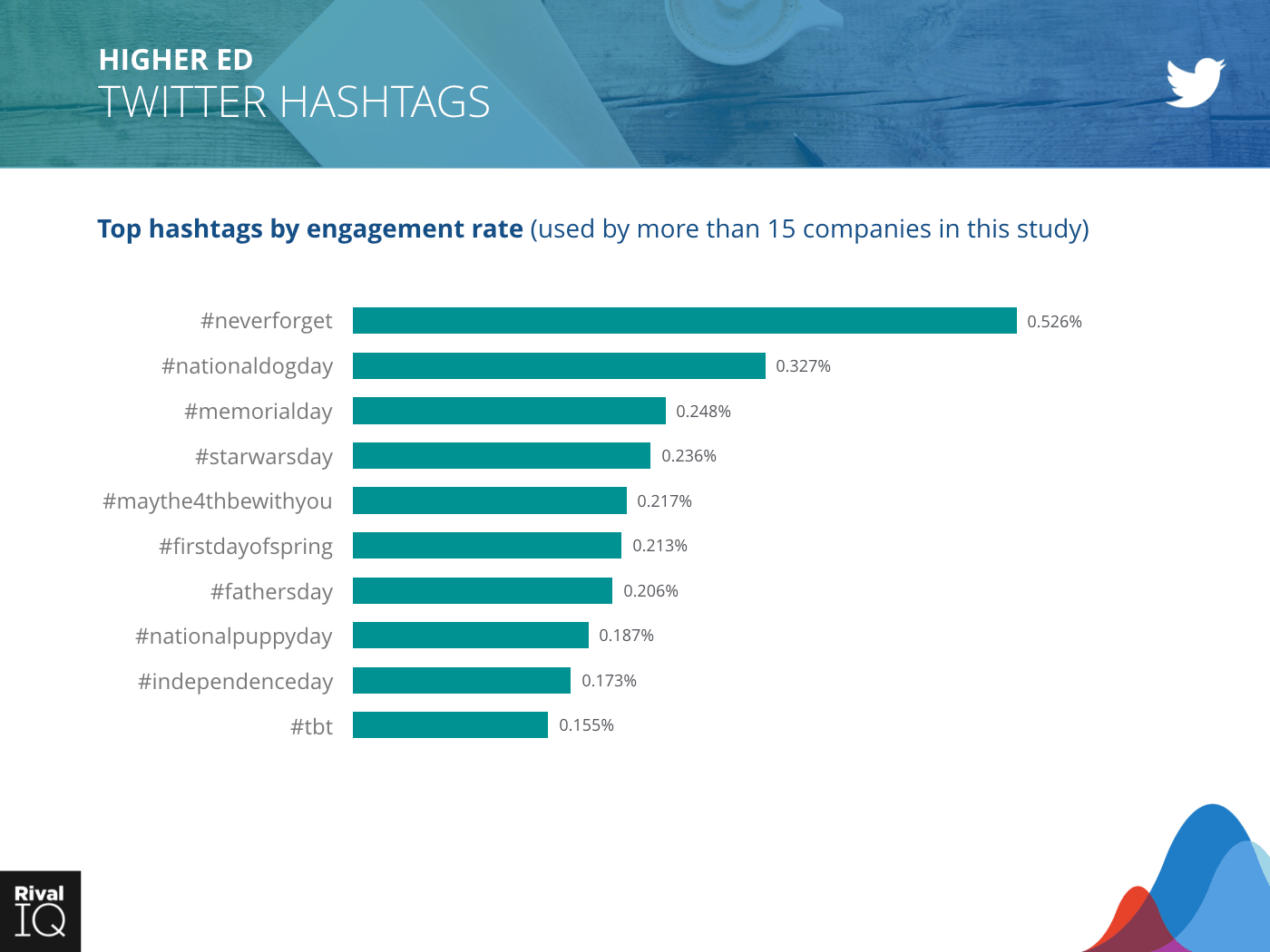

Top Twitter hashtags by engagement rate, Higher Ed

As on Instagram, high hashtag performance on Twitter is all about the holidays.

Industry Snapshot: Home Decor

Home decor brands struggled to engage their followers this year, with declines in engagement across all three channels. Photos performed well on Facebook and Instagram.

Some ideas for growth:

- Reinvest Facebook energy by doubling down on Instagram posts.

- Increase videos on Twitter, and be sure to repurpose that content on other channels.

Overview of all channels, Home Decor

Notable Home Decor brands from our random sampling include One Kings Lane, Benjamin Moore, West Elm, CB2, Structube, and Jonathan Adler.

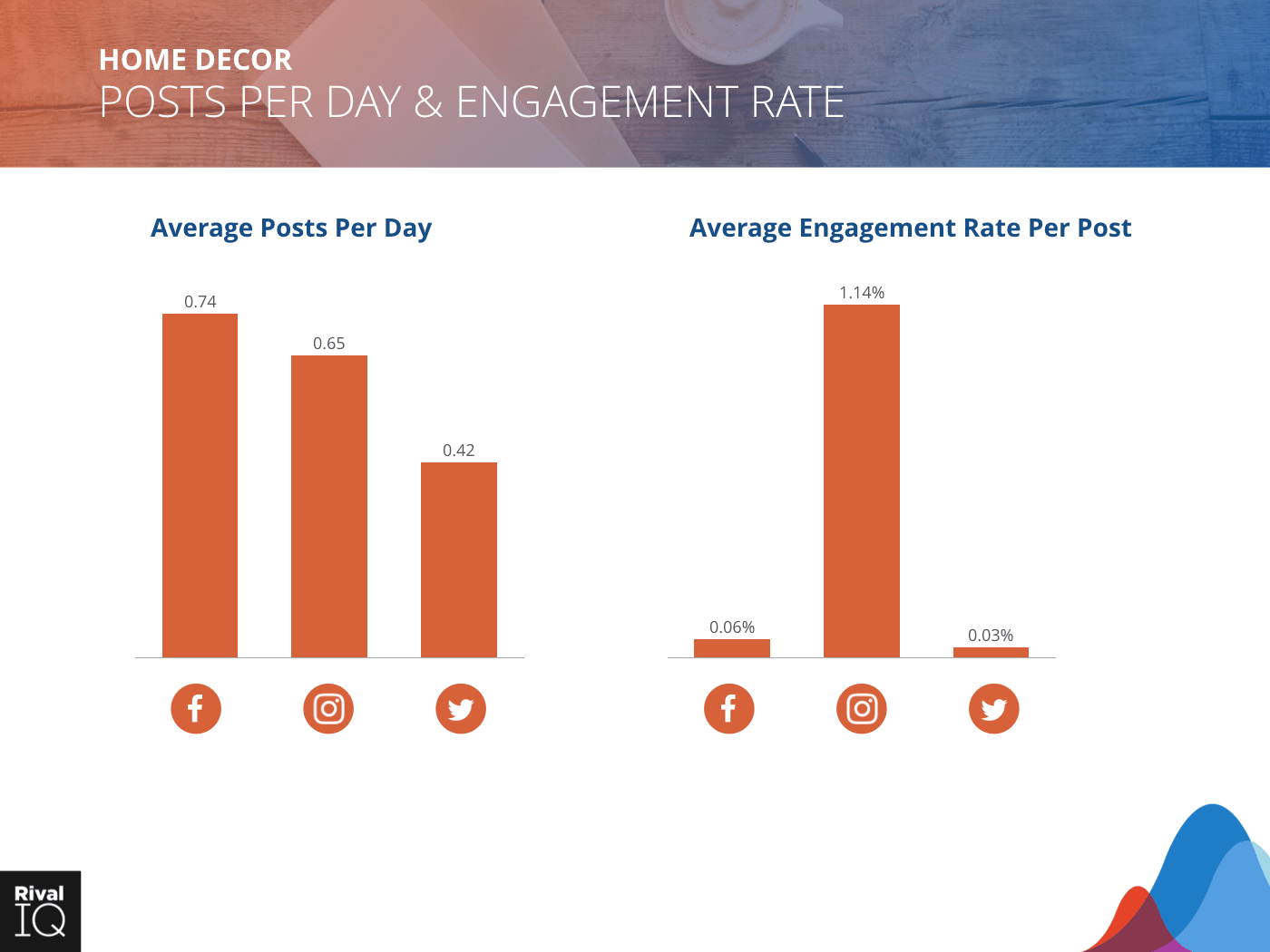

Average posts per day and engagement rate across all channels, Home Decor

Home Decor brands see notably low engagement on Facebook, so might want to put that energy toward increasing Instagram posting frequency instead.

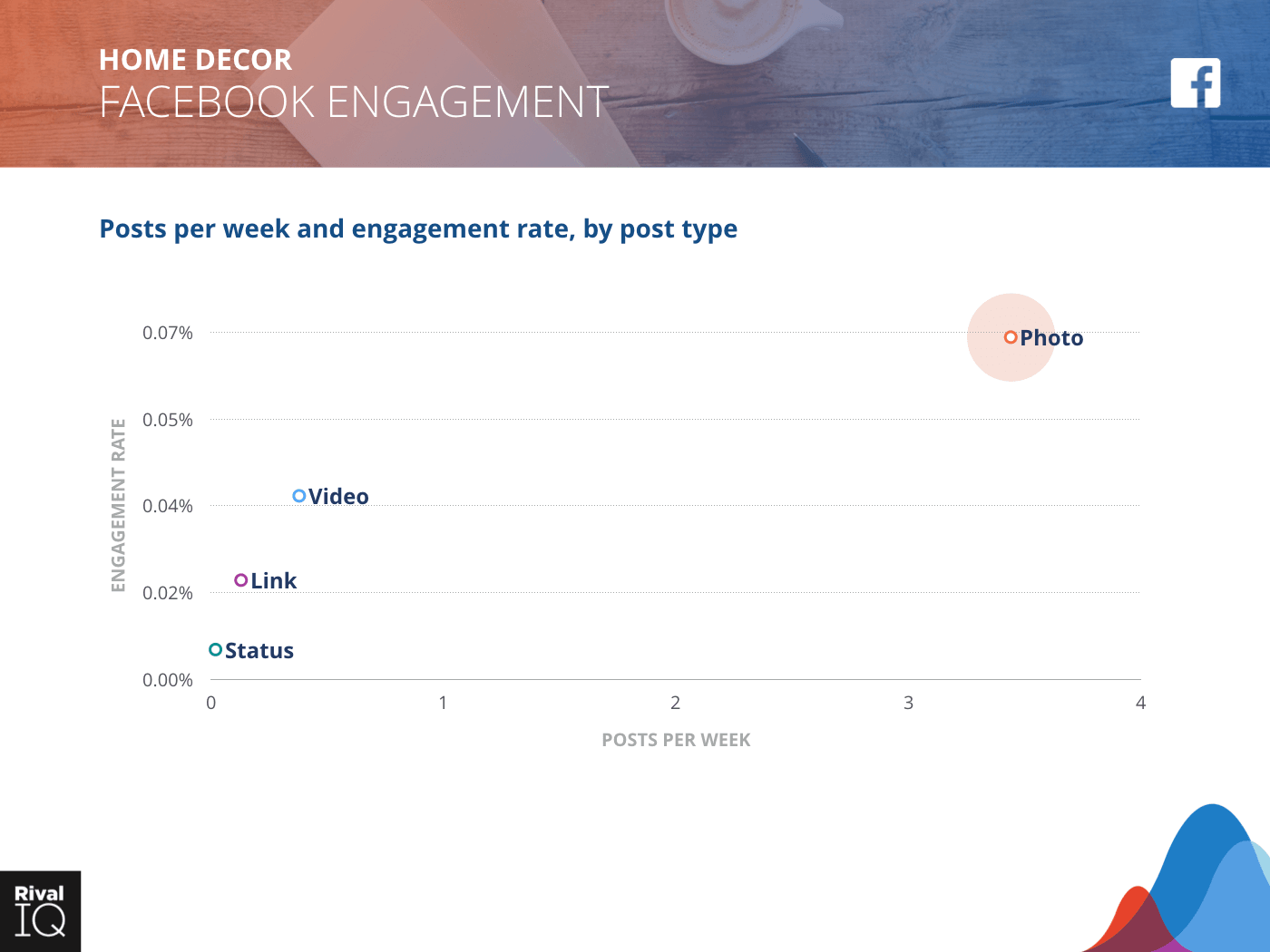

Facebook posts per week and engagement rate by post type, Home Decor

Engagement rate for every post type on Facebook is down for Home Decor brands from last year. Focus on higher-performing photos.

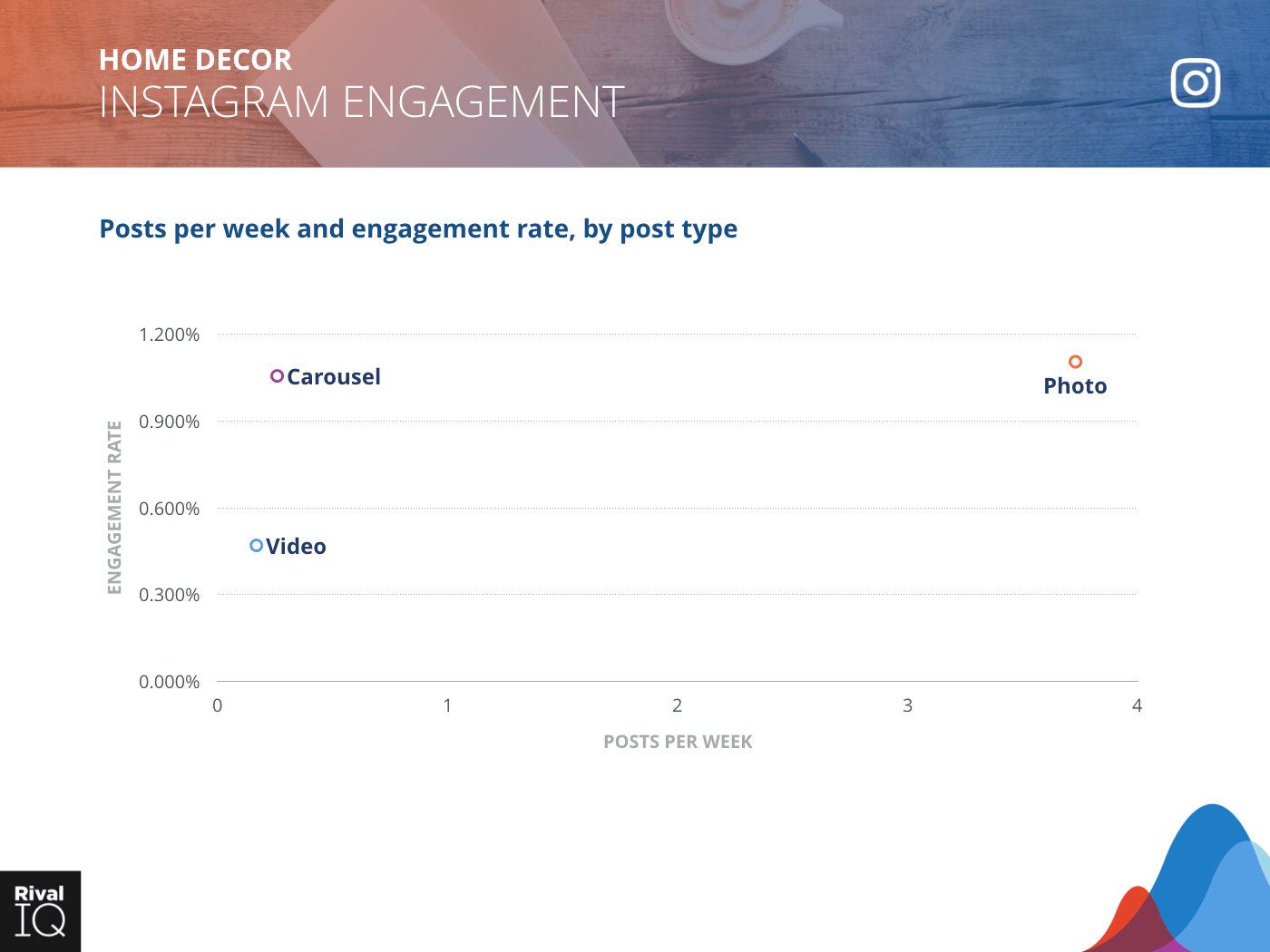

Instagram posts per week and engagement rate by post type, Home Decor

Home Decor brands are posting half as often on Instagram but seeing higher engagement than last year.

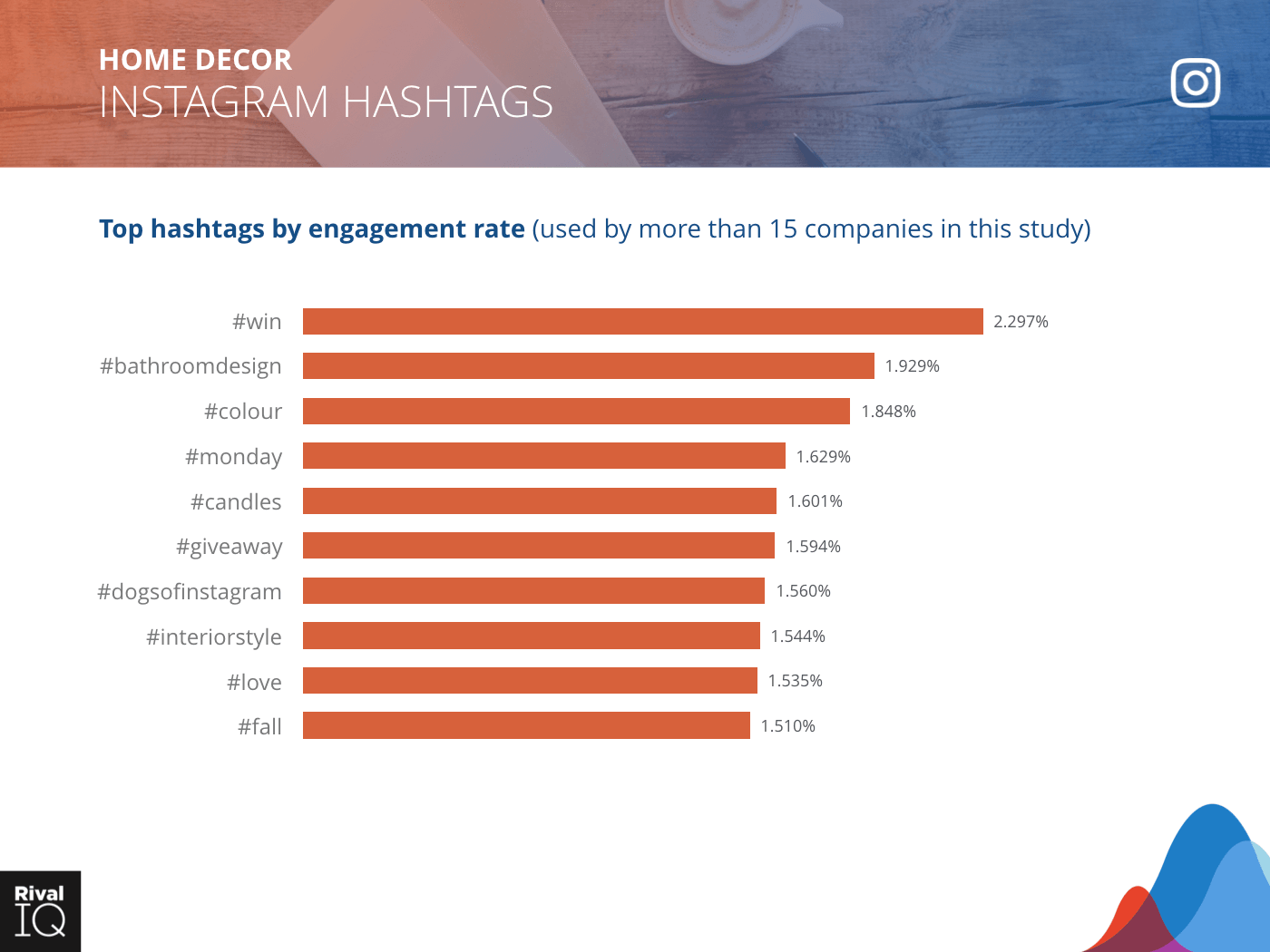

Top Instagram hashtags by engagement rate, Home Decor

Consistent with other lifestyle industries, Home Decor followers were all about the contests on Instagram.

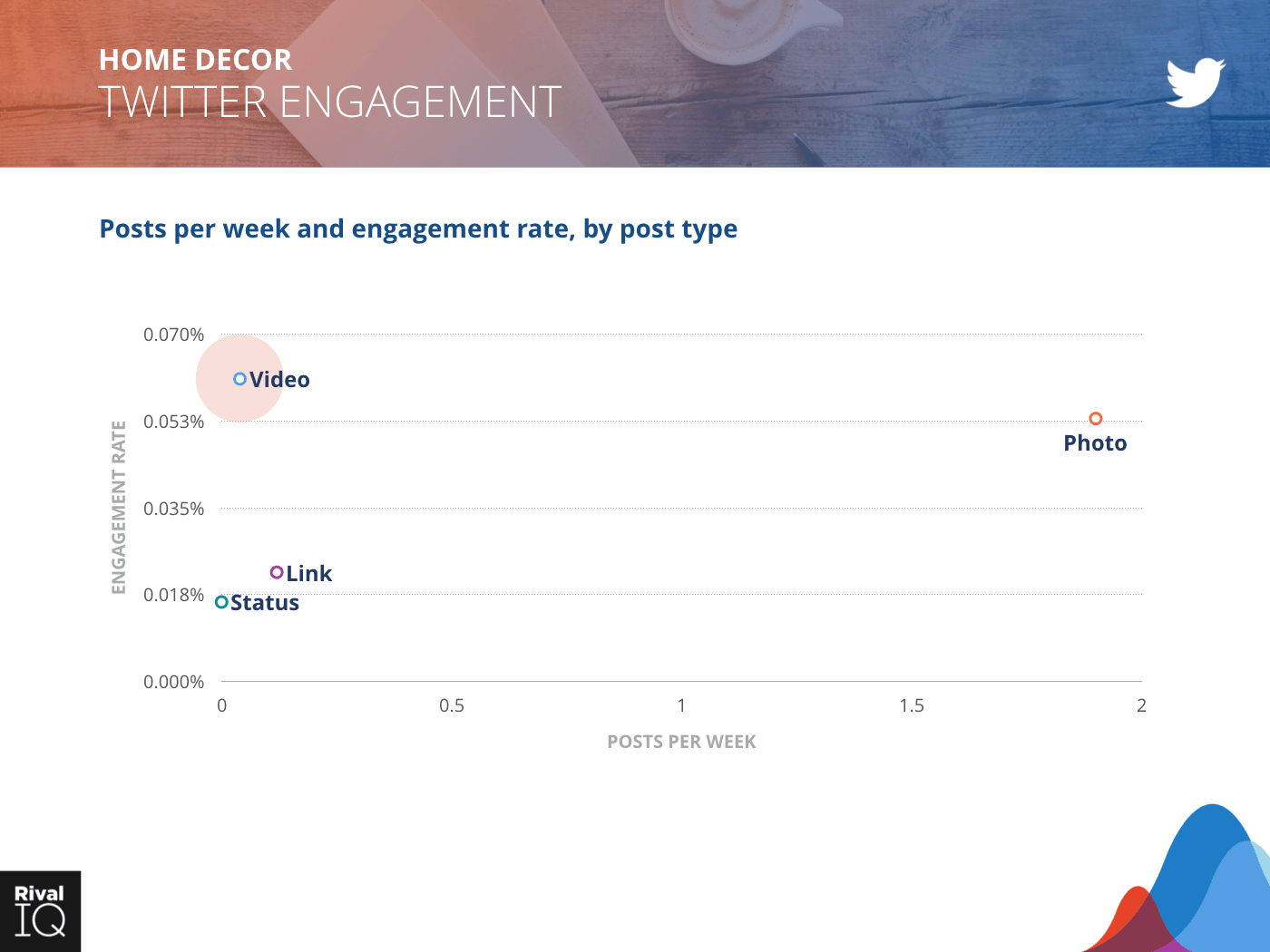

Twitter posts per week and engagement rate by post type, Home Decor

Which came first, the decline in Twitter posting frequency or engagement? Both are down this year, so these brands should focus on upping their video content.

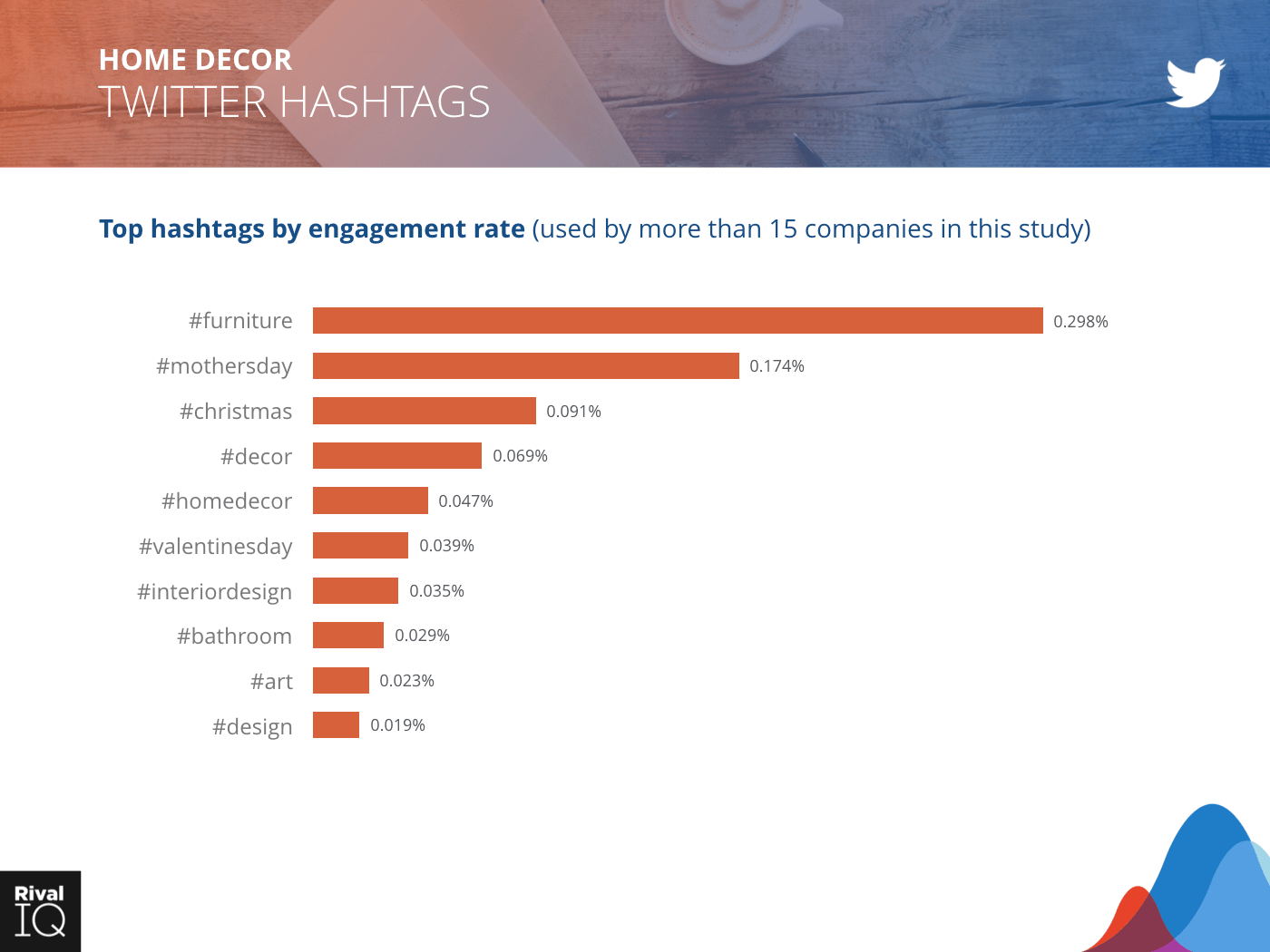

Top Twitter hashtags by engagement rate, Home Decor

Home Decor’s top-performing Twitter hashtags saw little overlap from their most successful Instagram hashtags, indicating that they’re tailoring their content well on each channel.

Hungry for more benchmarking? We’ve got the definitive guide to all things Instagram Stories.

Download the Instagram Stories benchmark reportIndustry Snapshot: Hotels & Resorts

Hotels & Resorts saw high Twitter engagement again this year, but took a dip on Facebook and Instagram. The most successful post types (photos and videos) and hashtags helped followers feel like they were already on vacation.

A few suggestions to keep up the social momentum:

- Keep on keepin’ on with posting frequency, content, and hashtags on Twitter.

- Take some Facebook energy and put it toward Instagram instead.

Overview of all channels, Hotels & Resorts

Notable Hotels & Resorts from our random sampling include Hotel Playa Mazatlan, Fairmont, Liberty Mountain Resort, St. Regis Mumbai, Le Bristol Paris, and Six Senses.

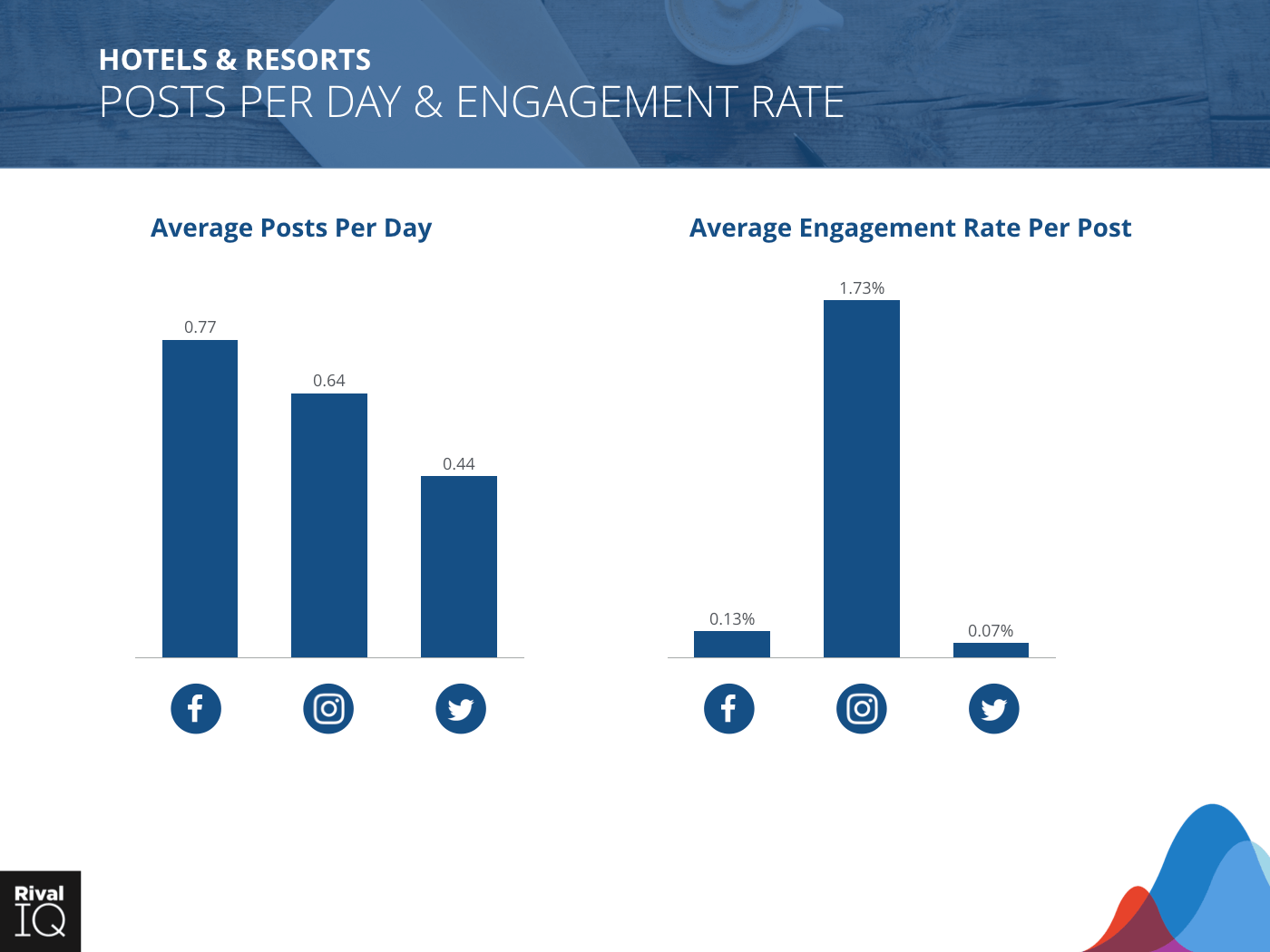

Average posts per day and engagement rate per posts for all channels, Hotels & Resorts

Hotels & Resorts are posting most frequently on Facebook despite declining engagement on that channel. Consider refocusing those efforts back to Instagram.

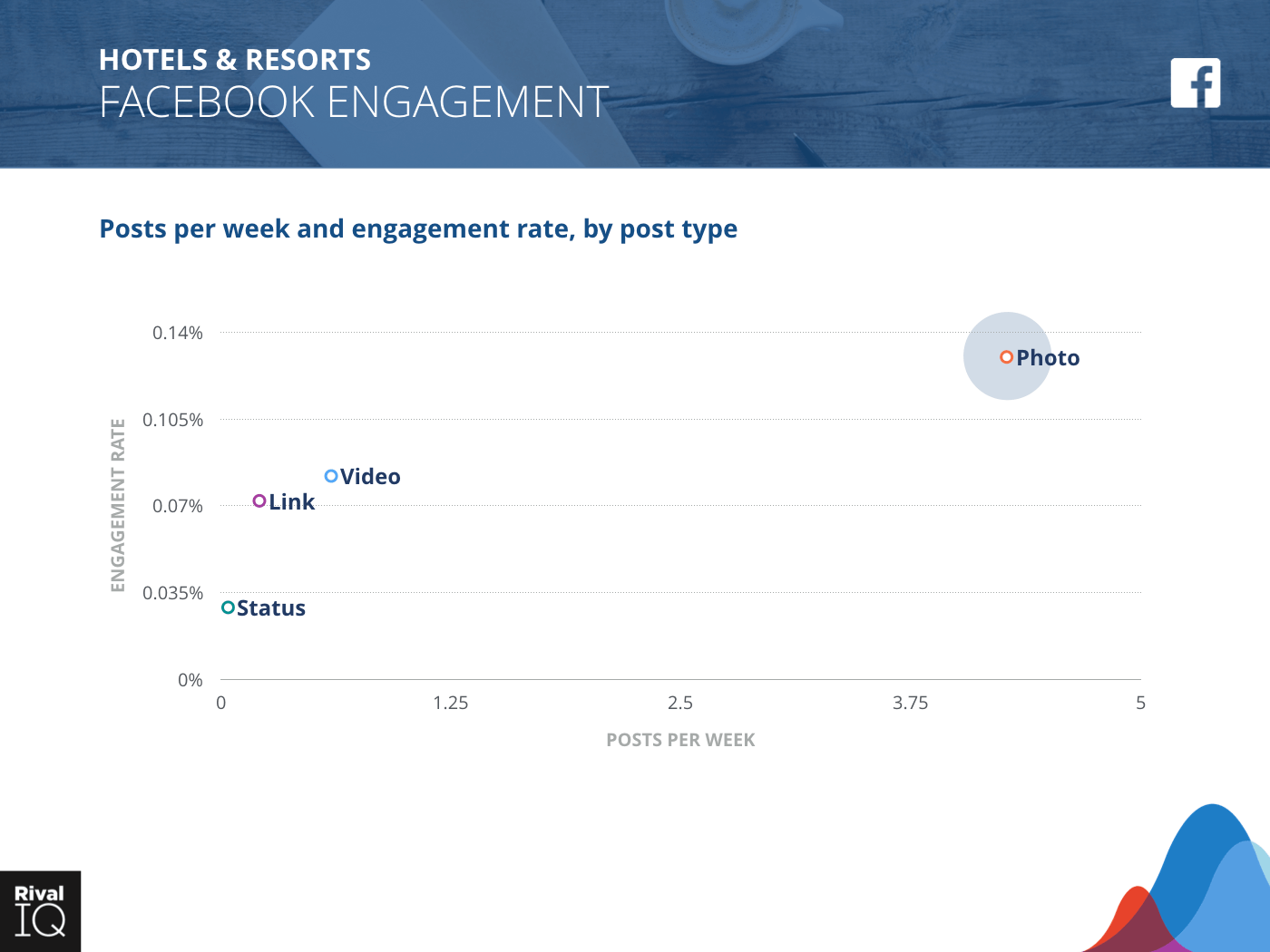

Facebook posts per week and engagement rate by post type, Hotels & Resorts

As you’d expect from such a visual industry, photos fare well for Hotels & Resorts on Facebook. Even that high-performing post type sees less than half the engagement it saw last year, though.

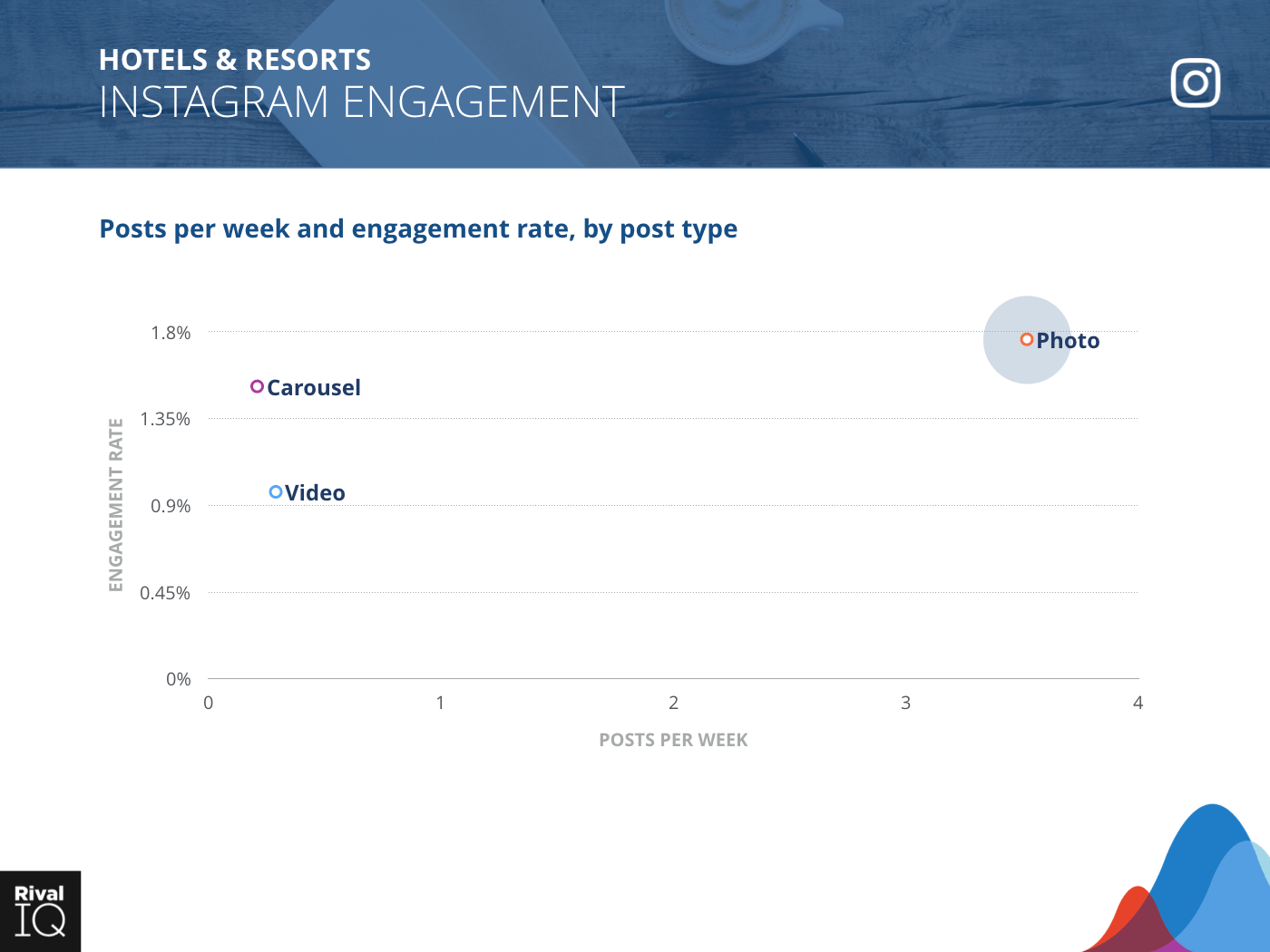

Instagram posts per week and engagement rate by post type, Hotels & Resorts

Hotels & Resorts pulled back on their posting frequency of every type on Instagram this year.

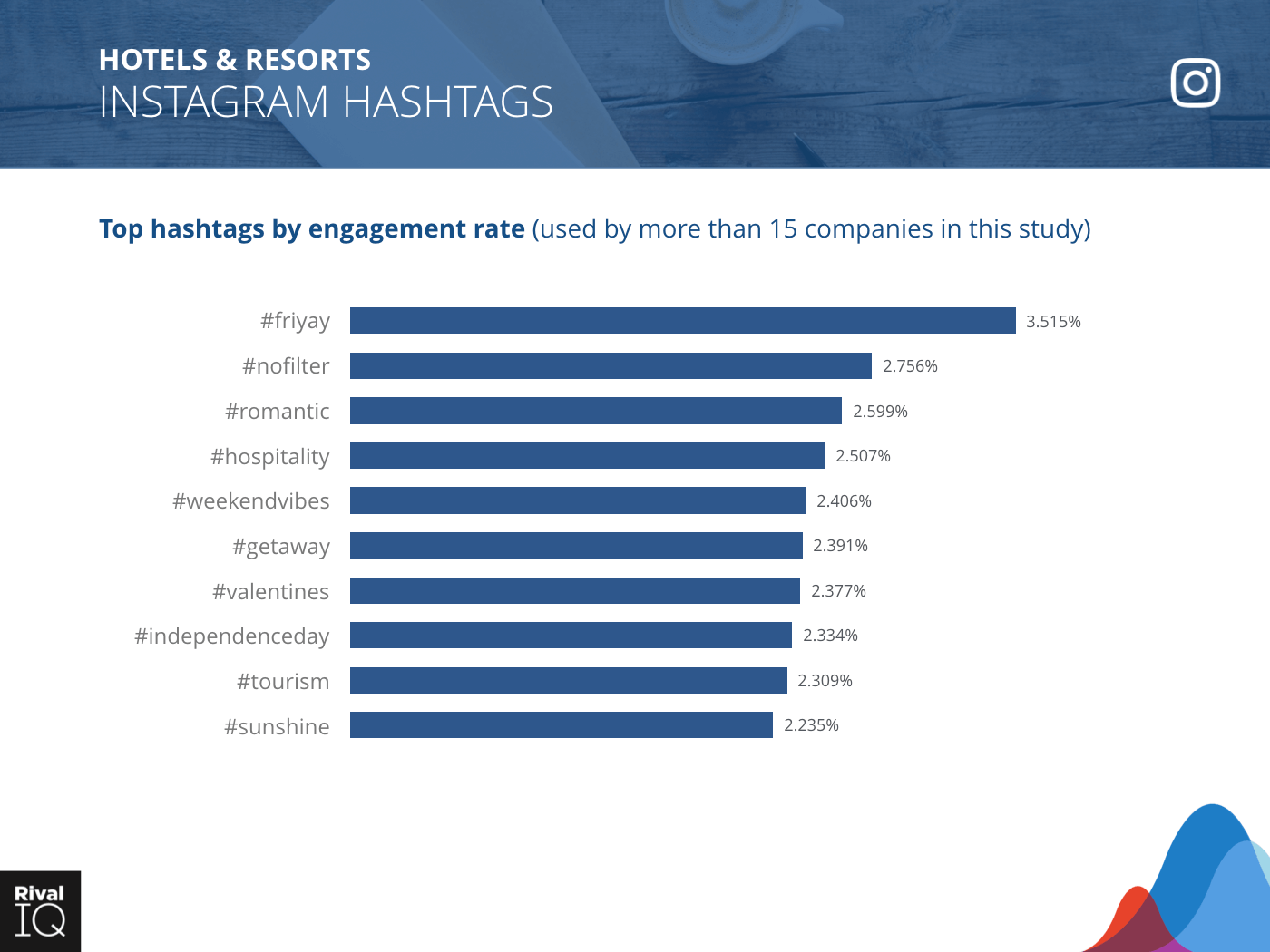

Top Instagram hashtags by engagement rate, Hotels & Resorts

For the second year in a row, Hotels & Resorts made the most of hashtags that helped followers feel like they were on vacation.

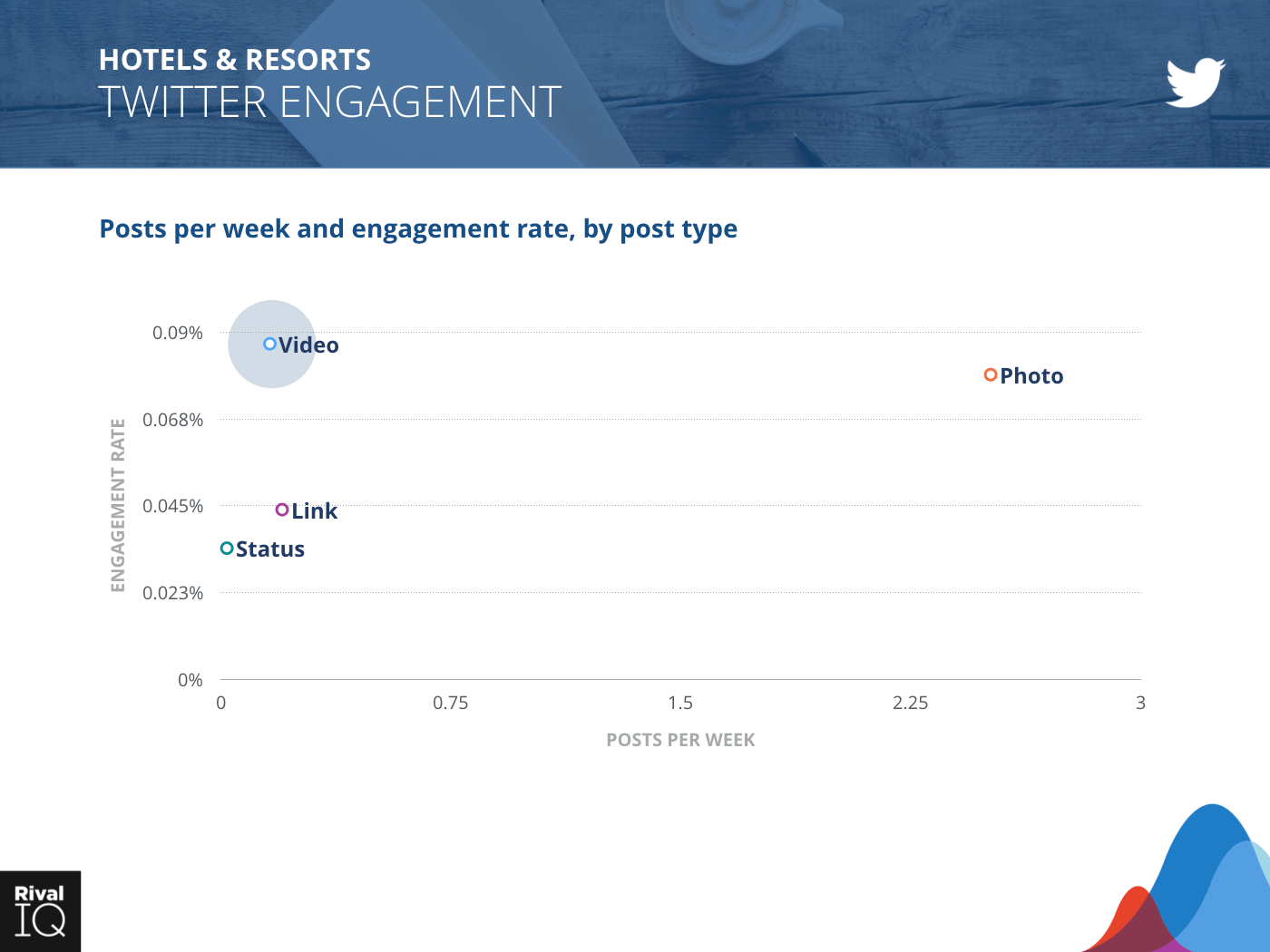

Twitter posts per week and engagement rate by post type, Hotels & Resorts

Hotels & Resorts saw great video engagement on Twitter for the second year in a row, and also doubled their photo engagement on this channel.

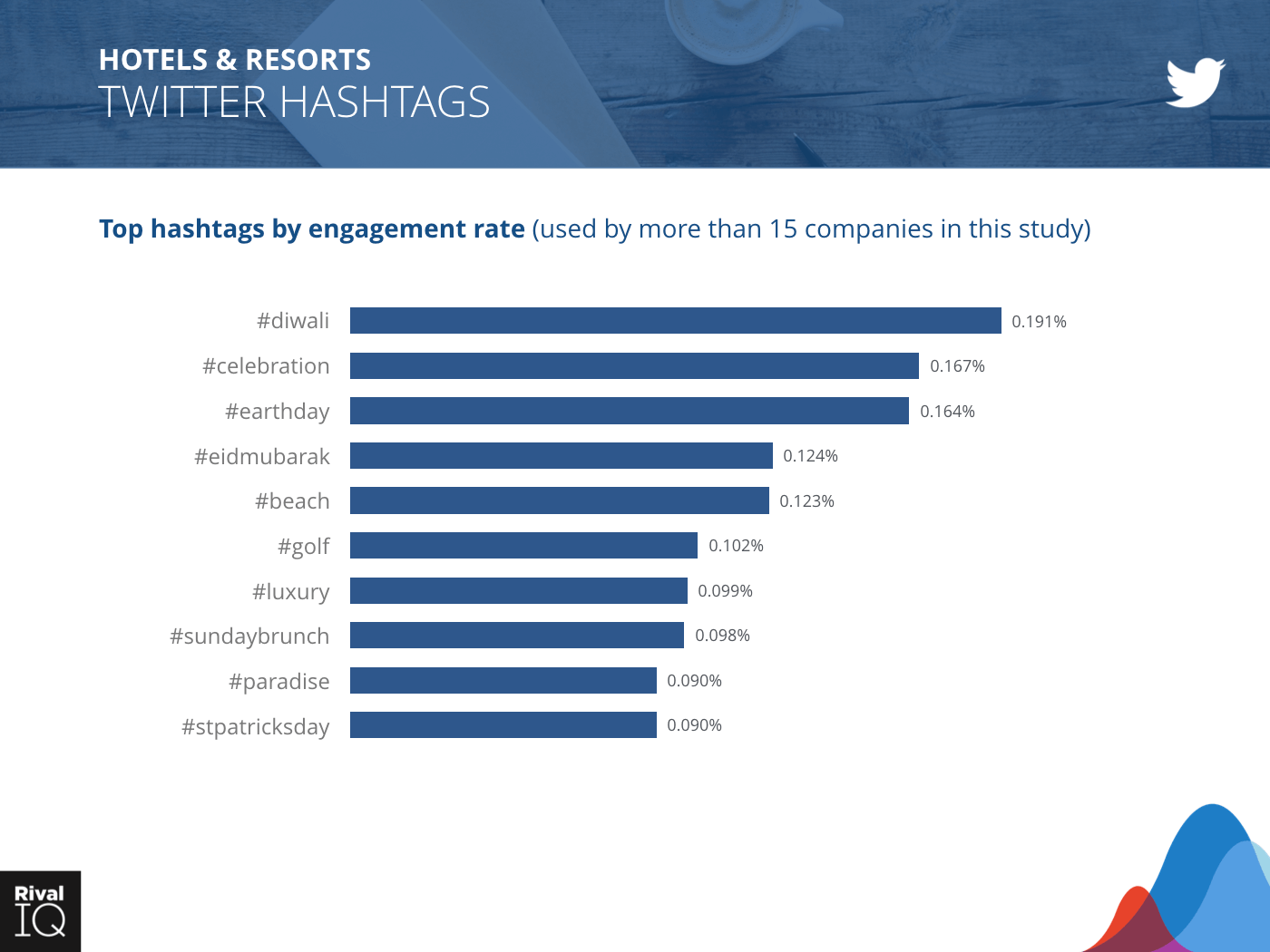

Top Twitter hashtags by engagement rate, Hotels & Resorts

Holiday hashtags were top performers on Twitter, with a multicultural theme running through hashtags like #diwali and #eidmubarak.

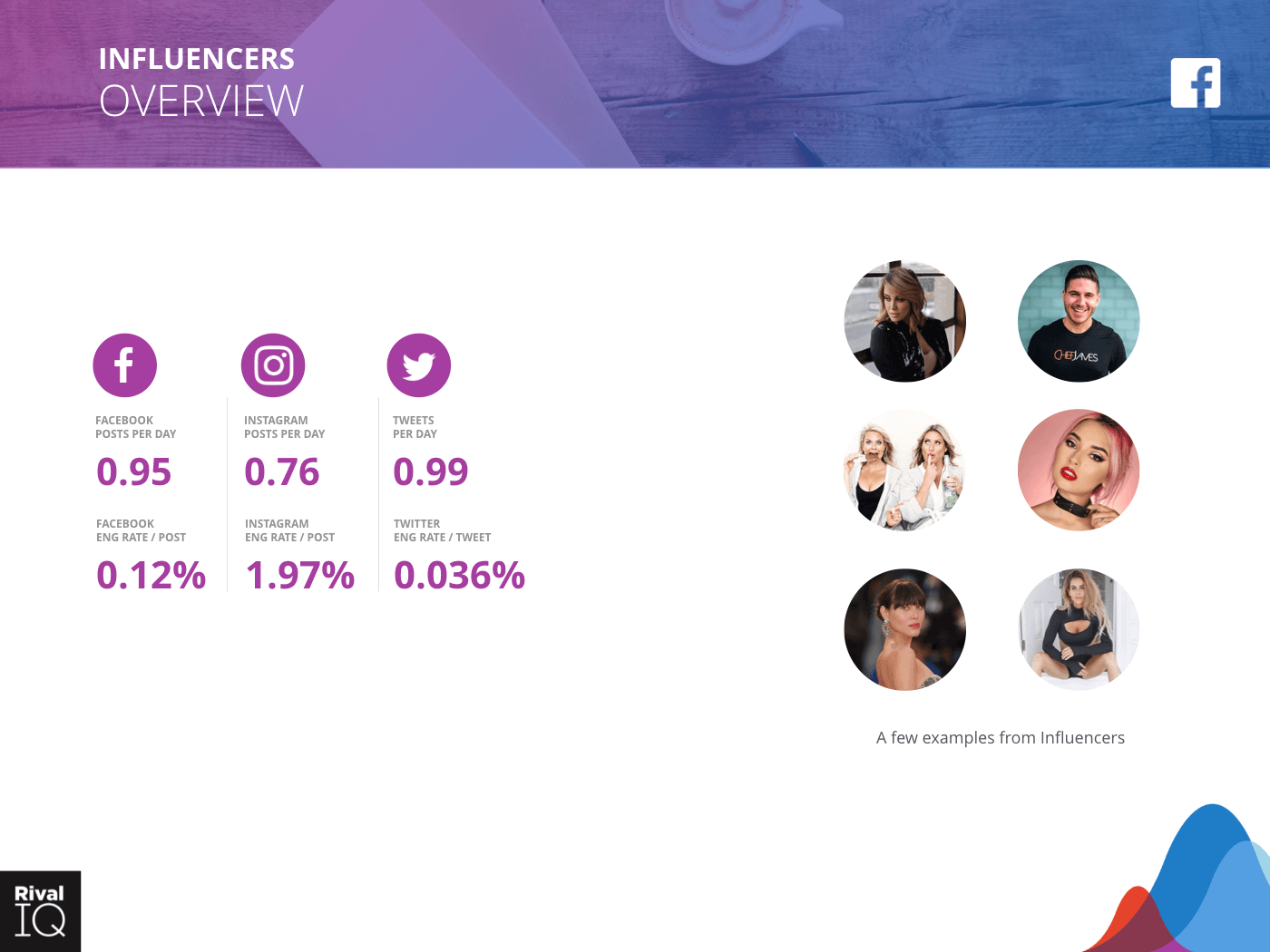

Industry Snapshot: Influencers

Once again, Influencers perform far above average on Facebook, and stay competitive against other industries on Instagram too. They have some work to do if they want to have any influence on Twitter, though.

Two recommendations for the year to come:

- Videos do well on Influencers’ strongest channels, Facebook and Instagram.

- Rethink your Twitter strategy by taking a closer look at what does well for you on that channel.

Overview of all channels, Influencers

Notable Influencers from our random sampling include Rosie Rivera, James Tahhan, Cat & Nat, Laura Sanchez, Natalie Lim Suarez, and Sophie Guidolin.

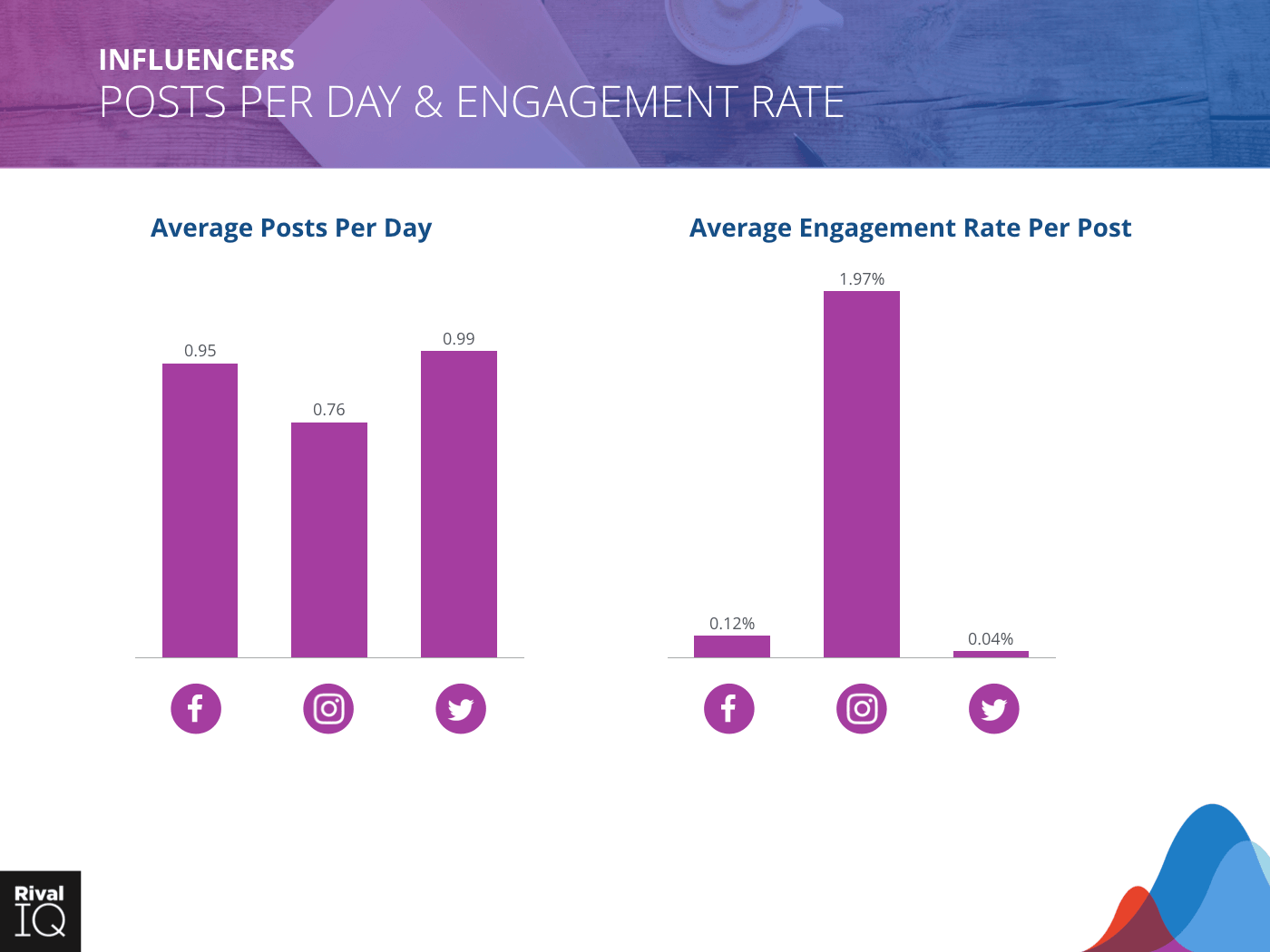

Average posts per day and engagement rate per post across all channels, Influencers

This year saw a decline in Influencer posting frequency across every channel.

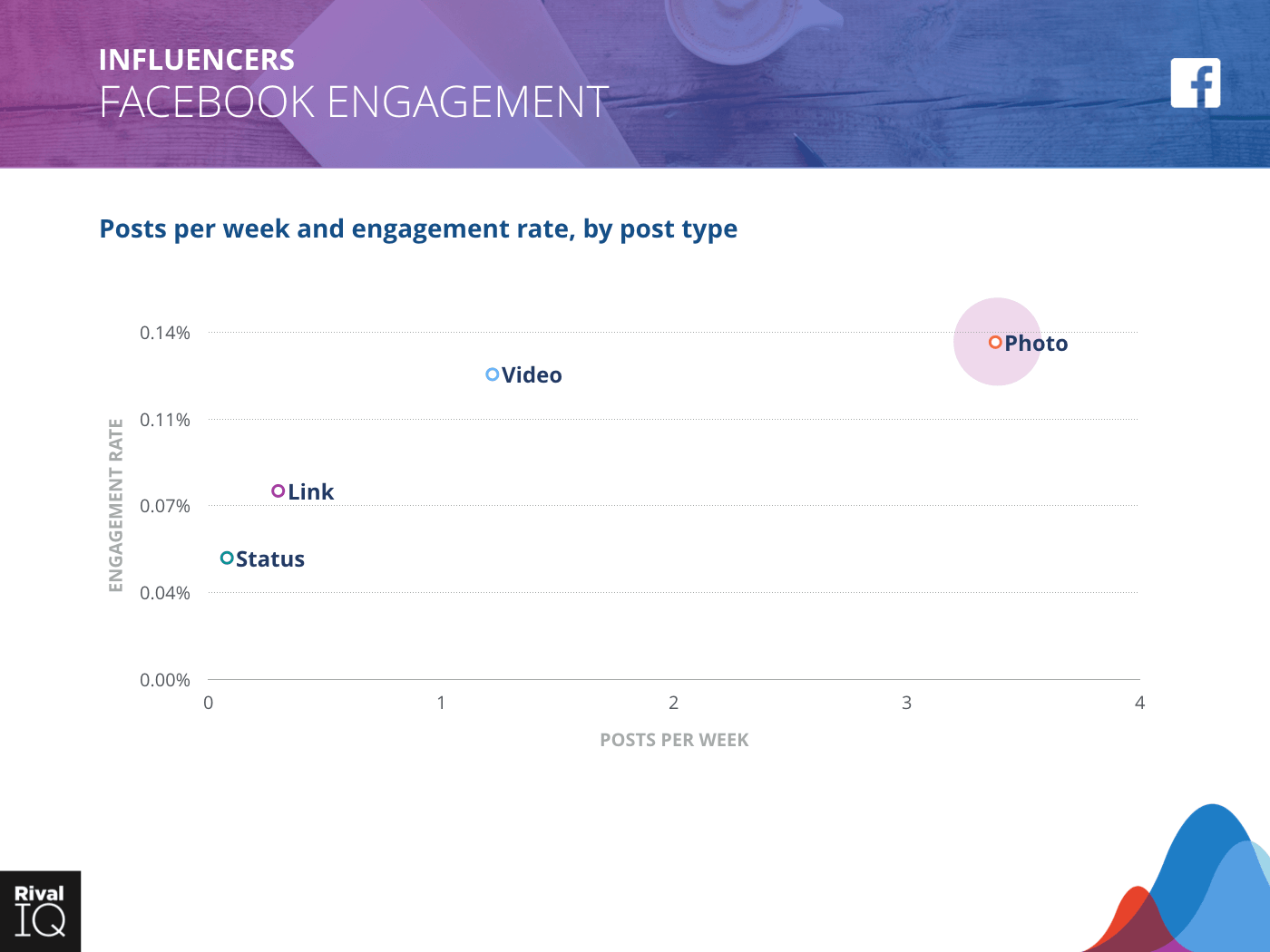

Facebook posts per week and engagement rate by post type, Influencers

Influencers saw half the Facebook engagement this year, but continued to focus on high-performing photos, which was the right move.

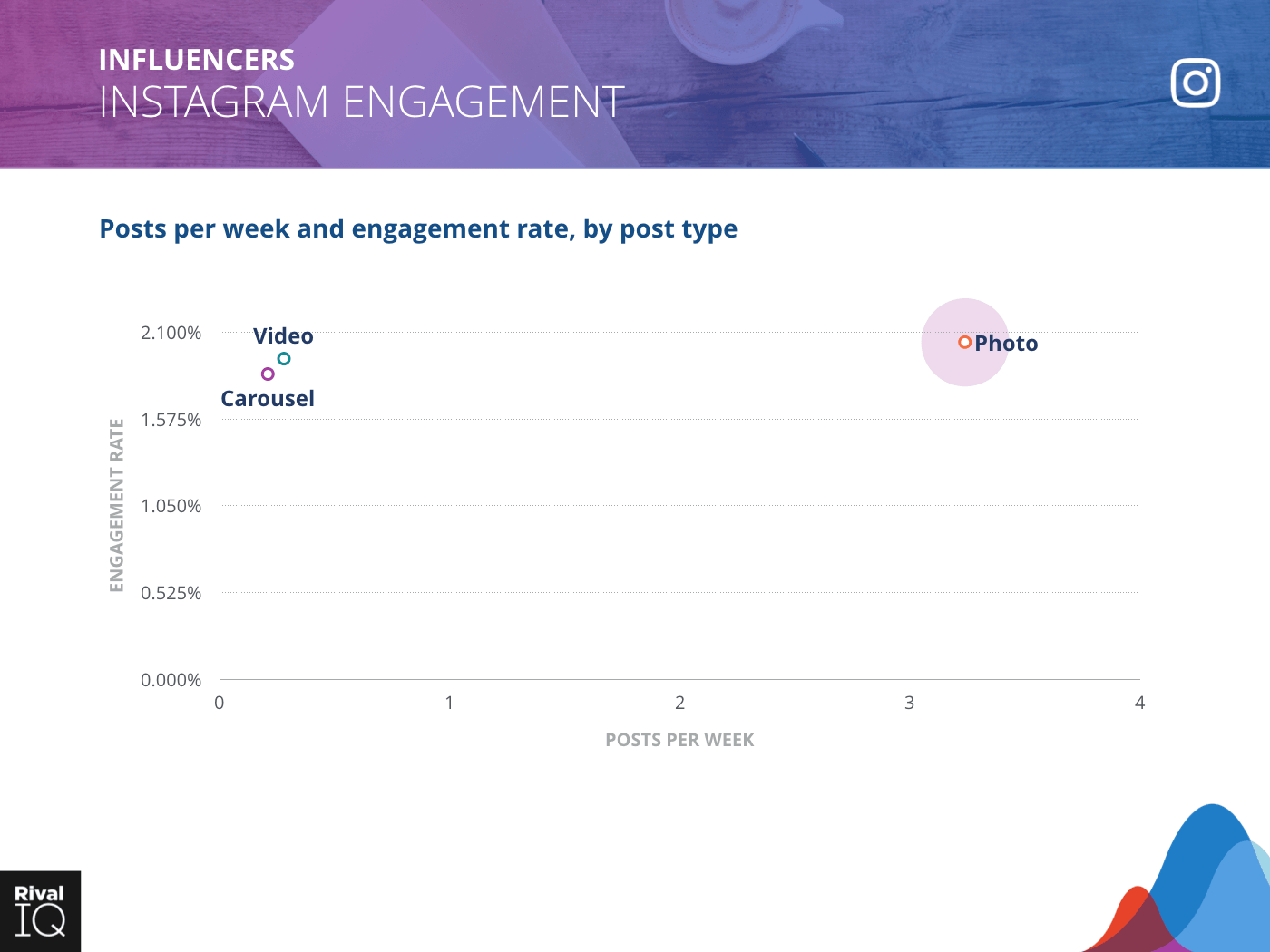

Instagram posts per week and engagement rate by post type, Influencers

No surprise that Influencers continue to find a home on Instagram. Photo, video, and carousel engagement are neck and neck for top performing post type on this channel.

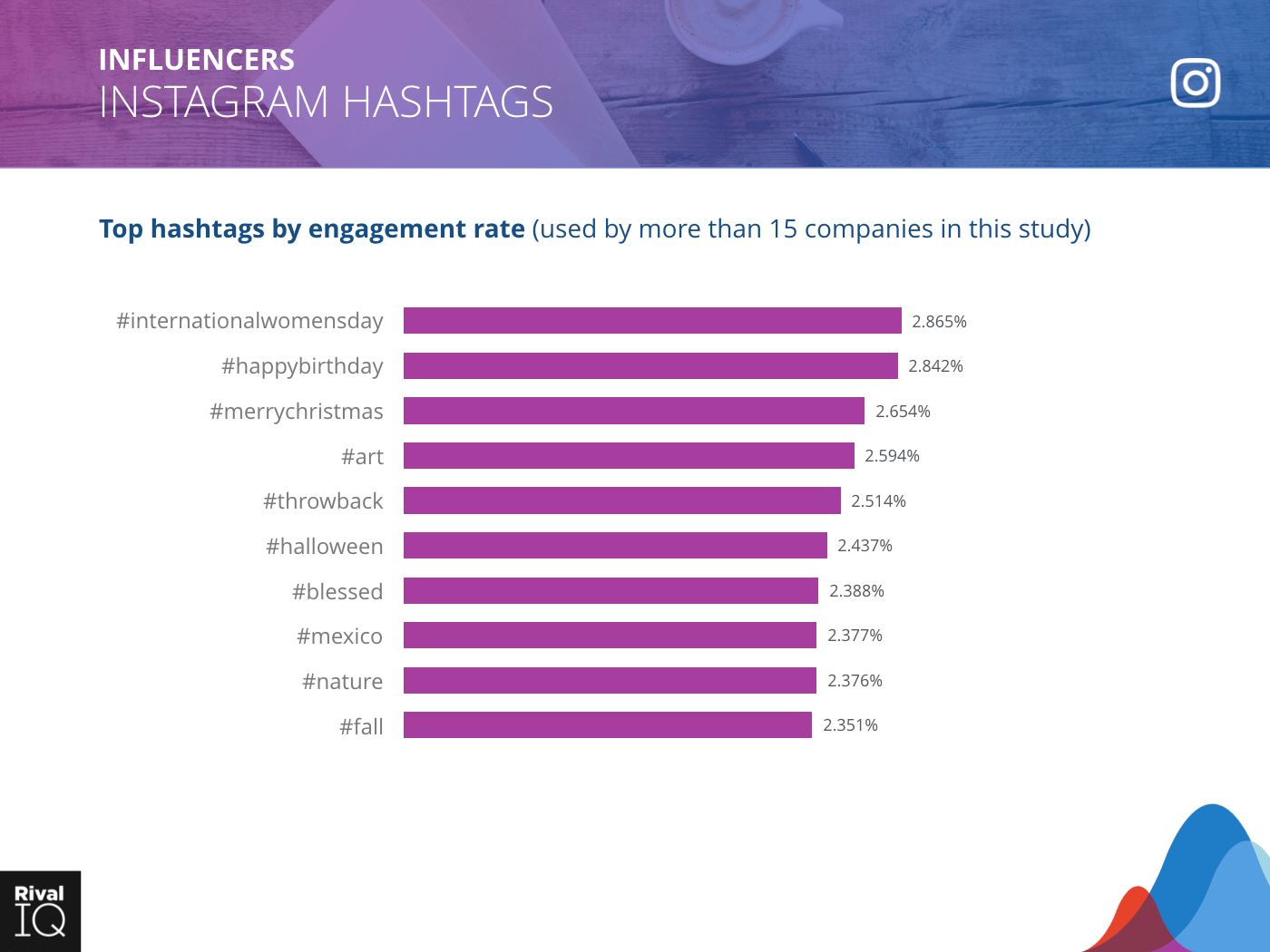

Top Instagram hashtags by engagement rate, Influencers

Continuing the trend, holidays performed well for Influencers on Instagram.

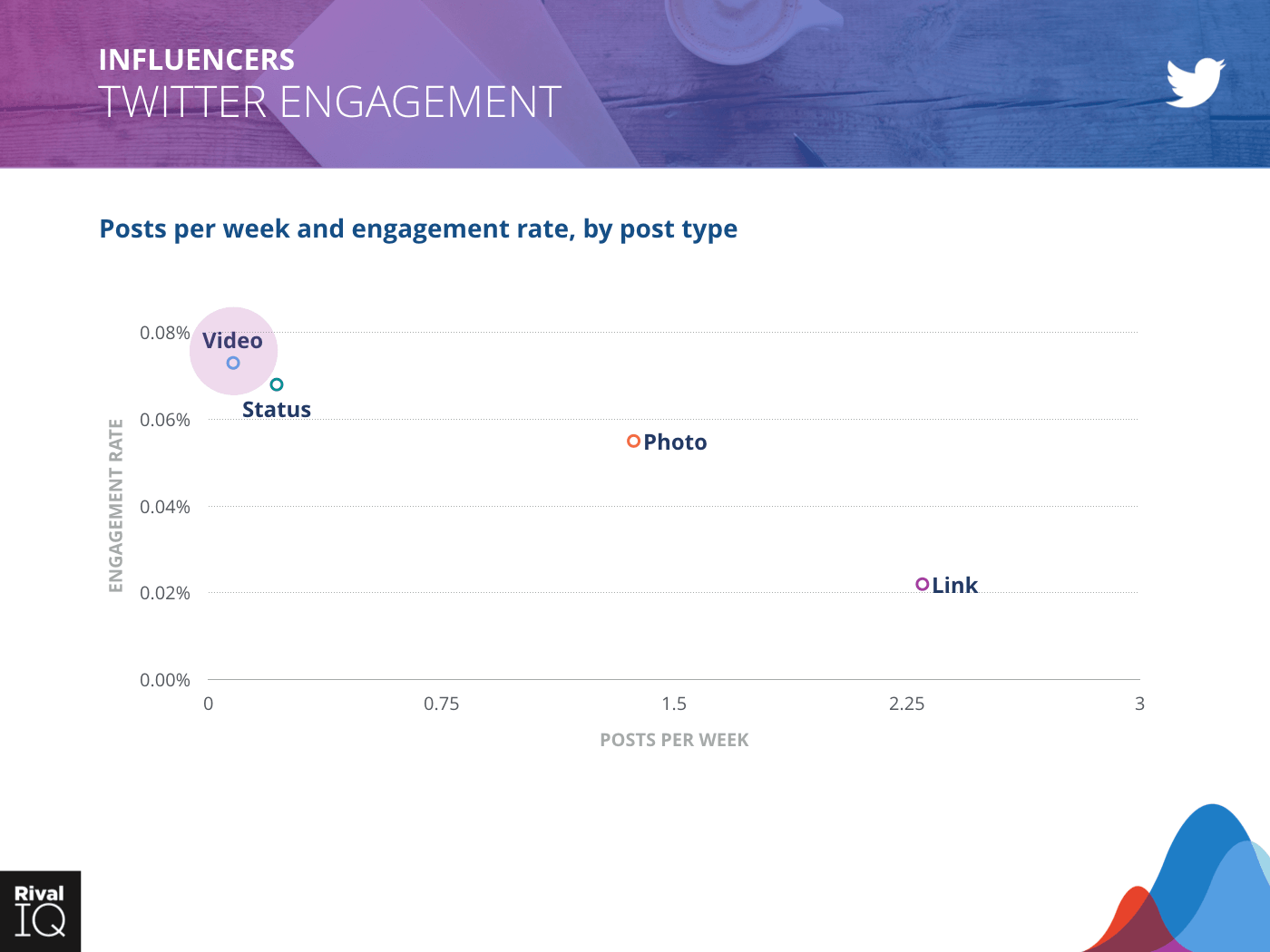

Twitter posts per week and engagement rate by post type, Influencers

This graph goes from high to low in exactly the wrong direction: Influencers are experiencing low engagement from the posts they’re putting up most frequently. Focus more on videos and status updates.

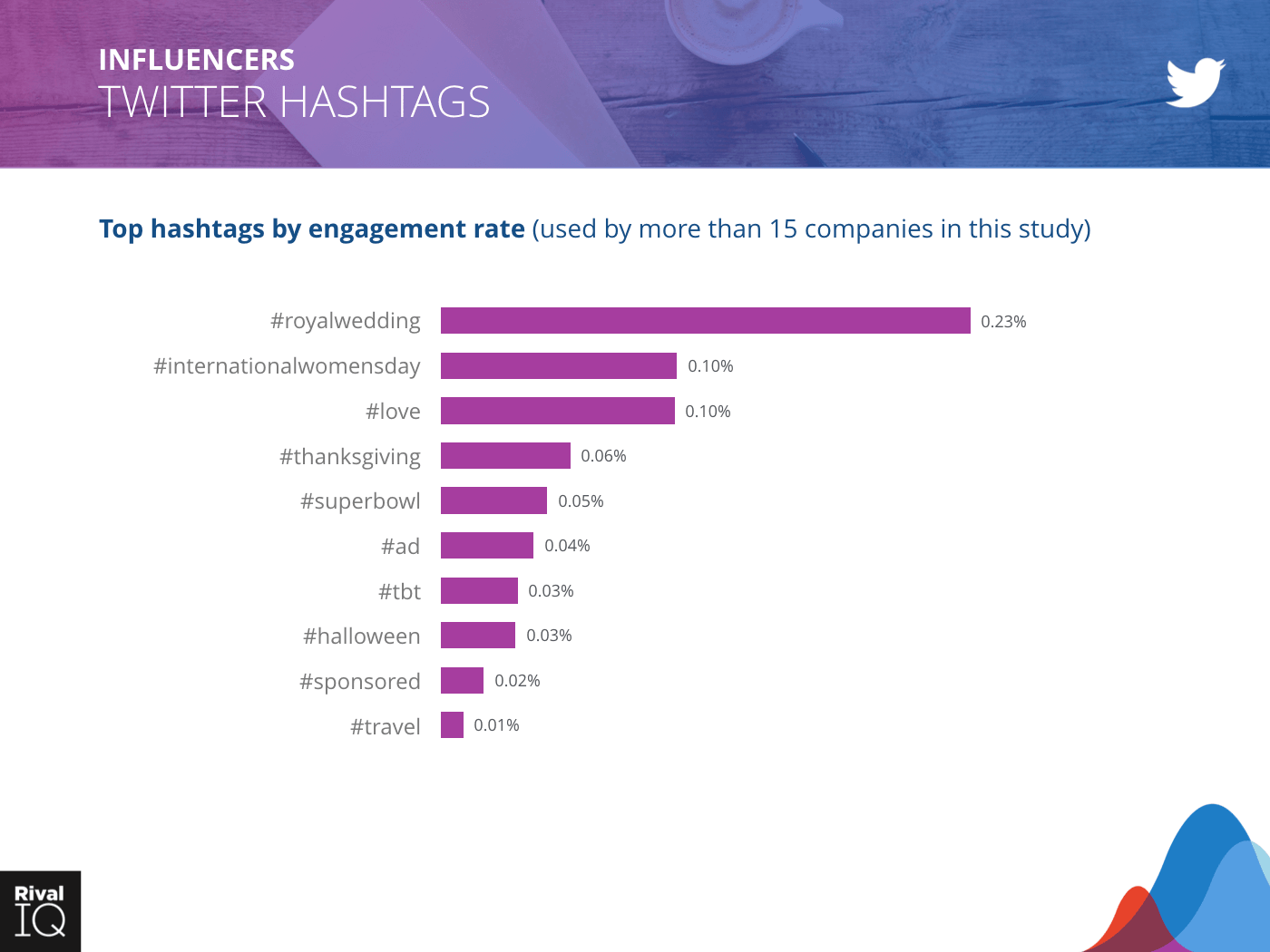

Top Twitter hashtags by engagement rate, Influencers

#internationalwomensday topped both the Instagram and Twitter charts for Influencers this year.

See how you stack up against your competition.

Run a free Head-to-Head ReportIndustry Snapshot: Media

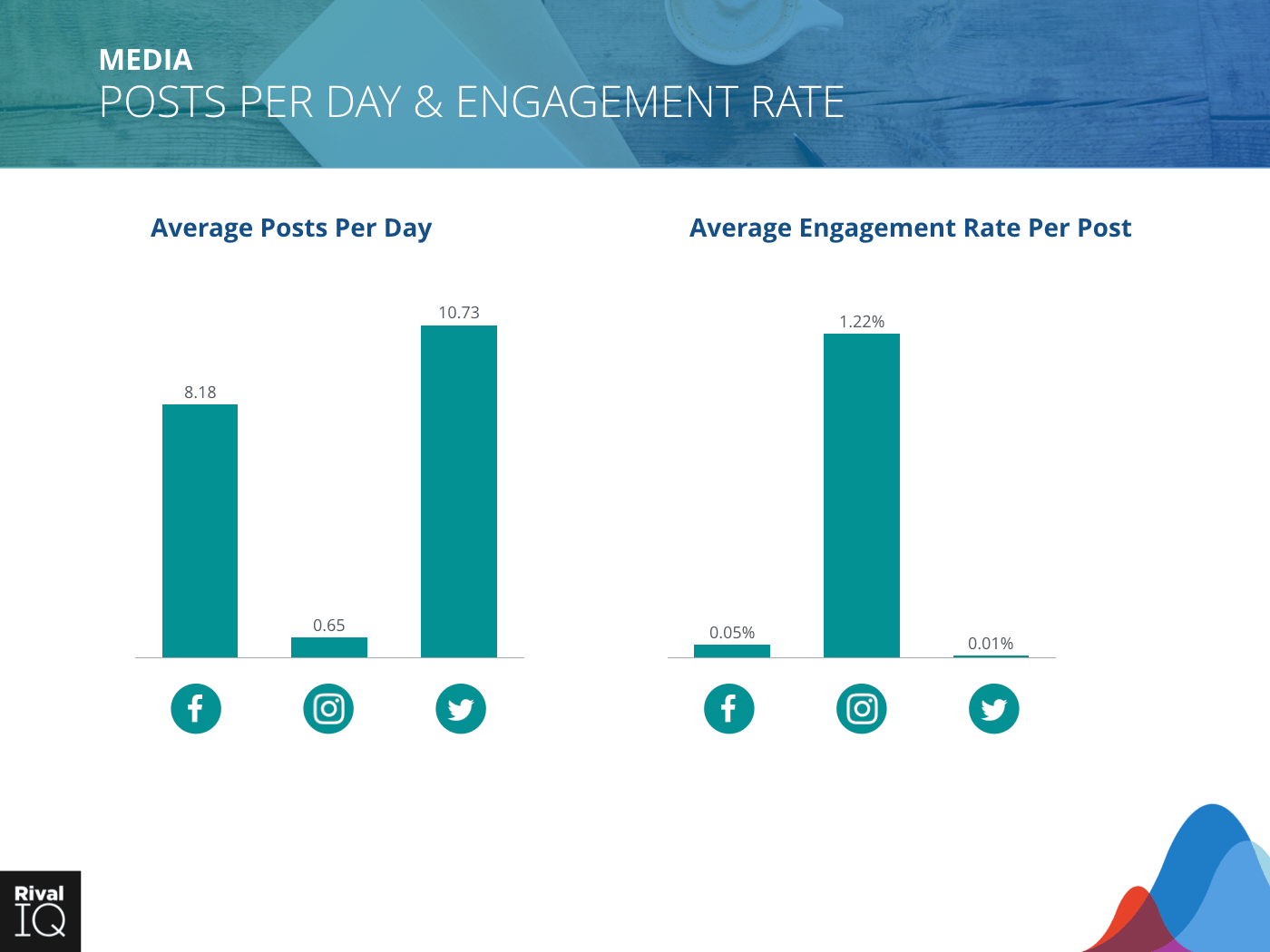

High posting frequency continues to plague Media brands’ engagement on Facebook and Twitter, but thanks to some smart investments in Instagram content, they’re on the rise on social media’s most engaging channel.

Two suggestions that could improve that engagement rate:

- Keep focusing on Instagram, and consider upping hashtag use.

- Pull back on posting Facebook links and put that energy into videos and photos, which resonate better with your followers.

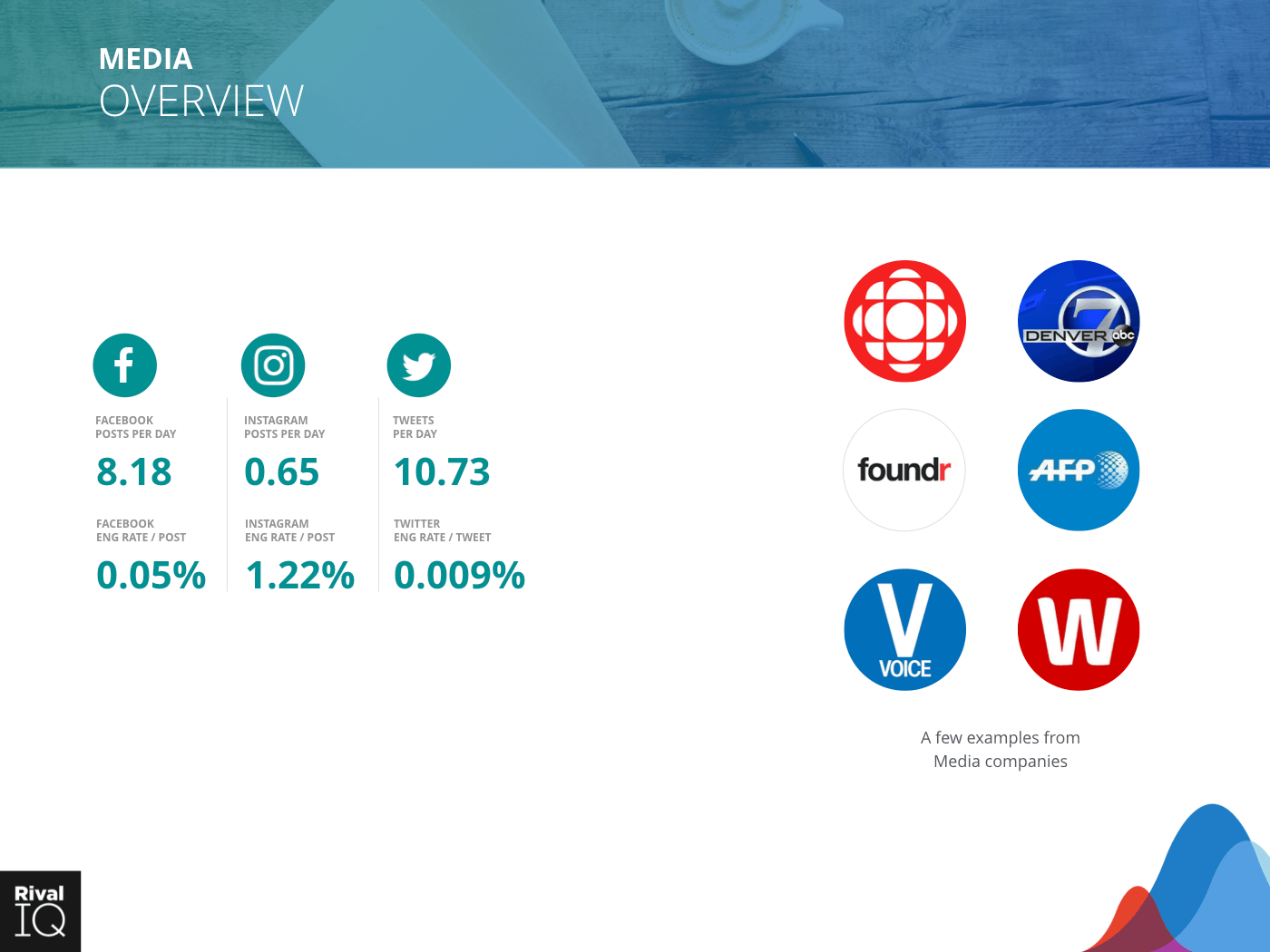

Overview of all channels, Media

Notable Media brands from our random sampling include CBC, Denver7, Foundr, AFP-L’Agence France-Press, Village Voice, and Wales Online.

Average posts per day and engagement rate per post across all channels, Media

For the third year in a row, Media brands saw low engagement rate and high post frequency on Twitter and Facebook, and posted infrequently on Instagram.

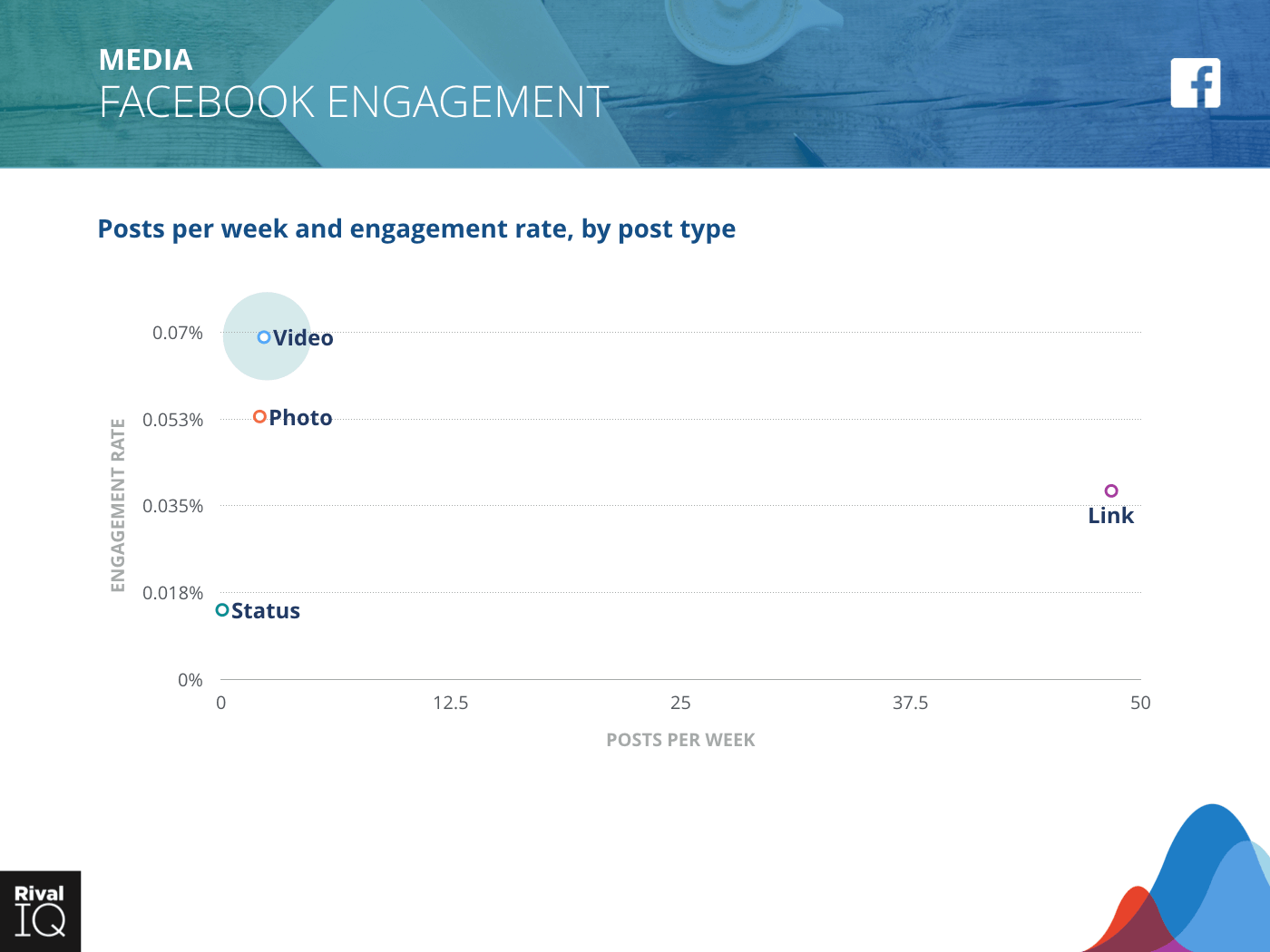

Facebook posts per week and engagement rate by post type, Media

Media companies are all about driving traffic to their sites, which explains their heavy reliance on link posts.

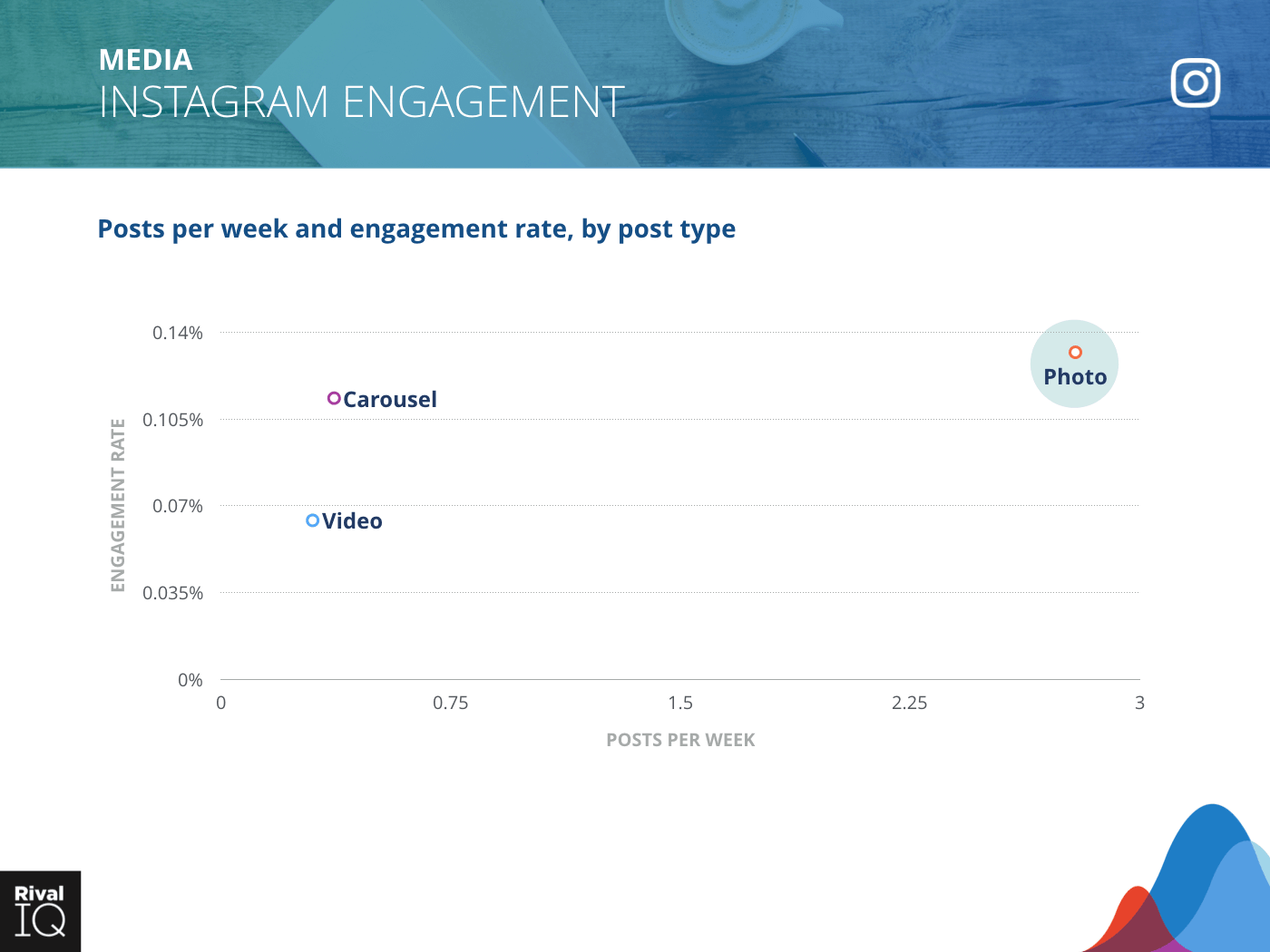

Instagram posts per week and engagement rate by post type, Media

As with many industries, Media companies saw high engagement but low frequency with carousel posts on Instagram. These companies might want to focus more here in the year to come.

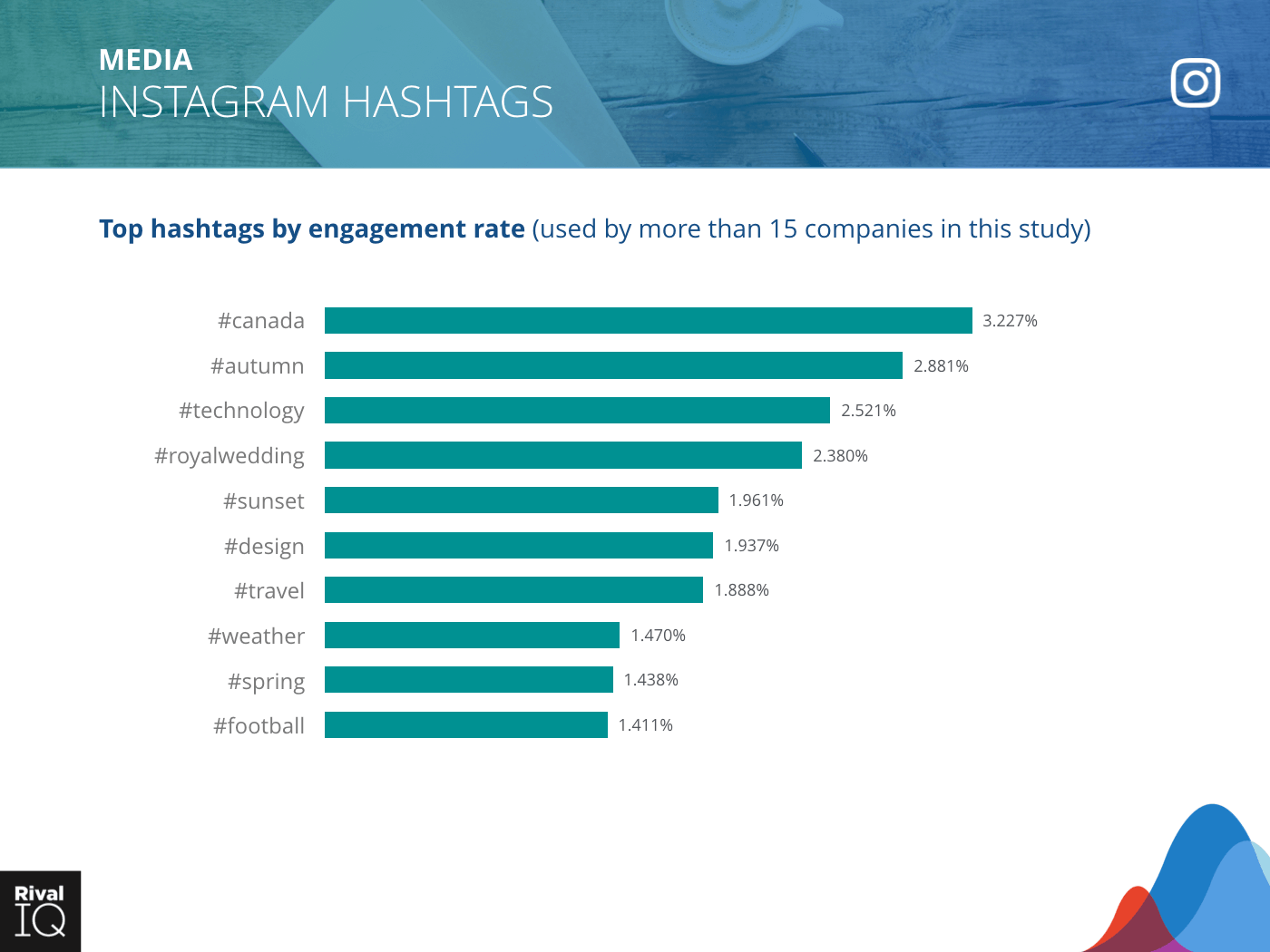

Top Instagram hashtags by engagement rate, Media

Instagram hashtag engagement was a full point higher this year, suggesting Media brands have cracked the hashtag code on this channel.

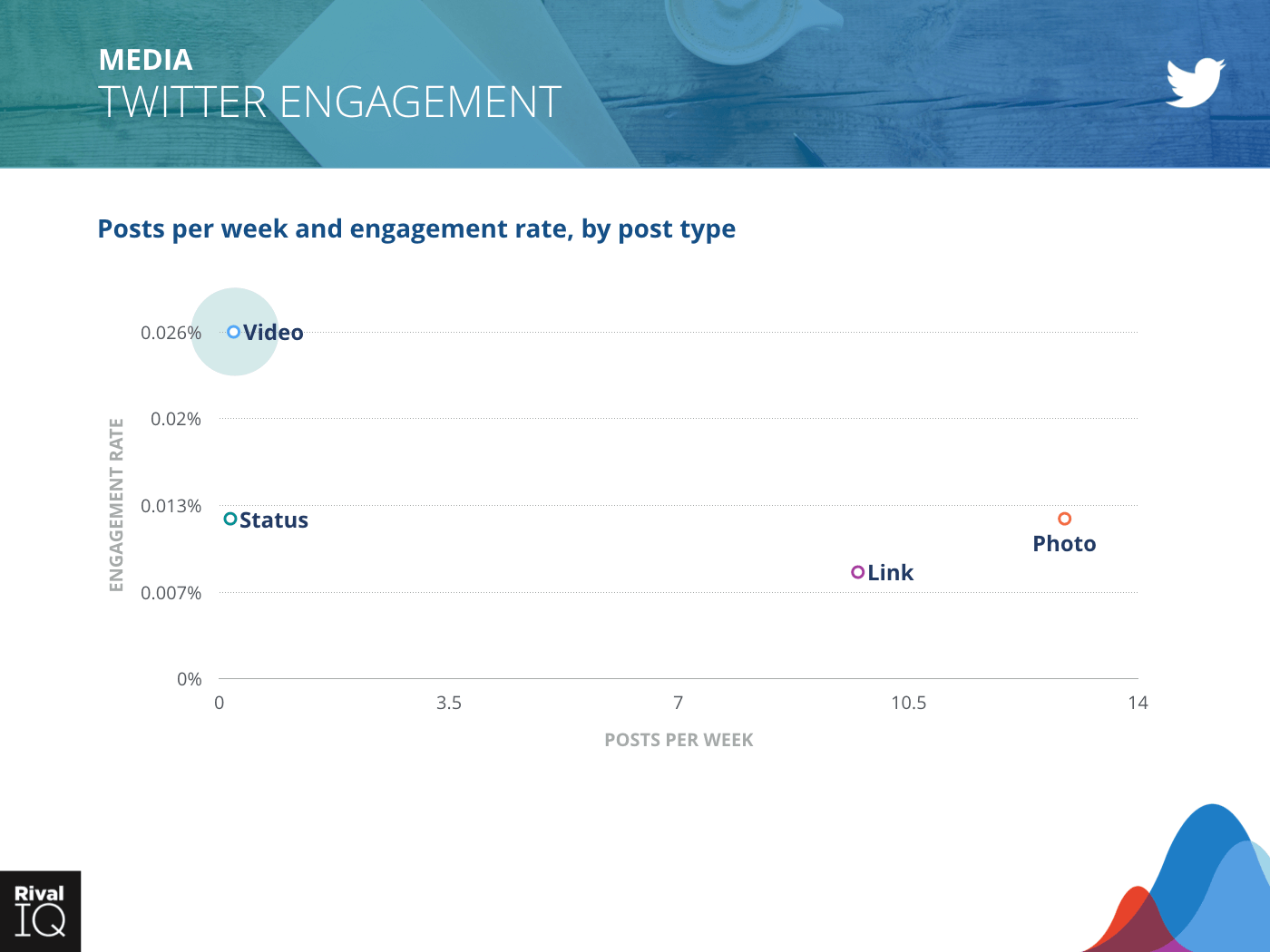

Twitter posts per week and engagement rate by post type, Media

Media companies are all about the links across all their channels. But, with photo frequency outstripping link frequency on Twitter, we can see that they include a custom photo more often than not on this channel.

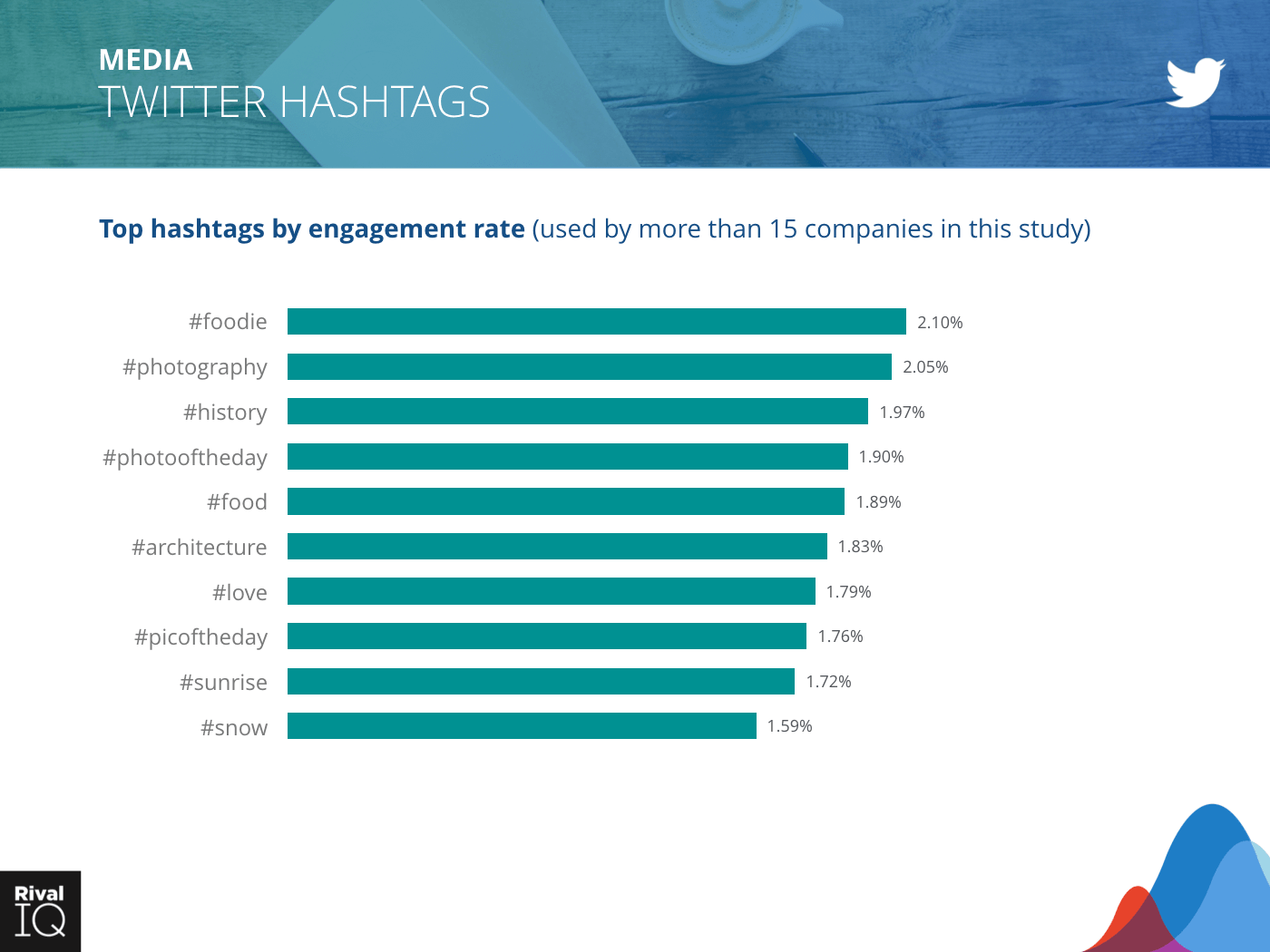

Top Twitter hashtags by engagement rate, Media

For the second year in a row, the highest-performing Twitter hashtags for Media brands are evergreen and generic instead of focused on a trending event.

Industry Snapshot: Nonprofits

Nonprofits performed consistently well across all three channels for the second year in a row, with standout engagement on Facebook and Instagram. Unlike many other brands, engagement on their top performing Instagram hashtags doubled.

Two recommendations for Nonprofits:

- Divert some low-return Twitter energy toward high-performing Facebook and Instagram.

- Make the most of the photos you’re already posting by combining them into carousels on Instagram.

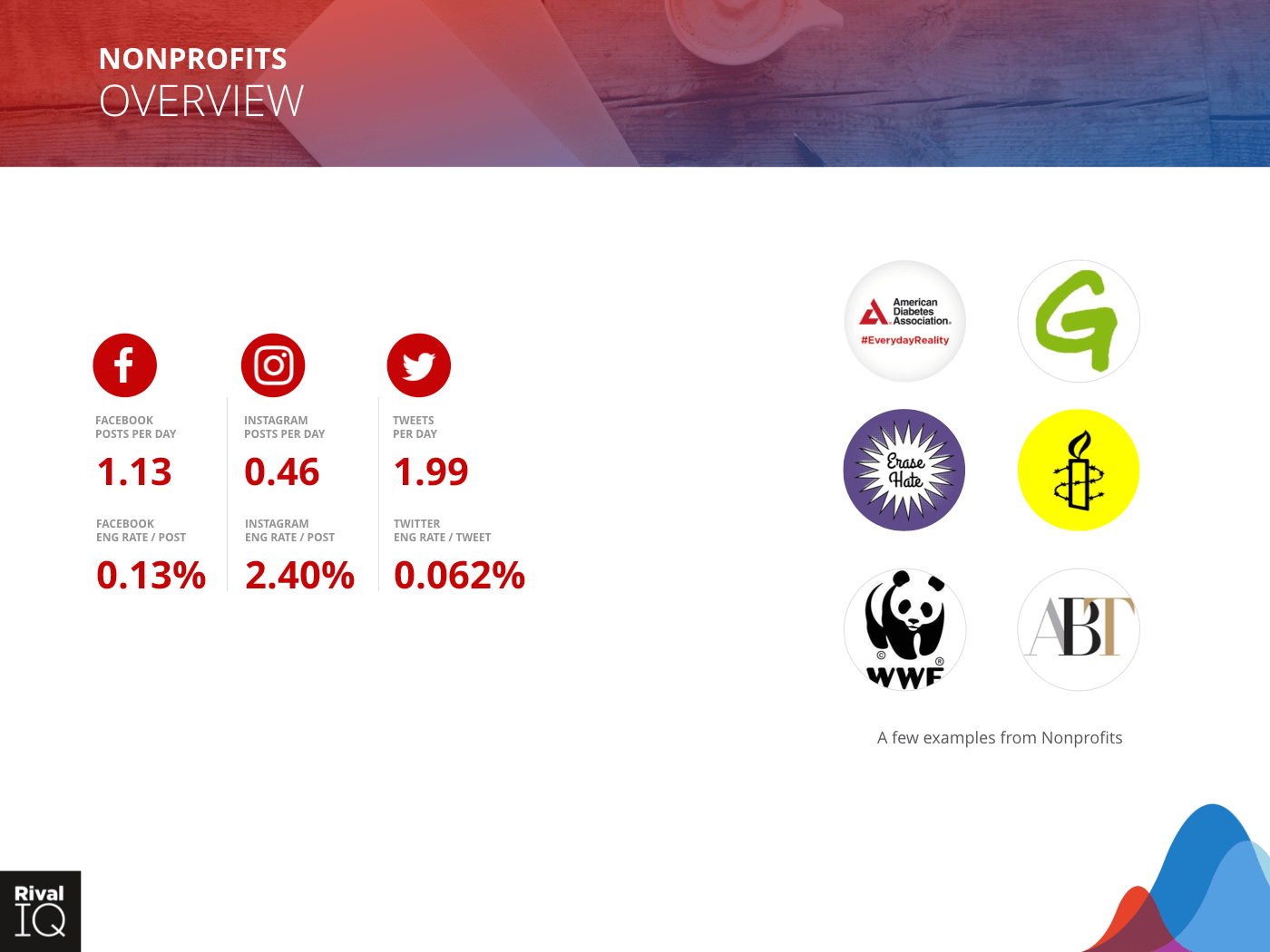

Overview of all channels, Nonprofits

Notable Nonprofits from our random sampling include American Diabetes Association, Greenpeace, Matthew Shepherd Foundation, Amnesty International USA, WWF Indonesia, and American Ballet Theatre.

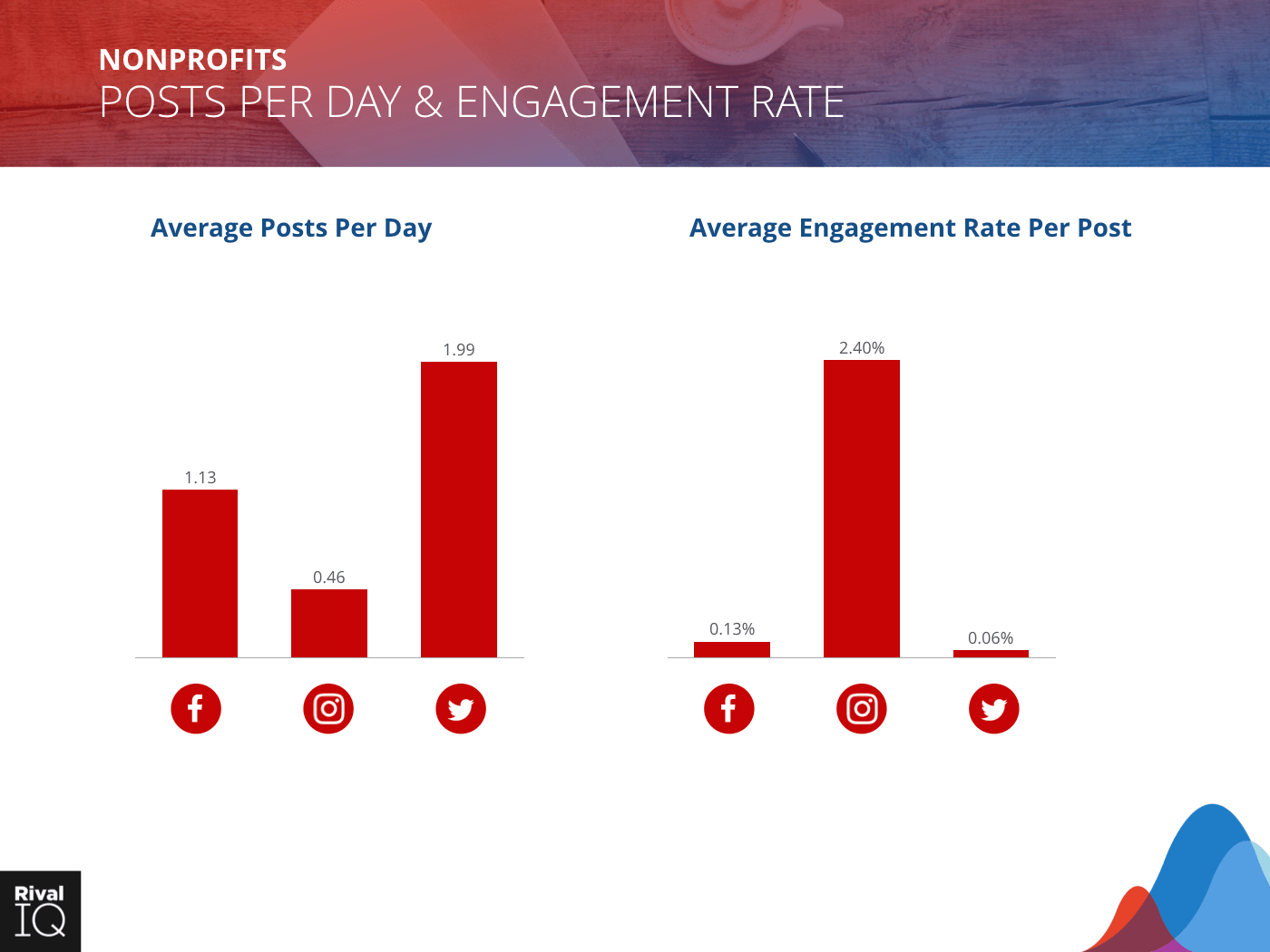

Average posts per day and engagement rate per post across all channels, Nonprofits

Nonprofits win the consistency award this year, with very similar post frequency and engagement across all three channels.

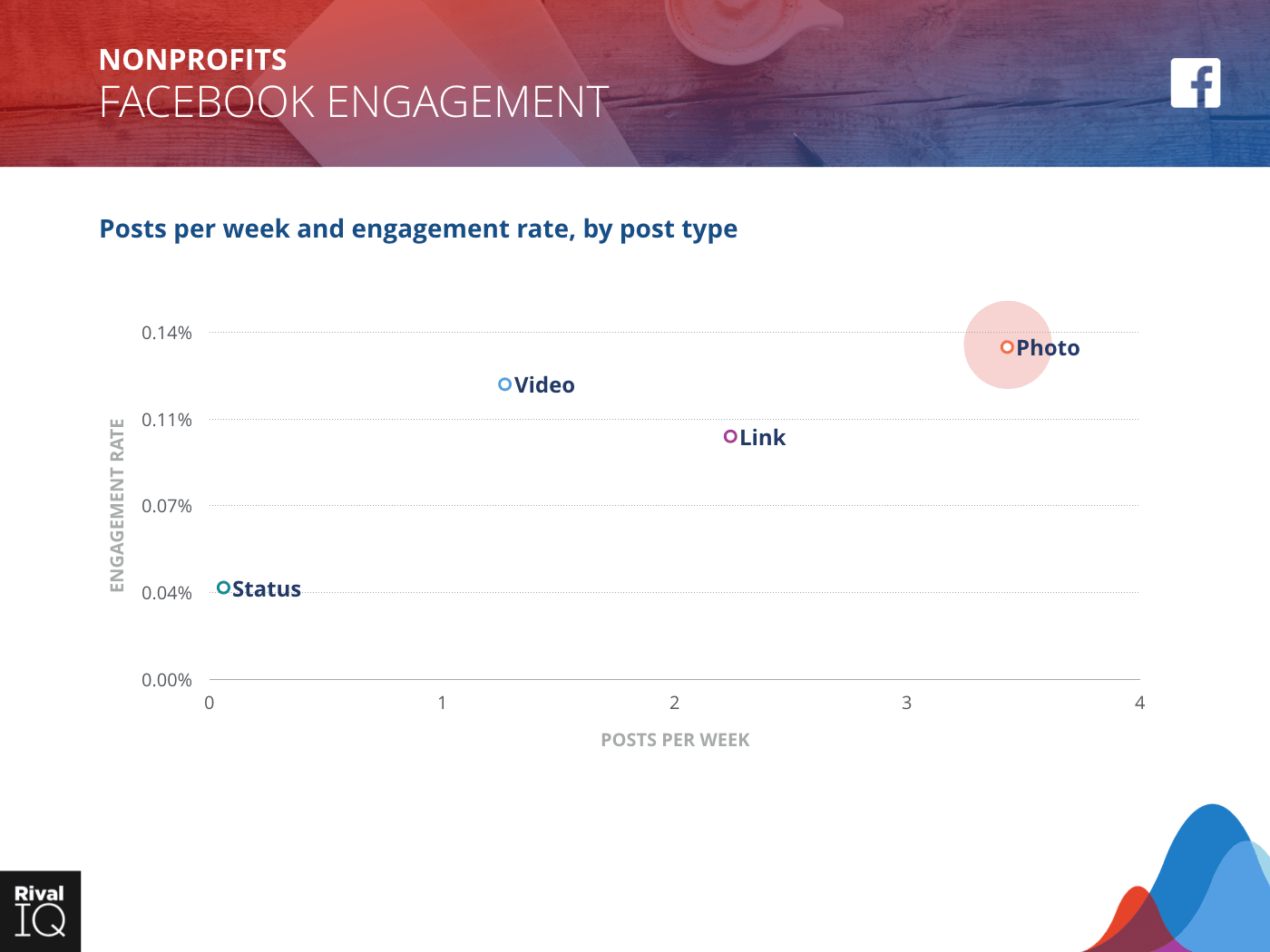

Facebook posts per week and engagement rate by post type, Nonprofits

Nonprofits saw the second highest engagement of the industries surveyed in this study, so they’re on the right track by favoring photos and videos on Facebook.

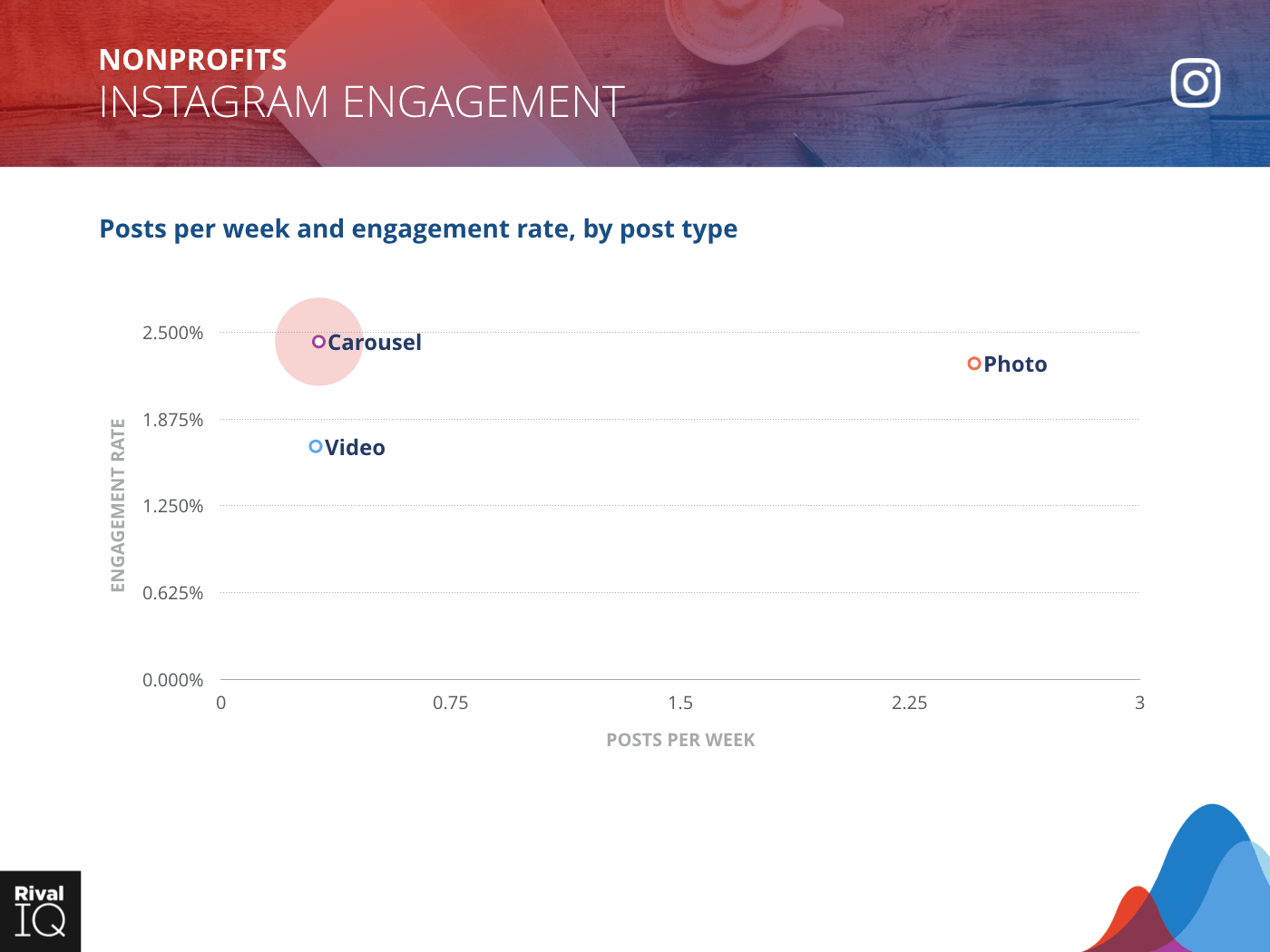

Instagram posts per week and engagement rate by post type, Nonprofits

Carousels have overtaken photos for Nonprofits’ Instagram engagement, so these companies should look into combining more of their photo posts into high-performing carousels.

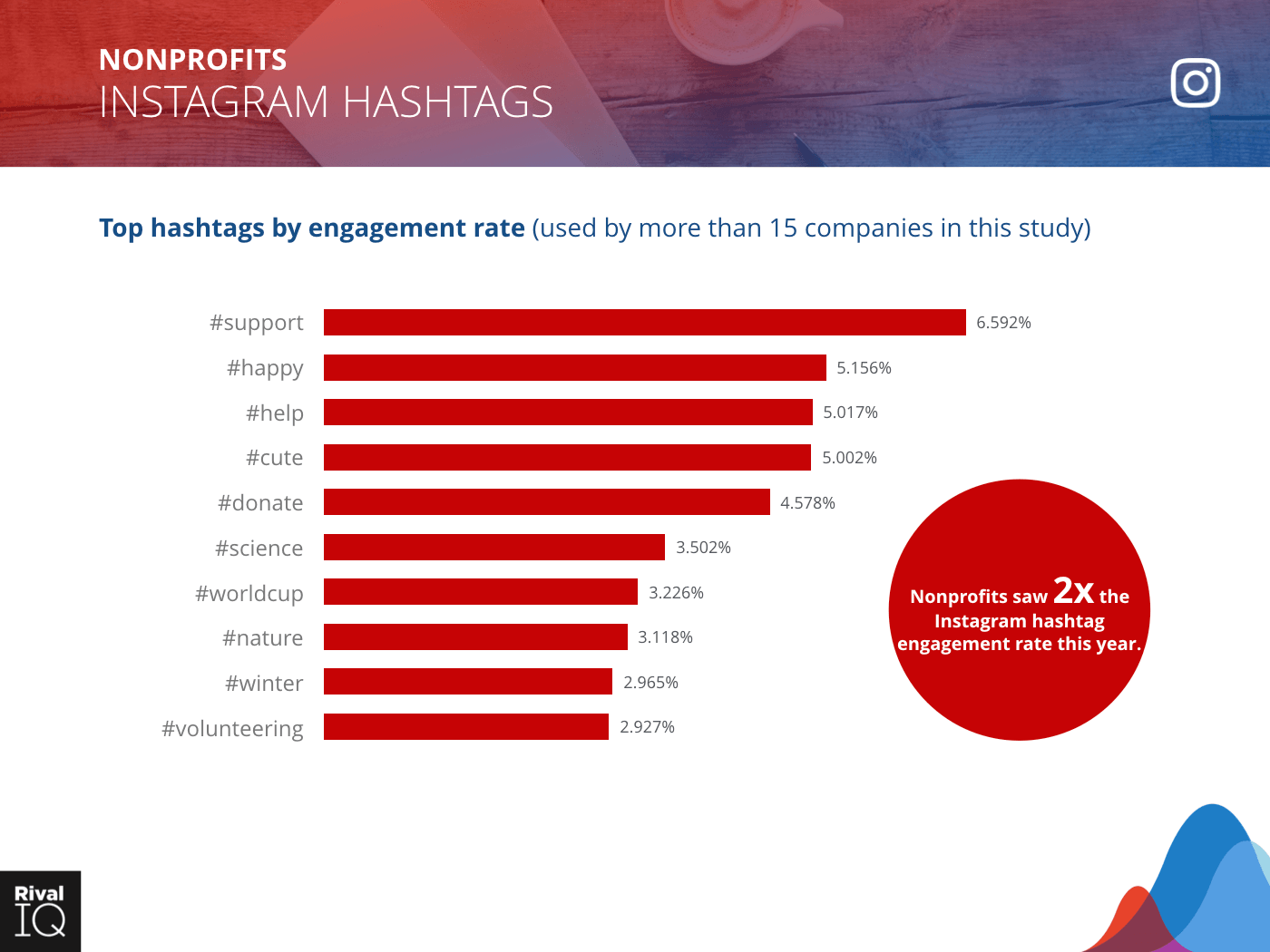

Top Instagram hashtags by engagement rate, Nonprofits

Generosity was a high-performing theme for Instagram hashtags for Nonprofits, like #support, #donate, and #volunteering.

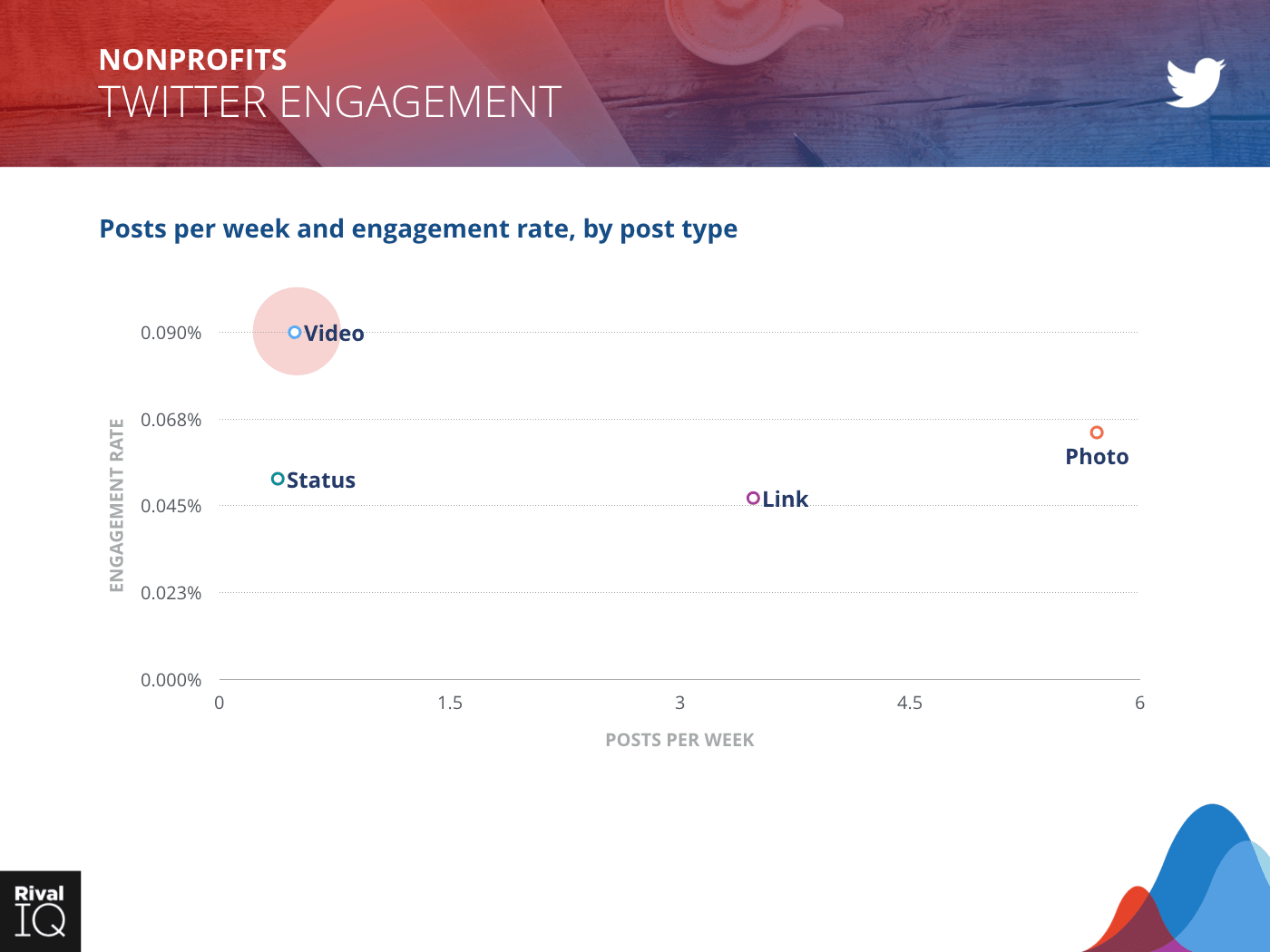

Twitter posts per week and engagement rate by post type, Nonprofits

Nonprofits are posting photos and links half as often as they were last year, but their engagement hasn’t declined very much as a result.

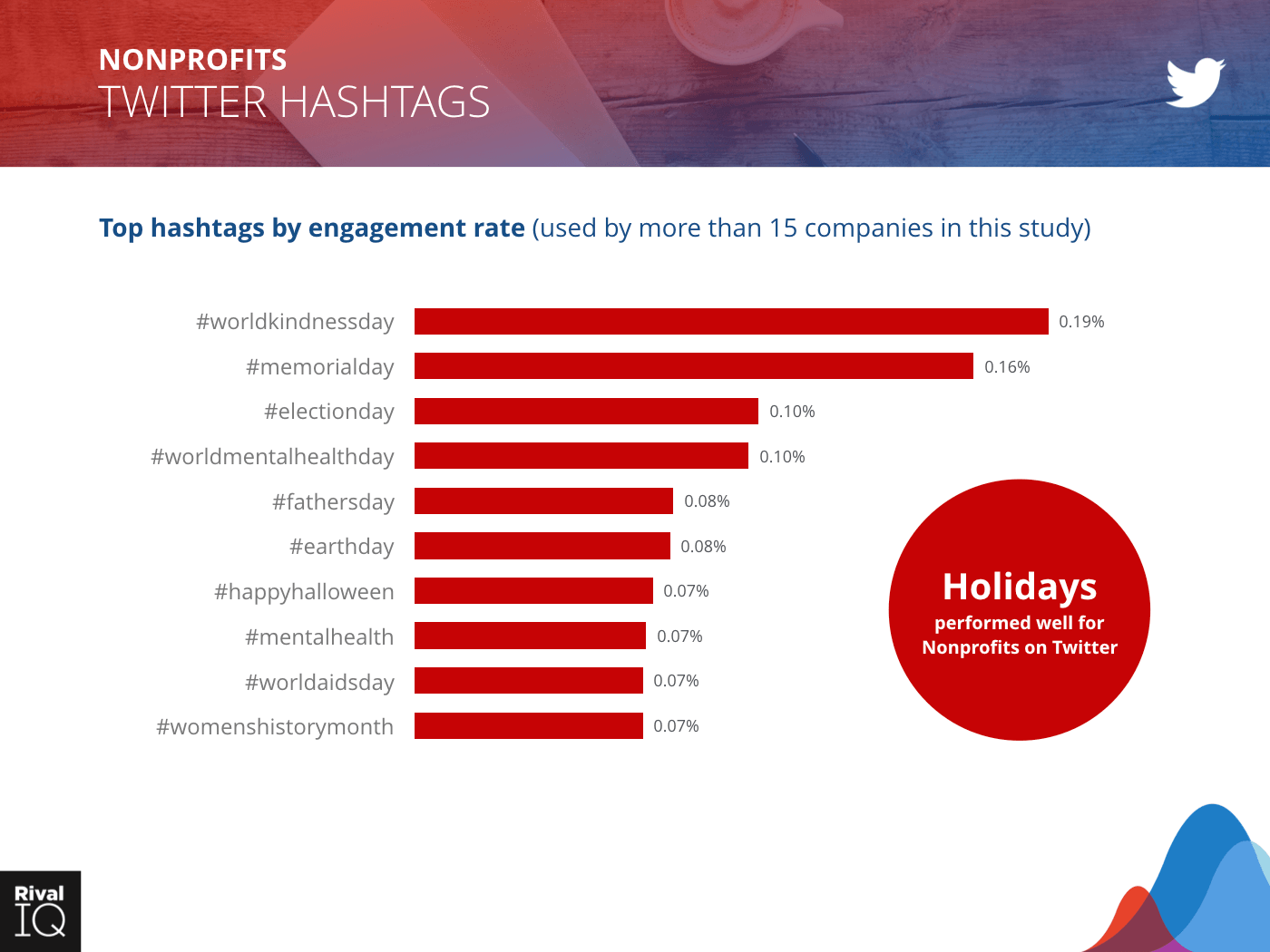

Top Twitter hashtags by engagement rate, Nonprofits

Nonprofits’ highest-performing Twitter hashtags didn’t have much in common with their best Instagram hashtags.

Industry Snapshot: Retail

Retail brands saw average performance on Facebook and Twitter, but have a long way to go to take a real bite out of highly-engaging Instagram. As with many other industries, Retail followers want to see the goods, so photos and videos performed well across the board.

Based on this study, there are two opportunities that could improve that engagement rate:

- Keep posting photos on Facebook, but try to repurpose them for Instagram too.

- Followers respond well to giveaway-themed hashtags on both Instagram and Twitter, so keep it up.

Overview of all channels, Retail

Notable Retail brands from our random sampling include Dick Blick, Red Wing Shoes, Francesca’s, Croma Retail, Tractor Supply, and ShopRite.

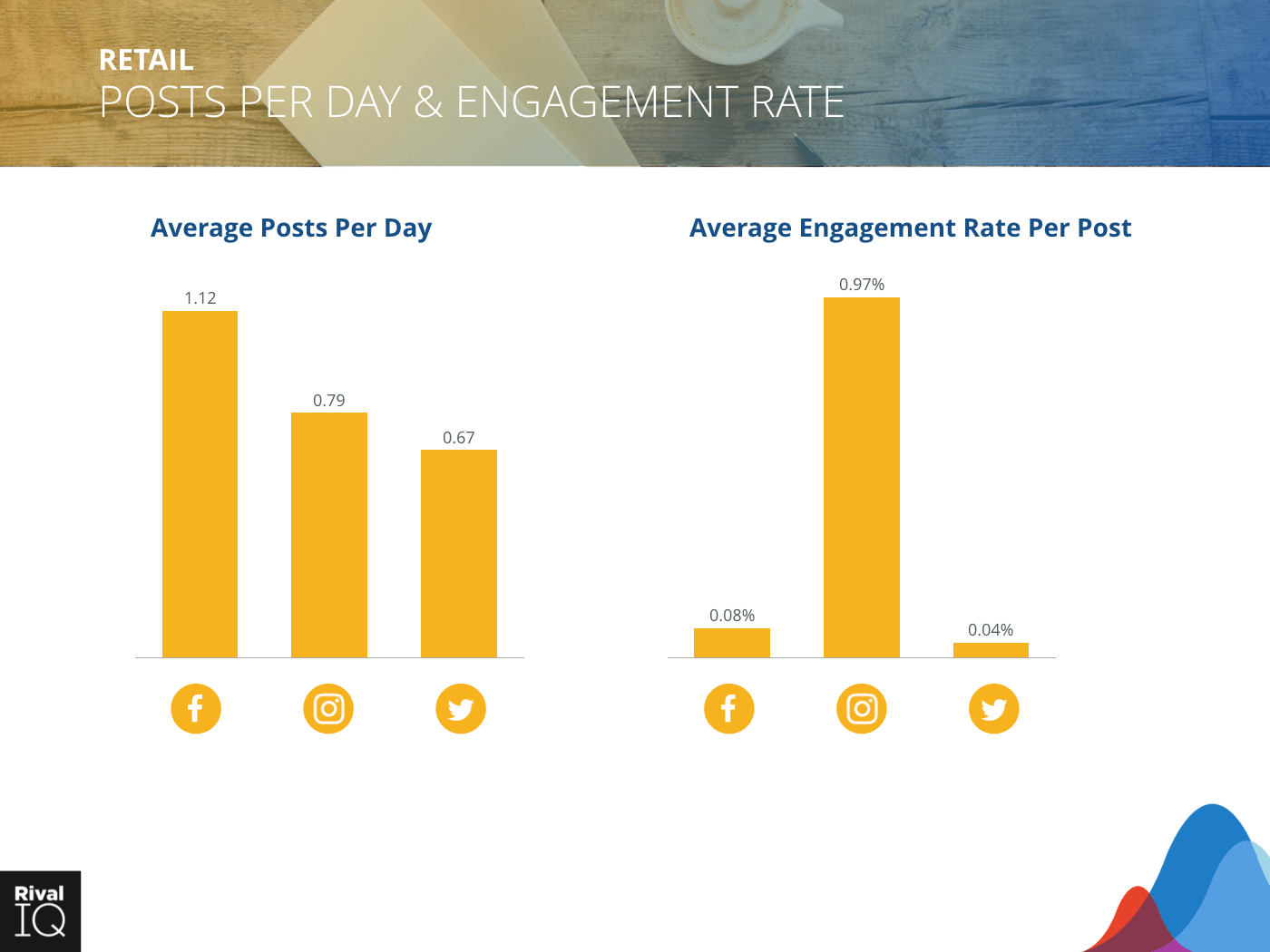

Average posts per day and engagement rate per post across all channels, Retail

Retail brands posted more often than average on Facebook and Instagram, and a little less often on Twitter, with a below-average engagement rate across all three channels.

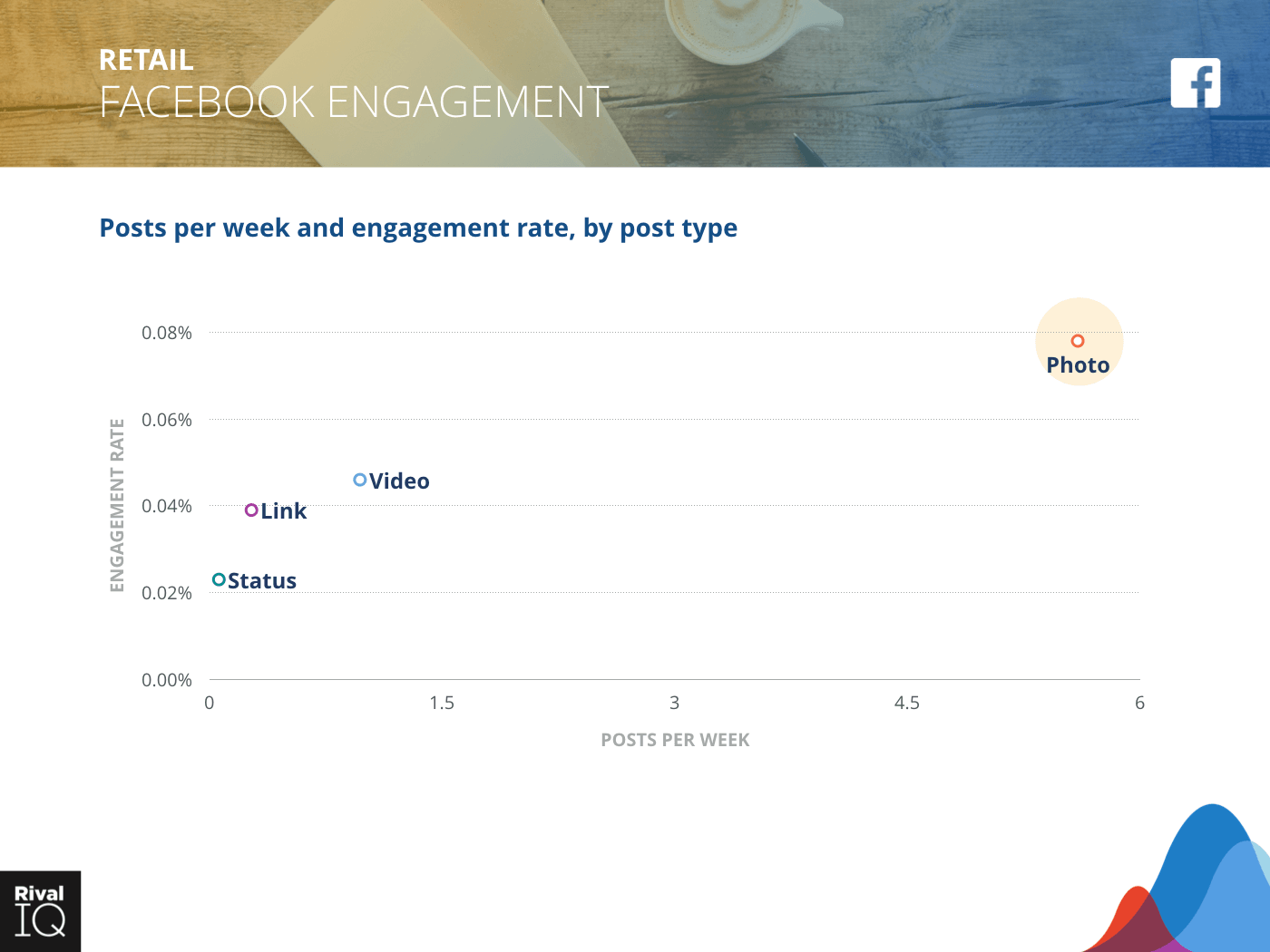

Facebook posts per week and engagement rate by post type, Retail

Photos were the runaway Facebook favorite for retail brands, and their posting frequency reflected this preference.

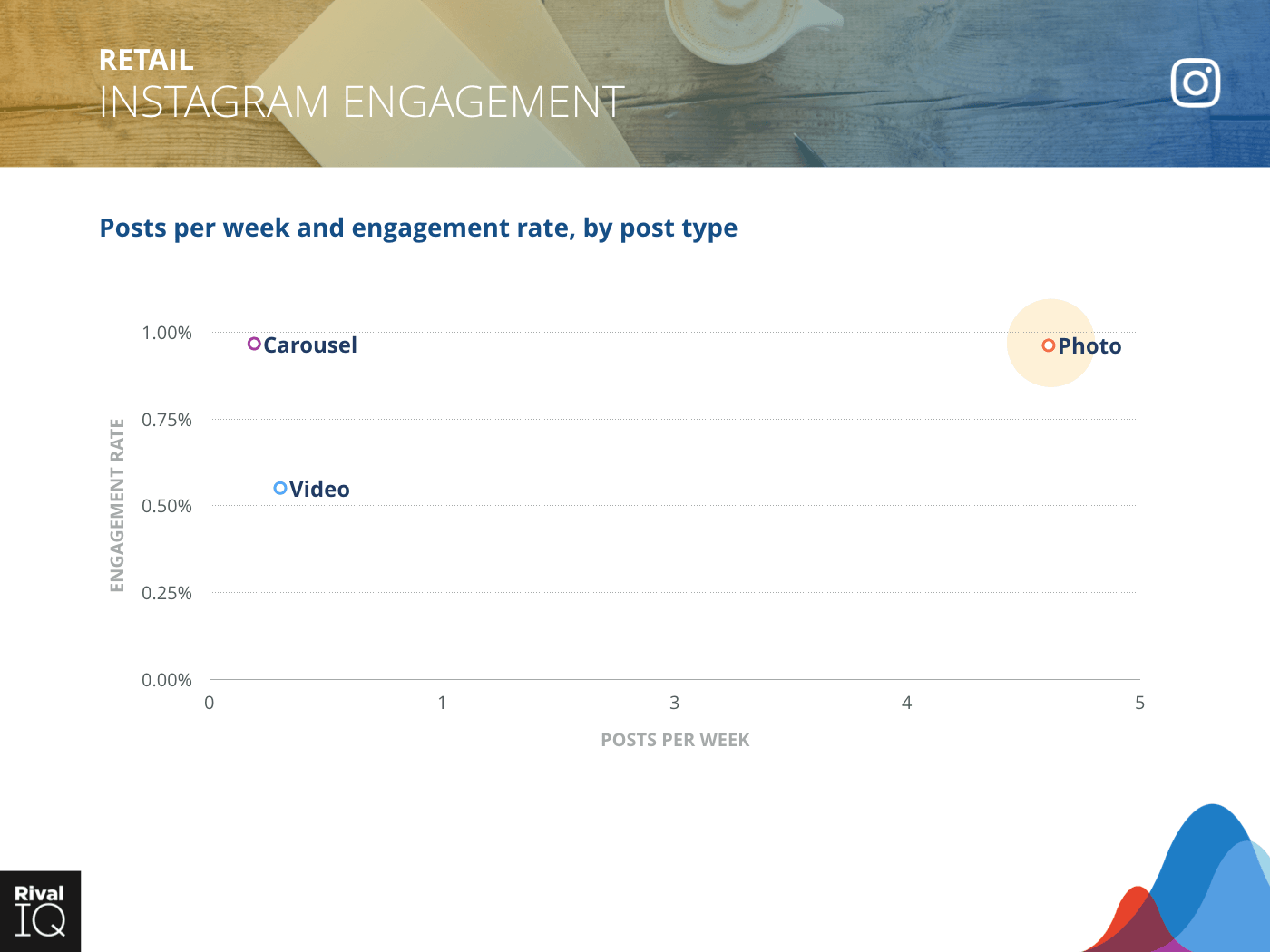

Instagram posts per week and engagement rate by post type, Retail

Photos and carousels were neck and neck for Retail brands on Instagram, but engagement rate across all post types lags behind other industries.

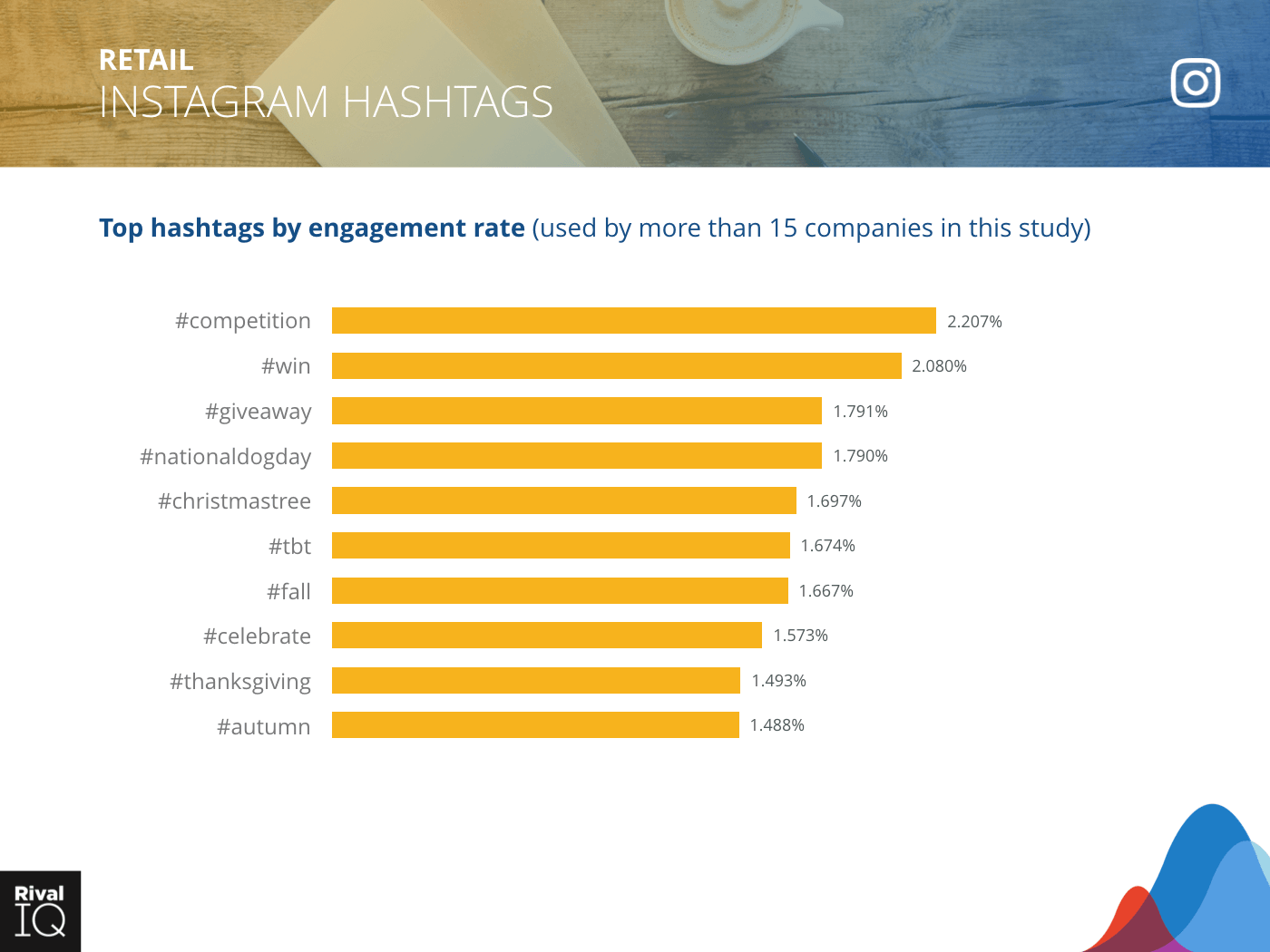

Top Instagram hashtags by engagement rate, Retail

Retail fans were all about the giveaways this year on Instagram – a trend we saw across many industries.

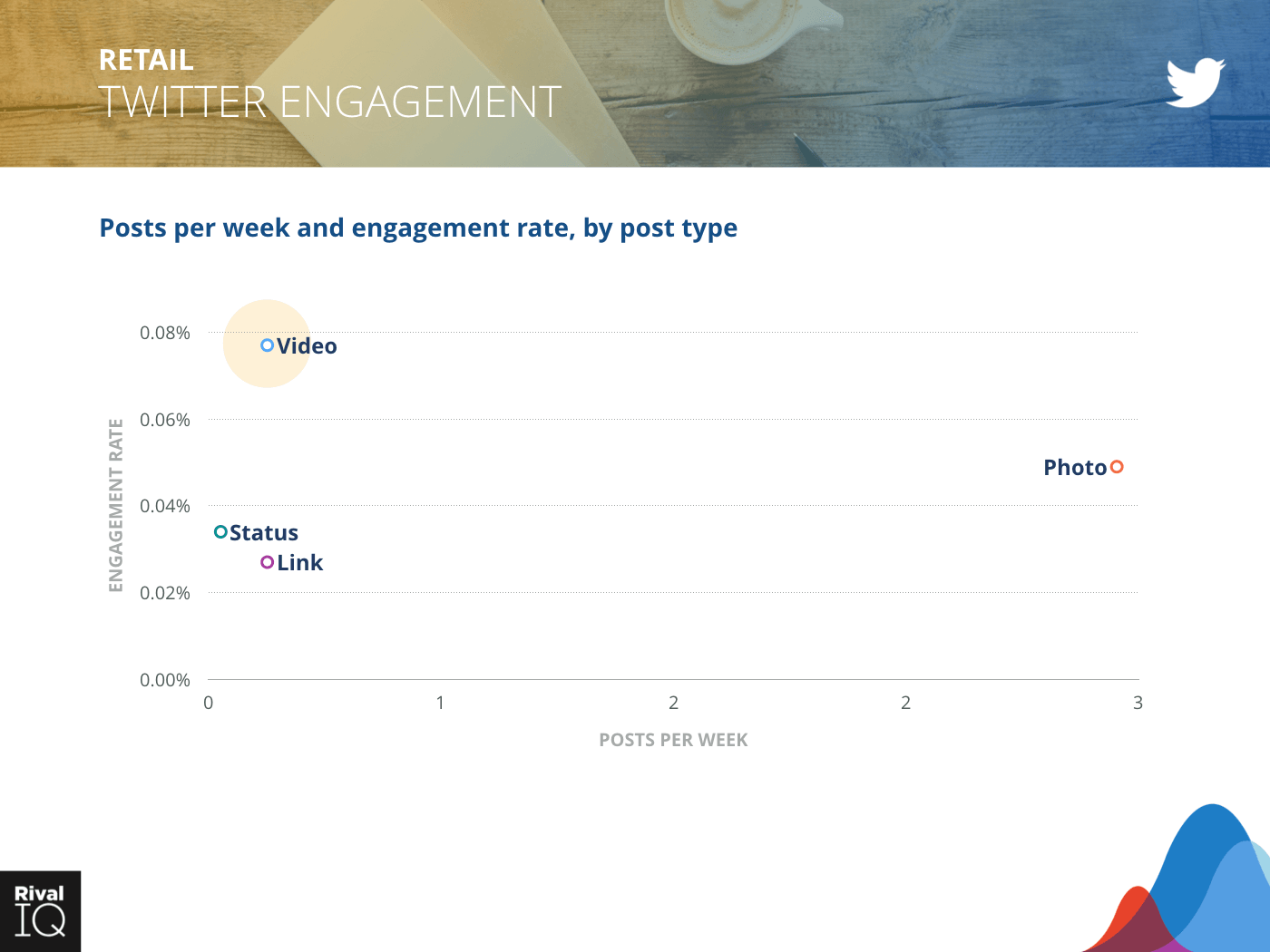

Twitter posts per week and engagement rate by post type, Retail

Lots of opportunity for high-performing videos on Twitter for retail companies.

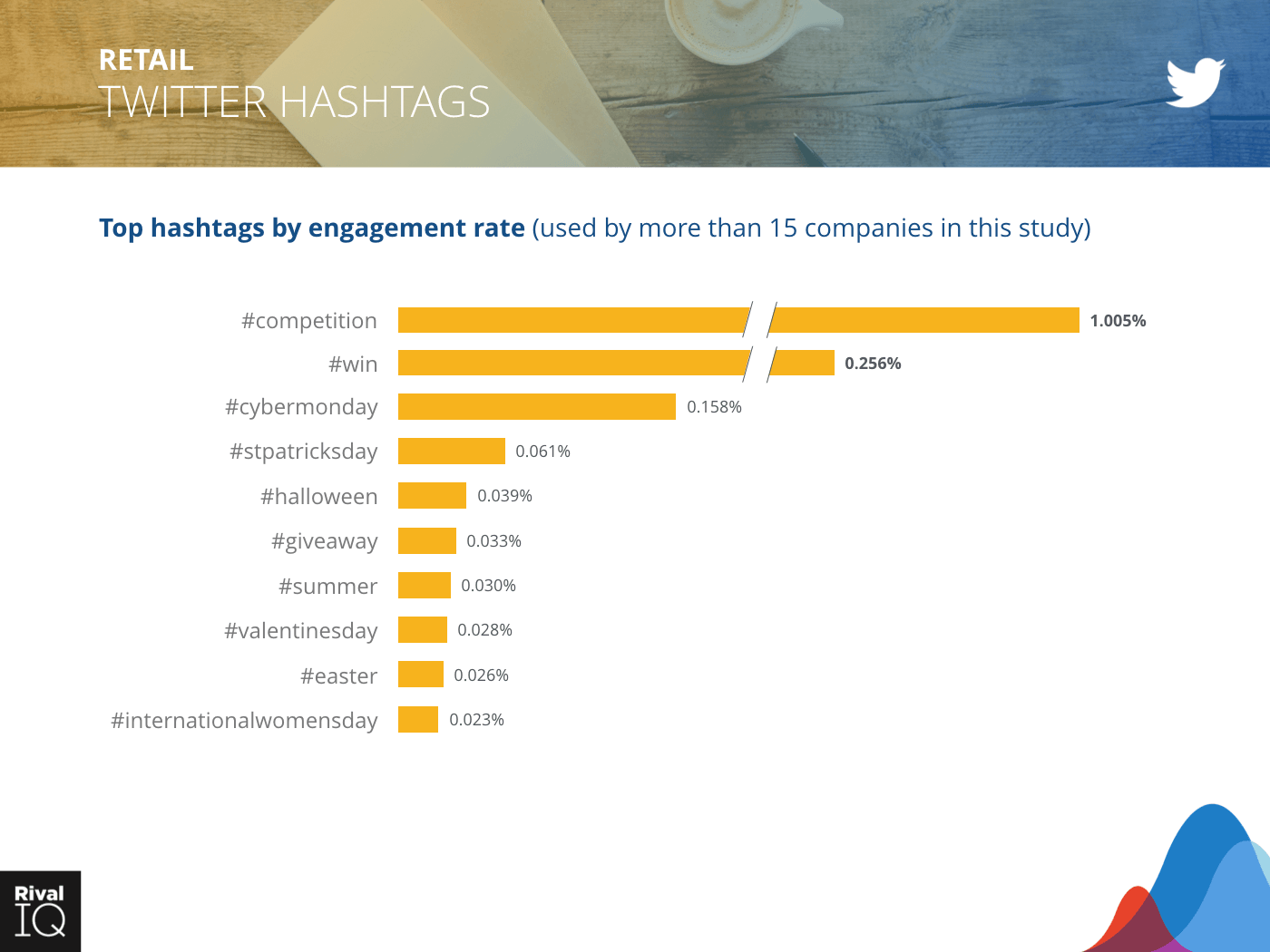

Just like their Instagram hashtag performance, Retail’s Twitter followers were all about the giveaway this year, with exponential performance against other top mostly holiday-themed hashtags.

Top Twitter hashtags by engagement rate, Retail

Just like their Instagram hashtag performance, Retail’s Twitter followers were all about the giveaway this year, with exponential performance against other top mostly holiday-themed hashtags.

Industry Snapshot: Sports Teams

Sports Teams crushed the competition on Facebook and Instagram this year. Much like Higher Ed, Sports Teams’ fans and followers are hungry for their social content in a way that other brands just can’t compete with.

Based on this study, there are two opportunities that could improve that engagement rate:

- Posting more often than the average industry works well for these teams.

- Keep fine-tuning hashtag use on Instagram and Twitter to engage new fans.

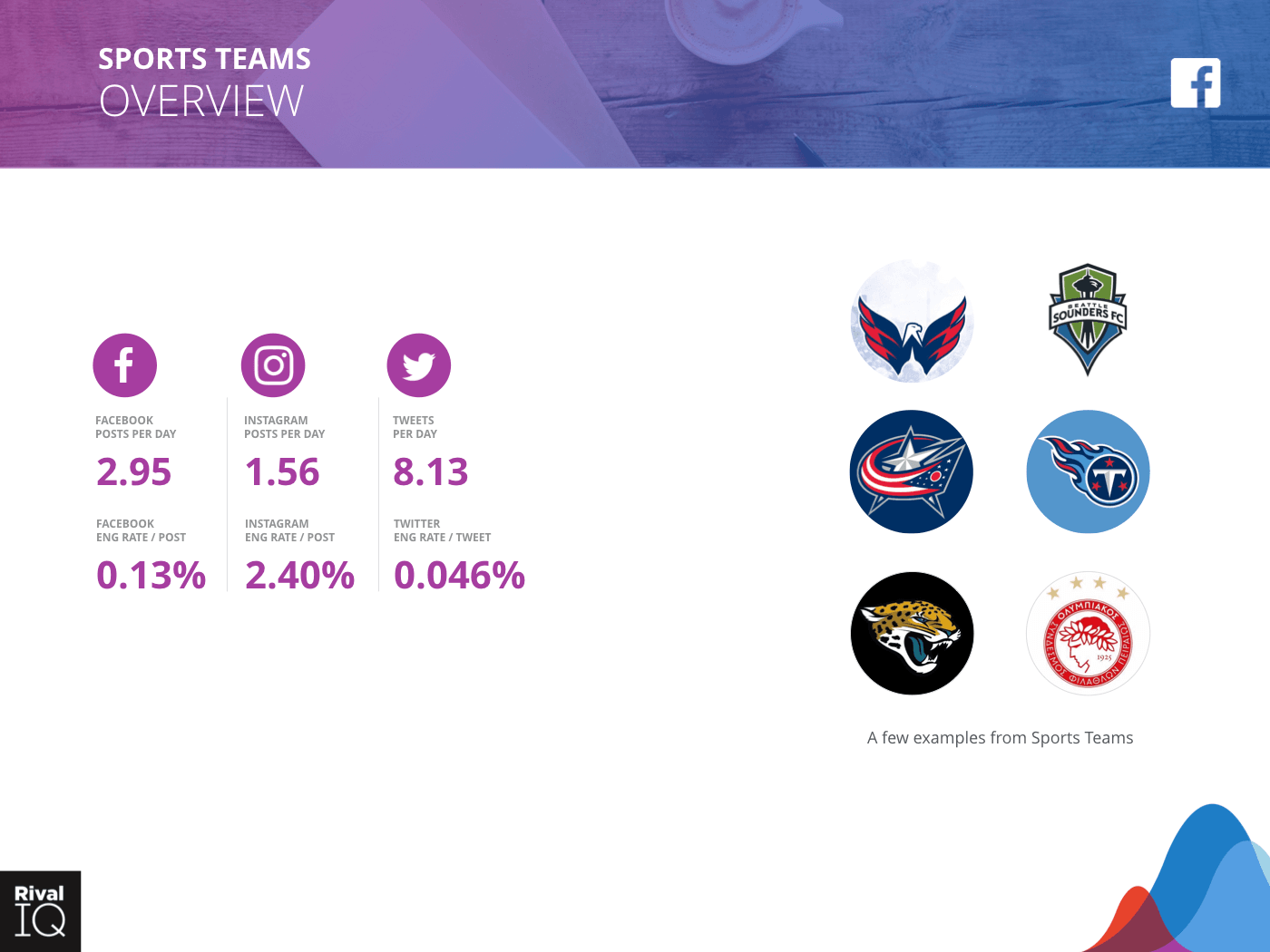

Overview of all channels, Sports Teams

Notable Sports Teams from our random sampling include Washington Capitals, Seattle Sounders FC, Columbus Blue Jackets, Tennesse Titans, Jacksonville Jaguars, and Olympiacos FC.

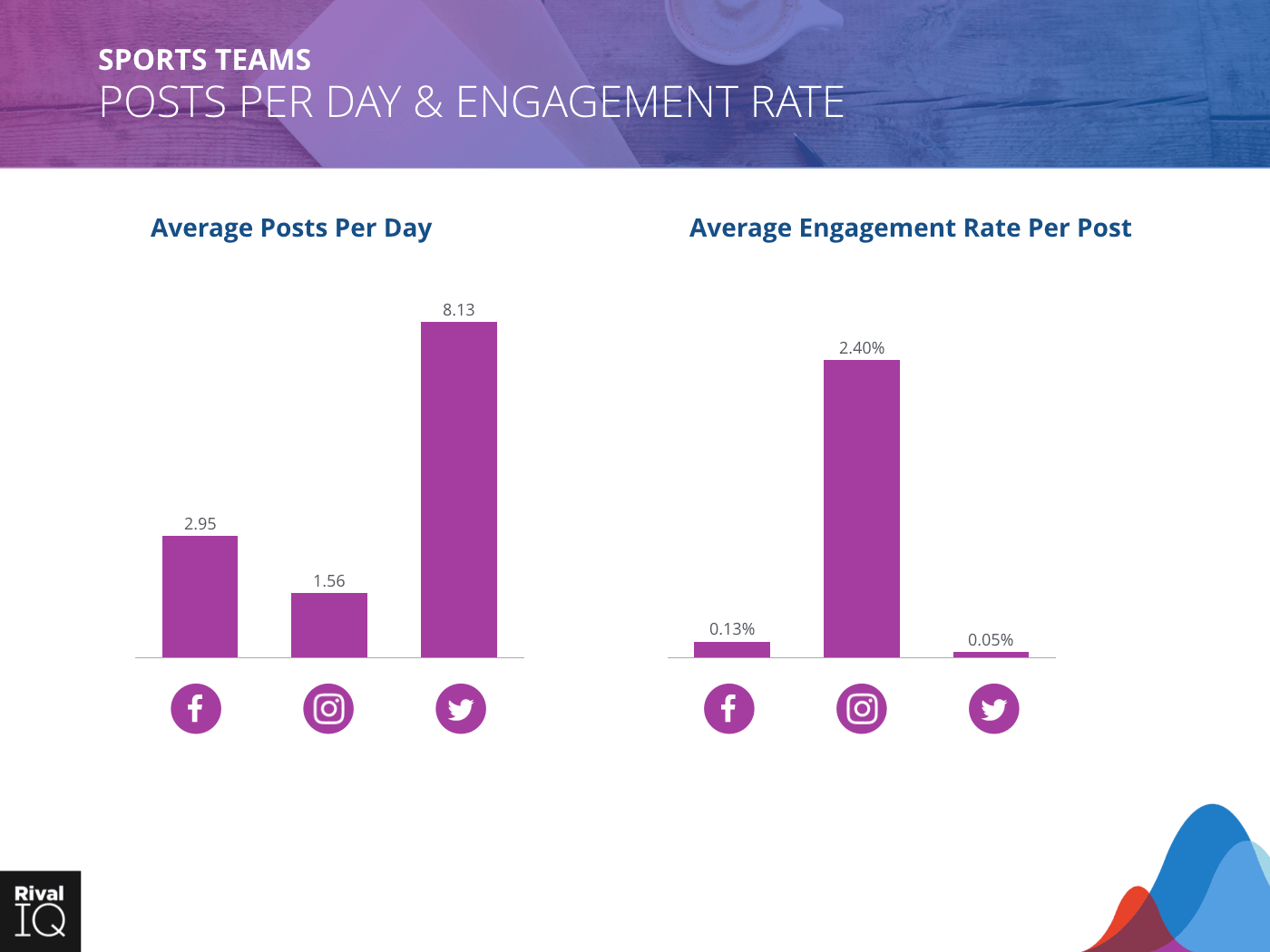

Average posts per day and engagement rate per post across all channels, Sports Teams

Sports Teams are all about the posts on all three channels, with sky-high posting frequency and above-average engagement on Facebook, Twitter, and Instagram.

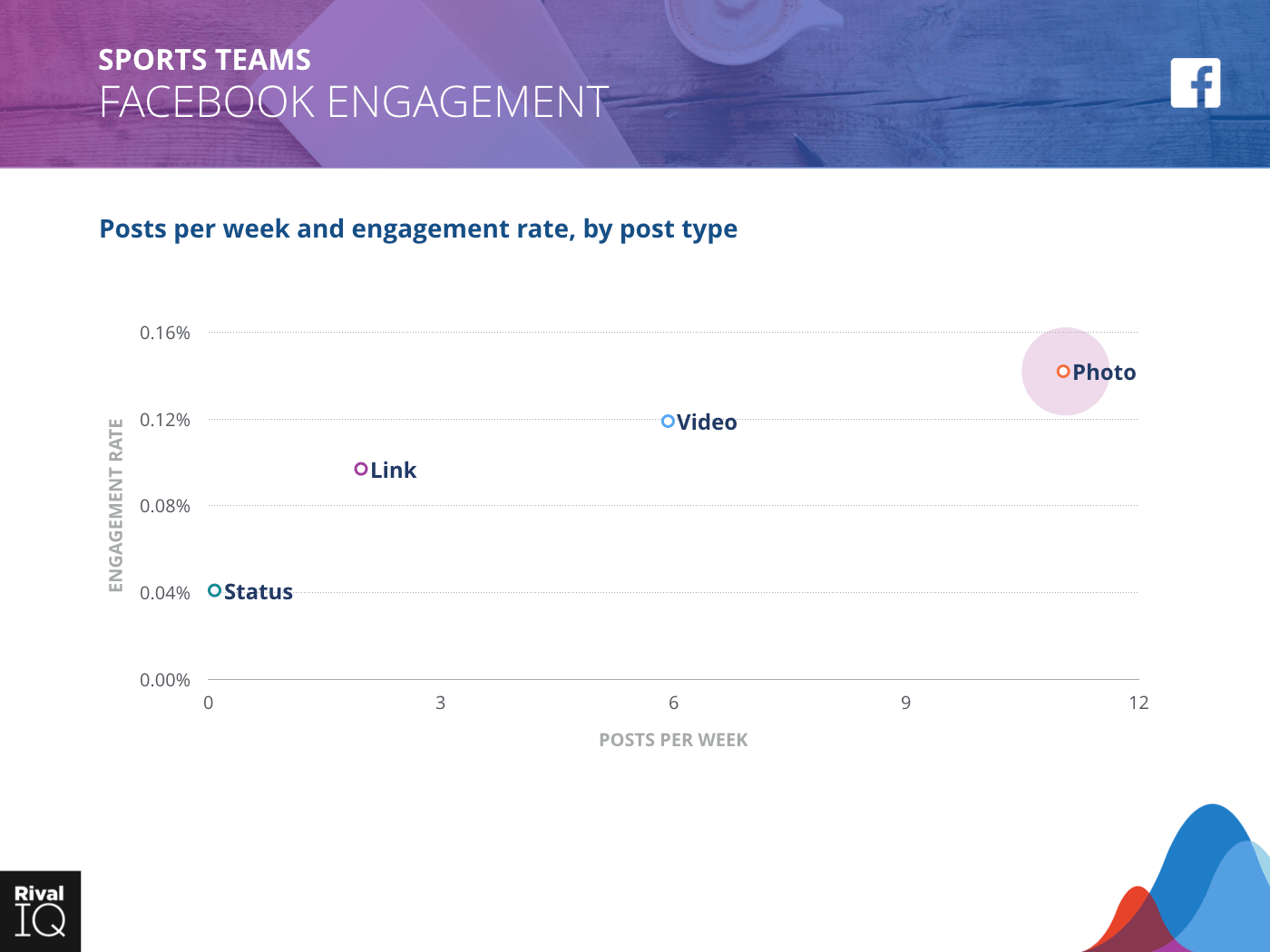

Facebook posts per week and engagement rate by post type, Sports Teams

Sports Teams are giving their fans a break on Facebook by posting a little less often than they did last year, but putting their energy where it matters with high-performing photos and videos.

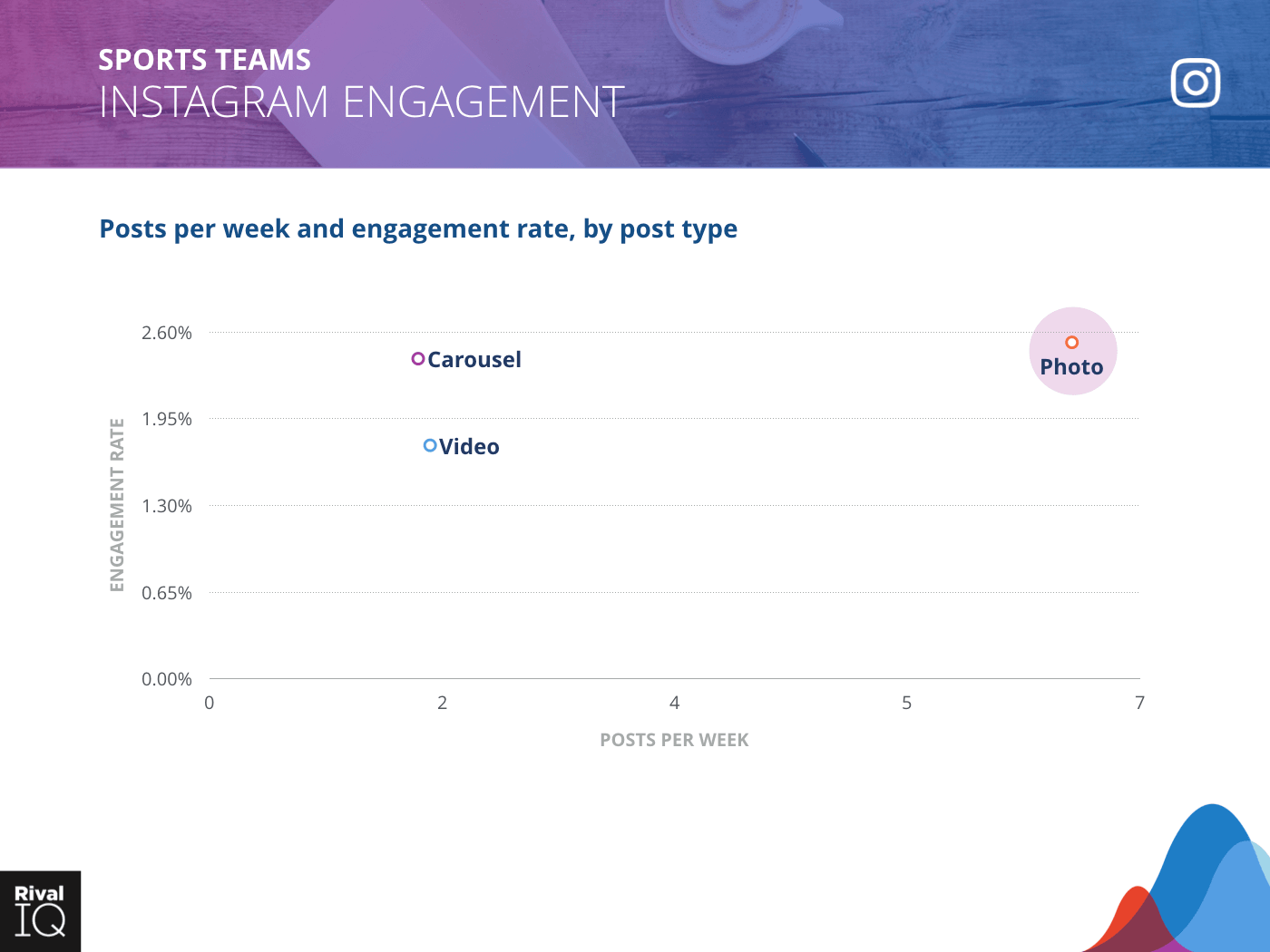

Instagram posts per week and engagement rate by post type, Sports Teams

Sports Teams are seeing great engagement on Instagram, and are taking more advantage of high-engaging carousels than many other industries this year.

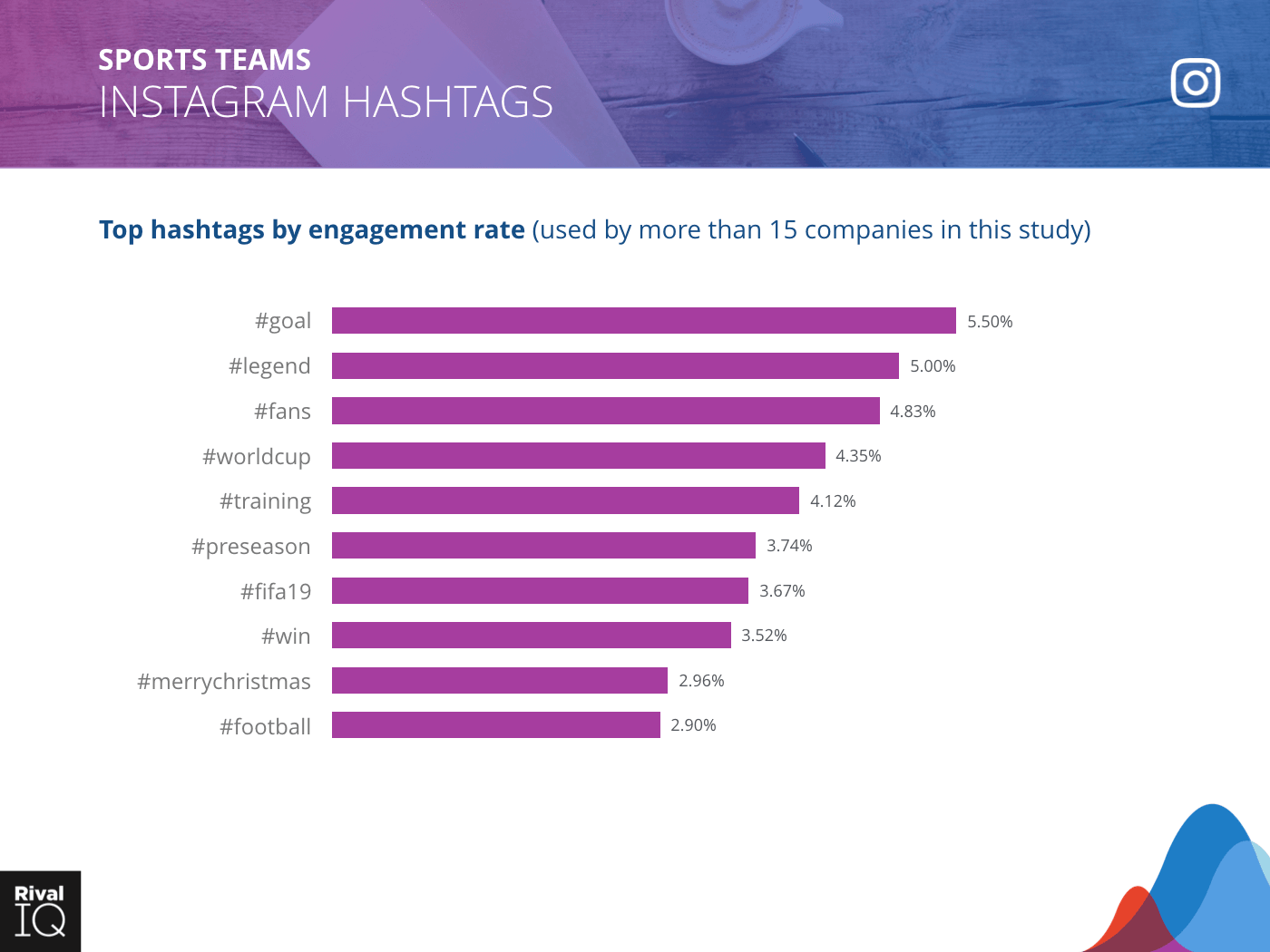

Top Instagram hashtags by engagement rate, Sports Teams

Sports Teams’ highest Instagram hashtag engagement was all about the game again this year – especially soccer.

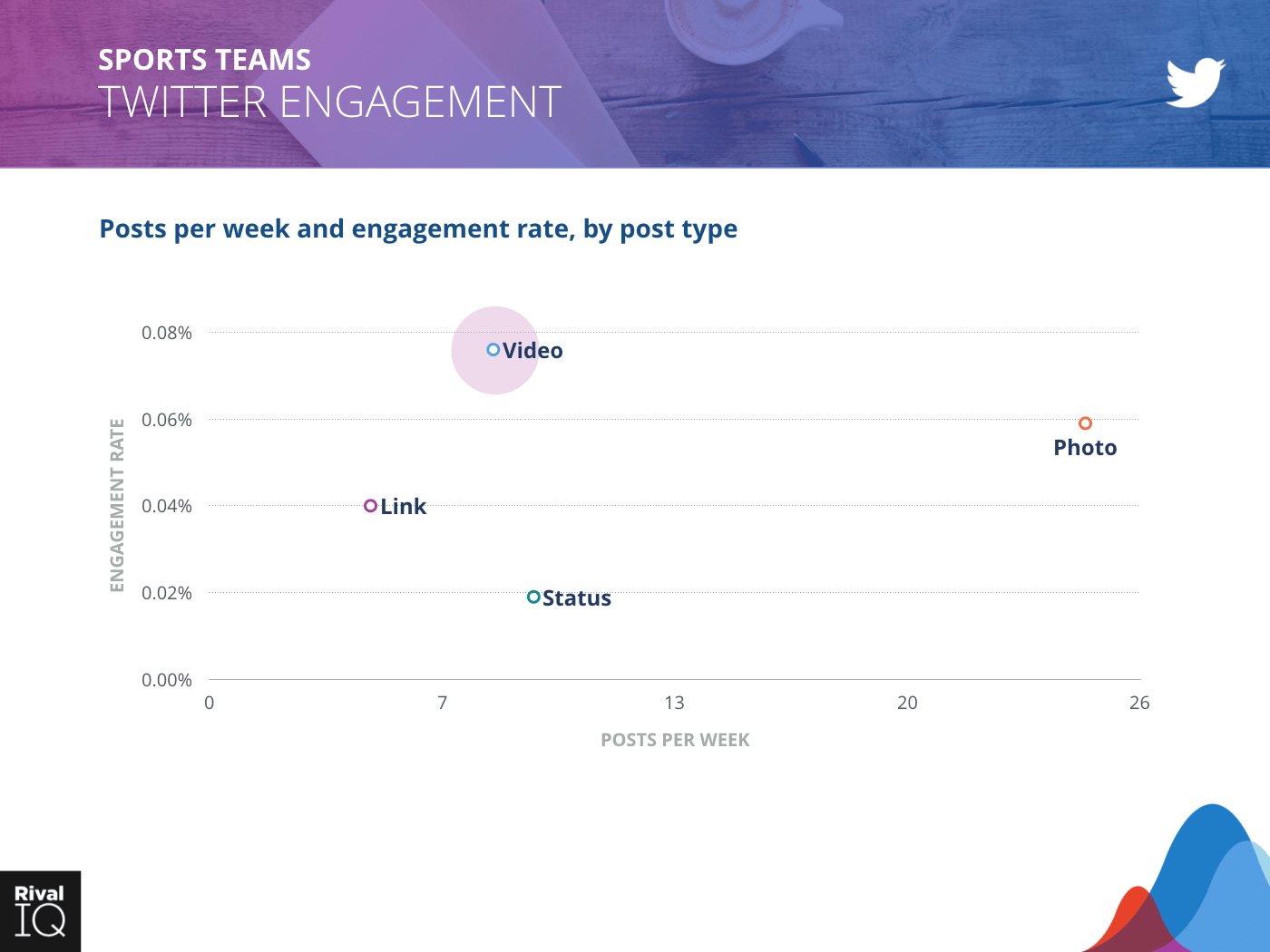

Twitter posts per week and engagement rate by post type, Sports Teams

Twitter was a tough nut to crack this year, but Sports Teams managed to boost their engagement for the Twitter post types that mattered most (video, photo, and link).

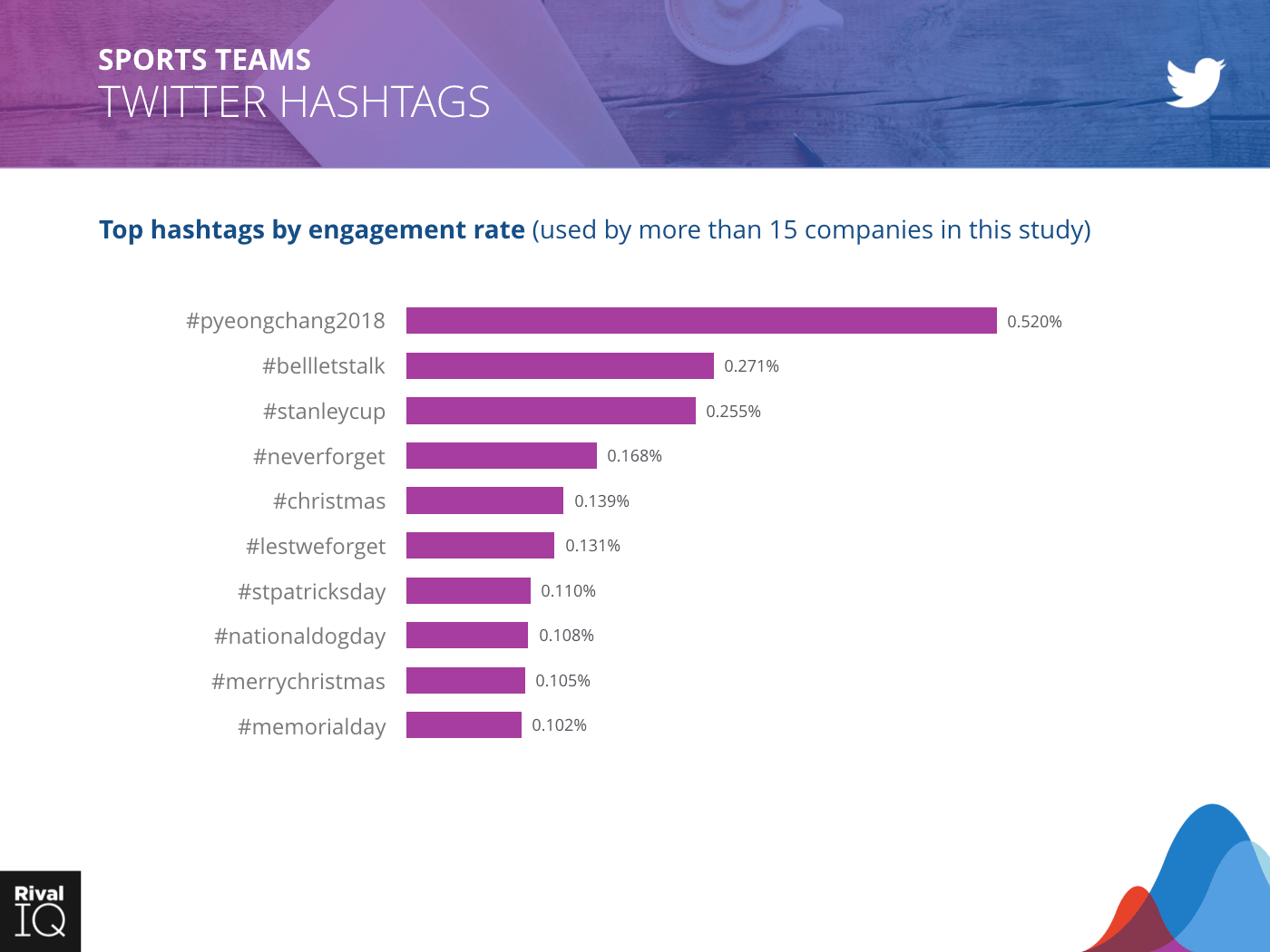

Top Twitter hashtags by engagement rate, Sports Teams

Olympics dominated Twitter hashtags for Sports Teams this year, while hockey and holidays tried to keep up.

Social Media Benchmarks: Looking Ahead

In looking back over this year’s report, a few noteworthy observations are worth revisiting.

First, Instagram continues to be a platform with lots of opportunity for social media marketers in 2019. The average engagement rates on Instagram stayed high, 1.6%, dropping less than 10% over the previous year. Those levels of engagement are certainly driven by the high organic reach we continue to see on Instagram posts. And, with the average brand posting only 5 times a week, there’s still room for everyone to grow here.

Second, like on Instagram, the average engagement on Twitter stayed relatively constant when compared with the previous year. Though the engagement rate is seemingly low at 0.048% per post, it’s important for brands not to write off Twitter because of that one statistic. There is still a great opportunity for brands to listen and engage one-to-one with users, and a small but engaged Twitter can still provide meaningful results for business. Also, Twitter-based customer service, when done well, can create a positive experience for customers.

Last, while Instagram and Twitter maintained their engagement performance, average engagement on Facebook declined substantially from our previous year’s report. The continued decline of organic reach for brands on Facebook has definitely impacted engagement — it’s hard to engage with content you never see. Still, photo and video posts dramatically outpace link posts. Brands that want to earn reach on Facebook will either need to refocus their energy on maximizing on-platform content or spend money to acquire it.

Did we miss an industry or a channel you’d like to see in next year’s report? Did you fall in line with industry standards? Let us know on Twitter!

Start analyzing with a free Rival IQ trial.

Get my free trial