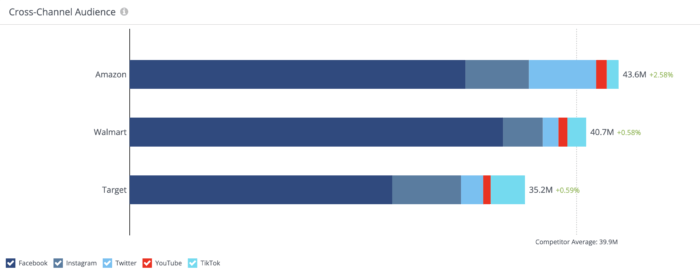

Amazon is a brand that hardly needs an introduction. As the global leader of e-commerce, it’s no surprise that the company also has a massive presence on social media. With a following of 43.6 million across Facebook, Instagram, Twitter, YouTube, and TikTok, Amazon’s social media strategy is one worth taking a closer look at.

Over the past year alone, Amazon gained 1.1 million followers on social — a 2.58% increase.

To put that in context, Walmart has a similar audience size at 40.7 million but added only 235K new followers (+0.58%) over the same period. Target, too, only grew its audience by 0.59%.

So what’s fueling Amazon’s growth on social? Let’s take a closer look at the strategy behind the retail giant.

A Quick Look at Amazon’s Social Media Activity

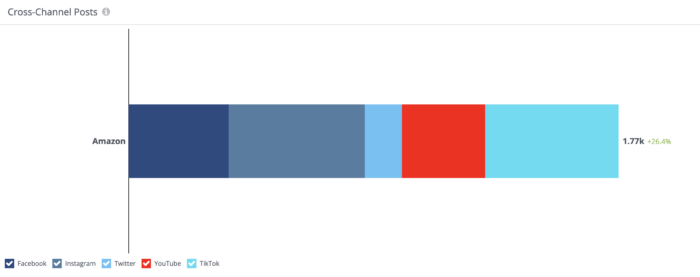

In addition to having a huge following, Amazon is also one of the most active retail brands on social media.

Over the past year, the company shared around 1.77K posts across social. Instagram led the way with 491 posts, which averages to about 9.4 posts per week. TikTok was a close second, with 482 posts, or roughly 9.2 per week. Facebook followed with 362 posts, averaging 6.94 per week, while YouTube saw 301 video uploads. Twitter came last at only 134 posts.

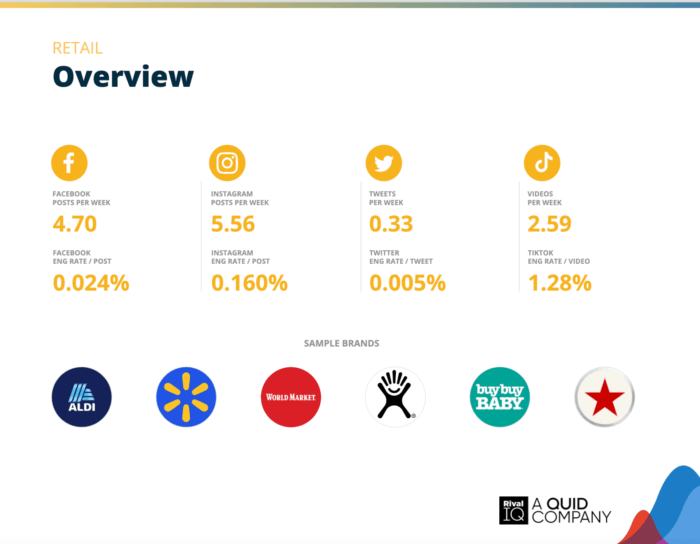

That all adds up to a highly active presence — far more than the industry norm. Compared to the median posting frequency of retail brands, Amazon stands out for its speed and volume. The average retailer posts 5.56 times on Instagram, 2.59 times on TikTok, and 4.7 times per week on Facebook. Amazon exceeded all of those benchmarks by quite a bit.

Clearly, consistency and frequency are key to Amazon’s social strategy. This high-frequency approach helps the brand stay top-of-mind and keeps its audience continuously engaged.

Start analyzing your brand's performance with Rival IQ.

Whether it’s showcasing new products, hopping on trends, or spotlighting seasonal deals, Amazon’s posting frequency ensures there’s always something new in the feed.

But what exactly does the brand post? Here are its most effective social content strategies.

1. Prioritizing the Most Engaging Post Types

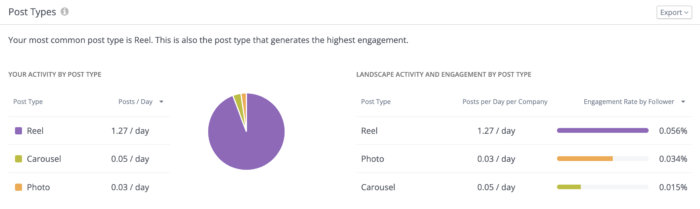

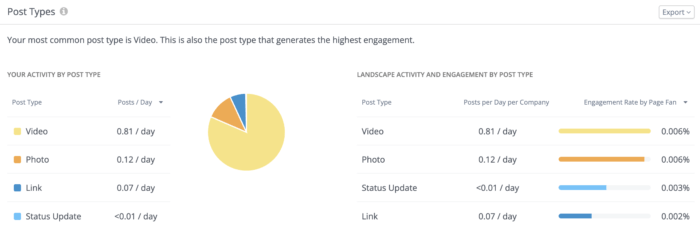

One of the smartest moves in Amazon’s social media playbook is leaning into what works. With Rival IQ’s social posts analysis capabilities, it’s easy to see not just which post types a brand uses most, but which ones drive the highest engagement. In Amazon’s case, the alignment between volume and performance is likely no accident.

Take Instagram, for example. Reels are by far the most common post type Amazon shares. Reels also happen to be its most engaging format on the platform, generating an average engagement rate by follower of 0.056%, which slightly surpasses the retail industry median of 0.055%.

The brand uses Reels for all kinds of purposes, from showcasing products and sharing fun delivery moments (more on that later!) to promoting the benefits of its Prime membership.

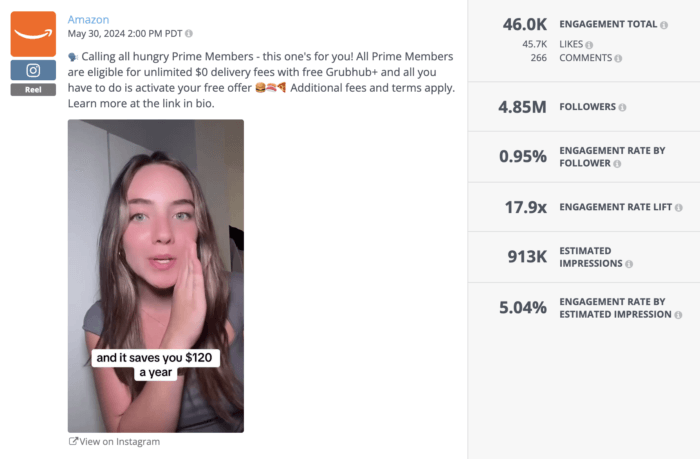

For instance, the Reel below announcing Prime Members’ eligibility for free Grubhub+ effectively grabbed its audience’s attention, garnering more than 45K likes and an engagement rate nearly 6x higher than the industry median.

Over on Facebook, the story’s similar. Amazon leans heavily into video and photo posts — again, the two top-performing formats on that platform. It’s a sign the brand isn’t just pumping out content but making strategic decisions about what it posts.

That said, there’s still a little room for fine-tuning. On Instagram, Amazon’s photo posts average 0.034% engagement, while carousels lag behind at just 0.015%. A slight pivot toward more single-photo content could boost overall performance. The same goes for Facebook, where status updates outperform links.

Overall, though, Amazon shows a clear understanding of what drives interaction. And with small data-driven tweaks, it could improve its results even more.

2. Leaning Into UGC

Amazon knows that when it comes to influencing purchase decisions, nothing beats authenticity. That’s exactly why the brand regularly features user-generated content (UGC) across its platforms.

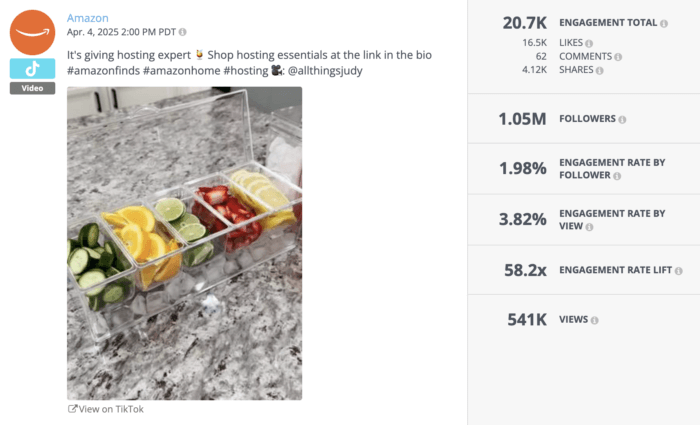

UGC, by definition, is content created by individual users and then repurposed by the brand for its own channels (with permission, of course). Often, this means reposting a creator’s existing content. For instance, a TikTok posted in January 2025 by influencer @allthingsjudy was later reposted by Amazon in April.

In fact, this piece of UGC became Amazon’s second most engaging TikTok of the period analyzed, pulling in a 1.98% engagement rate — comfortably above the retail industry’s median engagement rate of 1.28%.

Why does UGC work so well? Consumers inherently trust “real” people more than a corporate spokesperson. Seeing a creator unbox, test, or style a product taps into that peer-to-peer recommendation effect and makes the content feel relatable and credible. Plus, the video format lets them see the product in action, unveiling details that static photos often can’t.

3. Investing in Influencer Marketing

Beyond reposting organic UGC, Amazon also actively invests in influencer marketing and having creators develop content specifically for its social channels. These collabs range from subtle integrations to full-scale campaigns, and often blur the line between UGC and sponsored content.

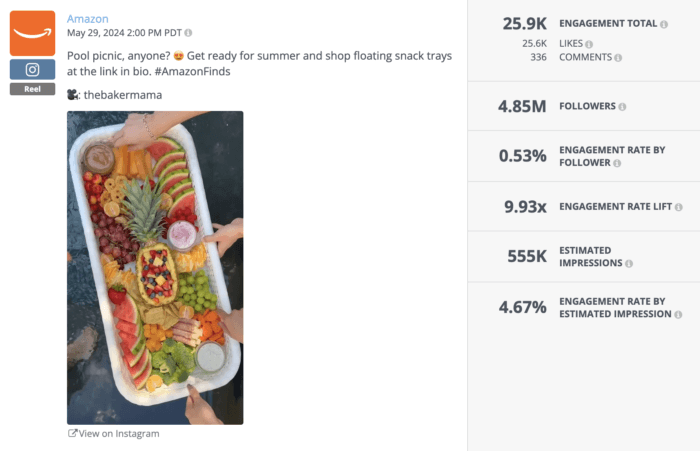

Take Amazon’s Instagram Reel featuring @thebakermama, for example. While the video wasn’t posted on the influencer’s own feed, it’s also not obviously branded as a piece of Amazon content.

Featuring the influencer promoting a floatable snack tray, the UGC-style video drove a 0.53% engagement rate — 3.3x higher than the retail industry median. It also ranked as Amazon’s fifth most engaging Instagram post in the period analyzed.

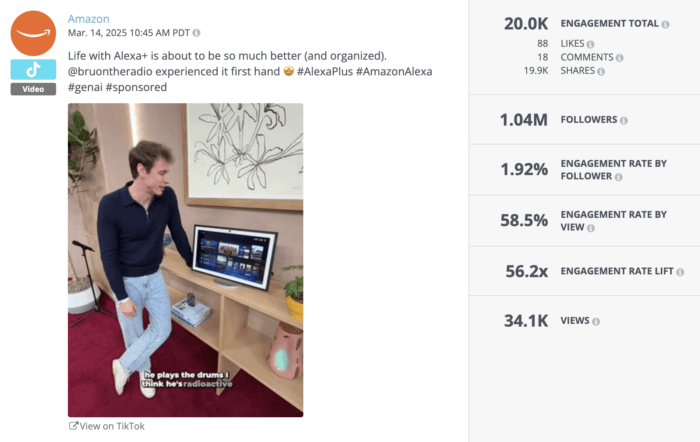

Then we have the more traditional influencer campaigns, which are often larger in scope and clearly marked with #ad or #sponsored. Amazon’s third most engaging TikTok of the year, for example, featured @bruontheradio, who was flown in to learn more about Alexa+. It was a fully branded collaboration that clearly resonated with viewers.

From everyday creators to more curated influencer partnerships, Amazon is tapping into outside voices to communicate its value. This helps the brand drive trust, expand its reach, and boost engagement.

4. Strategically Partnering With Major Celebrities

Amazon doesn’t lean heavily on celebrity partnerships, but when it does, the results are hard to ignore. Unlike brands that consistently rely on A-List collabs, Amazon only taps into star power occasionally, and that might just be the secret to its success here.

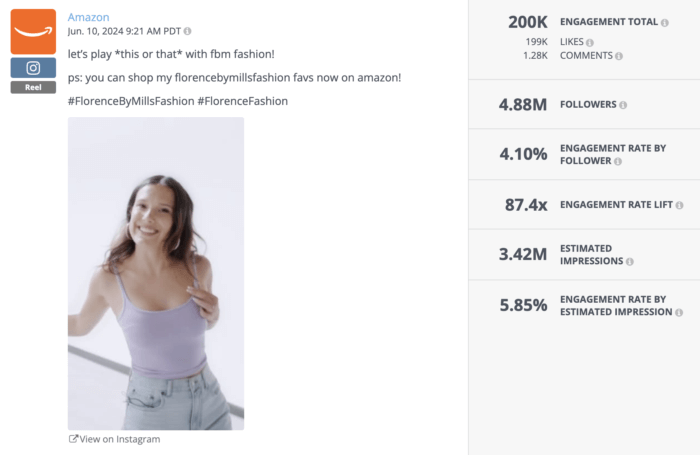

One standout example? An Instagram post featuring actress Millie Bobby Brown promoting her fashion brand. It became the most engaging post across all platforms during the time period analyzed, racking up 200K engagements and an impressive 4.10% engagement rate. That’s 25.6x higher than the median Instagram engagement rate for retail brands.

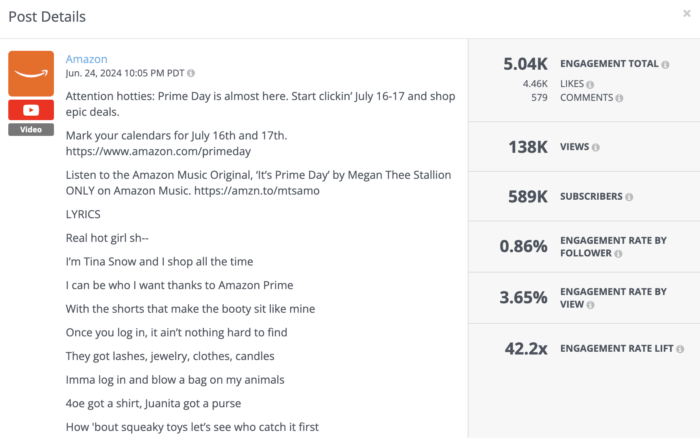

On YouTube, Amazon also saw major results from its Prime Day campaign starring Megan Thee Stallion. The video became one of the most engaged pieces of content on the platform, showing that when Amazon pairs a major event with the right celebrity voice, audiences respond in a big way.

Rather than overusing celebrity content, Amazon appears to reserve it for high-impact moments, whether it’s product launches or retail events like Prime Day. This scarcity makes the content more eye-catching and ultimately more engaging.

5. Spotlighting Human Moments

Amazon knows the value of showing its more human side. The brand regularly shares clips of real people — often its own delivery drivers — in funny, unscripted situations. These aren’t polished influencer videos or big-budget ads. They’re genuine moments from everyday life, and they resonate.

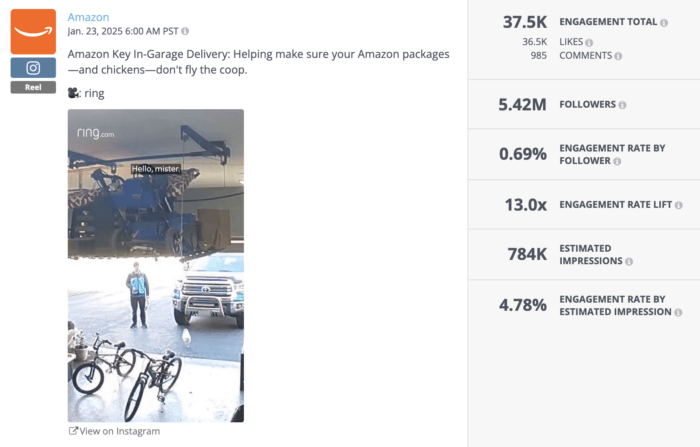

For example, a Ring clip showing a delivery driver’s interaction with a customer’s chicken earned 37.5K engagements. Viewers found it hilarious, and the video also showed the Amazon Key In-Garage Delivery service in action.

Another Ring video features a driver’s heartwarming moment petting mini pigs while on the job. That post drove over 30K engagements — nearly 4x the median engagement rate — and highlighted Amazon’s “Thank My Driver” feature, which sends drivers a $5 tip at no extra cost to customers.

There are several benefits to posting this type of content. For one, each clip doubles as a mini ad for Amazon-owned products or services (Ring cameras, in-garage delivery, driver appreciation) without feeling pushy. UGC like this also lets Amazon maintain a high posting frequency without creating all content in-house.

Perhaps most importantly, though, funny or heartwarming content cuts through the noise. By mixing in these human-centered stories, Amazon strengthens its connection with followers and adds lightness to its feed. It’s a reminder that behind the massive scale and global reach, there’s still room for small, authentic moments that make people smile.

Methodology

We used Rival IQ to analyze Amazon’s social media strategy and looked at key metrics like engagement rates, follower counts, and post types. The data in this breakdown reflects the period from May 27, 2024, to May 26, 2025. We also leveraged insights from our 2025 Social Media Industry Benchmark Report to provide context and compare Amazon’s performance against other leading retail brands.

The Wrap Up

From celebrity partnerships to funny delivery moments, Amazon does more than just broadcast its products. It keeps its massive audience engaged and growing. Creating effective social media content is all about knowing what resonates with your audience. And Amazon seems to have that figured out.

But how do you know if your own content is working? Social media analytics platforms like Rival IQ can help you run audits, track performance, and benchmark against competitors so you know exactly how well you’re doing. Ready to see how your brand stacks up? Start your free trial with Rival IQ today and take the guesswork out of your social strategy.