Each quarter, we do a social media evaluation of a key market. Our report is called the Rival Results Index or RRI. The RRI is a comprehensive analysis and scoring system of a market on social media. It is designed to provide a competitive and data-driven view across key social media measurements, including presence, reach, engagement and content.

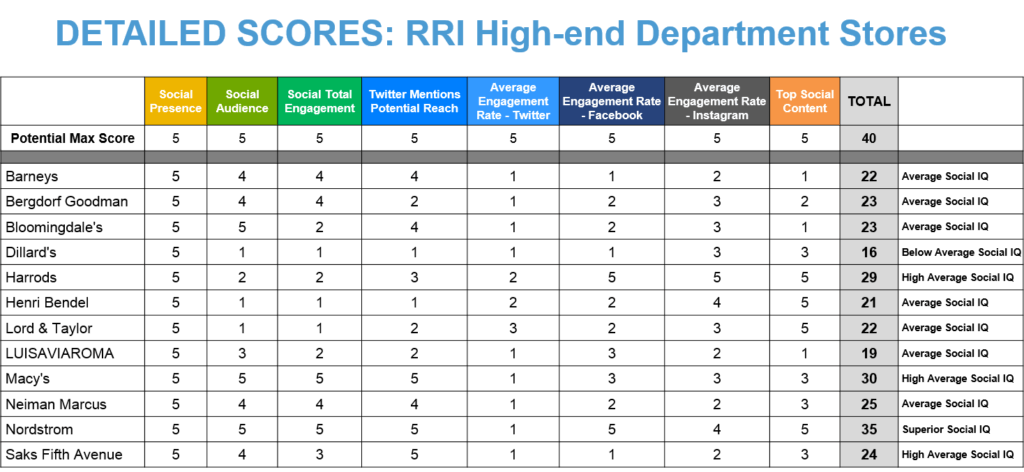

For Q1 2015, we did an RRI for High-end Department Stores, which analyzed and scored 12 top brands based on their social media performance from January 1 through March 31, 2015. In this report, Nordstrom was the only department store to receive the highest ranking of Superior Social IQ.

Download the complete report for free

Social IQ Evaluation Areas

The RRI evaluated the department stores on the following categories:

- Social Presence

- Social Audience

- Social Total Engagement

- Twitter Mentions Potential Reach

- Average Engagement Rate on Twitter

- Average Engagement Rate on Facebook

- Average Engagement Rate on Instagram

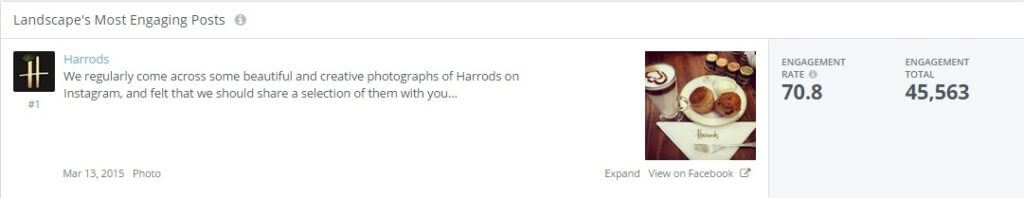

- Top Social Content across Twitter, Facebook, Instagram and Google+

High-end Department Stores Overall Analysis

While these brands surely spend billions on marketing overall, it would appear several are still not fully investing in social media. In our topline analysis, we found:

- A lot of social media best practices and “standards” are being missed by these huge department stores that spend millions on advertising. They are missing the viral value of social media.

- No eCommerce connection between their Instagram or Facebook pages and online stores. Big gap! They are only posting content, and not leveraging product images or content with potential purchases. We have seen many leading brands starting to beautifully connect their social media channels directly with eCommerce purchasing.

- Most brands do well on only one or two channels but are not consistently focused across channels or leveraging content or messages across channels. They should all be rocking Twitter, Instagram and Facebook – at least.

- No pattern or consistency in how much or when they post on different channels.

- There is a higher focus on building audience and activity (posting) rather than engagement.

Four Big Surprises

Based on this, we were really surprised by the following results:

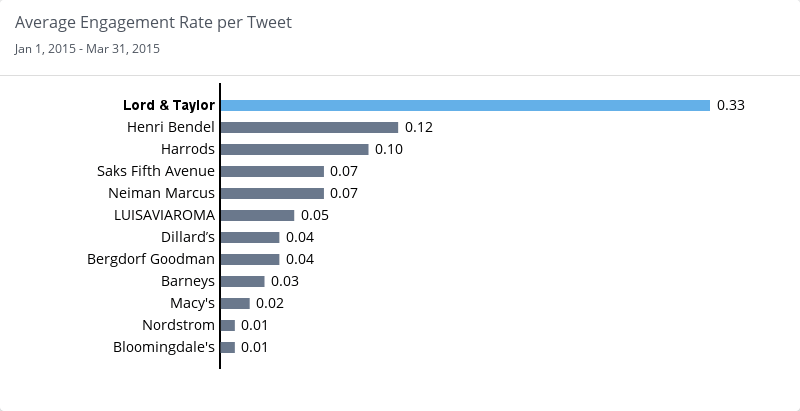

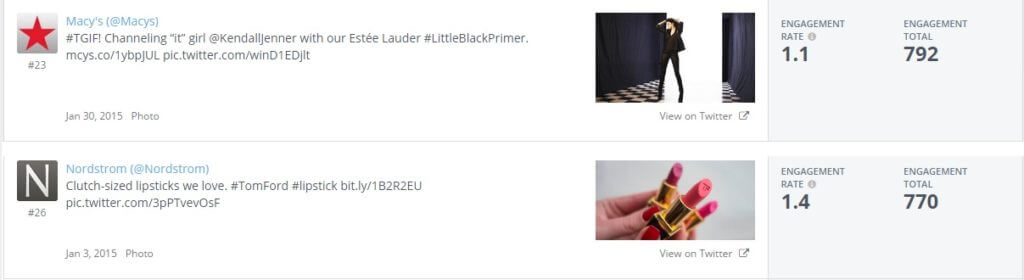

- Really low engagement on Twitter and Facebook. On Twitter, part of this is the lack of using images. Stores are posting frequently but not focused on engagement with their social audience.

- Hashtag abuse or lack of use overall. This is a huge issue on all channels, including Instagram, which is an extremely hashtag-centric network.

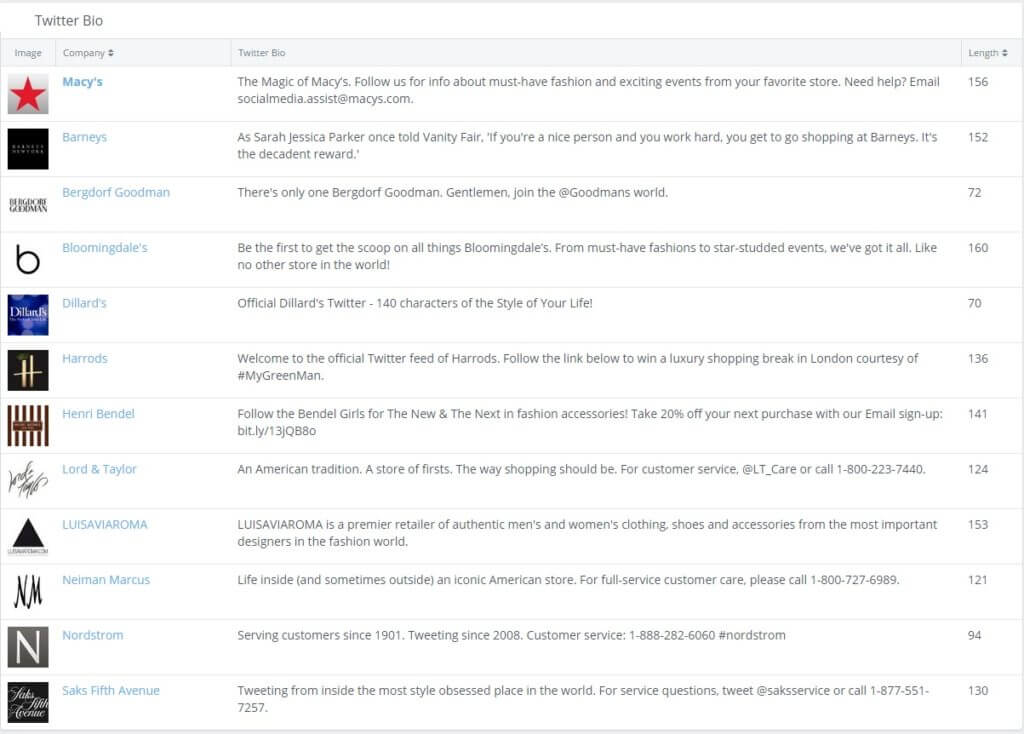

- Lack of social profile optimization or consistency. There are minimal to no product links, hashtags or branding consistency across channels. Even for sister companies, there is no cross-brand consistency.

- No connection or link to sub-brands or partner brands. For example, stores are not using product brand Twitter handles to tie the two brands together. This is true even for Nordstrom, who scored the highest Social IQ. In doing so, they are missing the influence and extended reach of these other brands.

What you can learn

The big takeaway from this is even some of the most well-known brands can improve on their social media. This is also another reminder to not do your social media in a vacuum – see how you are doing relevant to your competition and other brands in your market. You may be doing better than you think, or you may be drinking your own koolaid and getting out socialed by others!

Read the research report to learn more about how you can increase your Social IQ and beat the competition.