In our last few posts we’ve explored a couple of key SEO techniques by comparing key players in specific markets and drawing competitive insights from what we saw.

And that got me wondering…are tech companies more savvy when it comes to digital marketing?

Lucky for me, through our partnership with Geekwire, Rival IQ monitors and benchmarks the digital activities of approximately 297 Seattle-area tech companies that move in and out of the GeekWire 200 ranked index every month. So it didn’t take long to find answers…

Drumroll please…

I decided to compare these high-growth tech companies to the thousands of companies Rival IQ tracks regularly. Specifically, I looked at the quality of their meta descriptions and whether or not they were exposing their keywords to the world.

Top-Notch Meta Description? No better than the average bear.

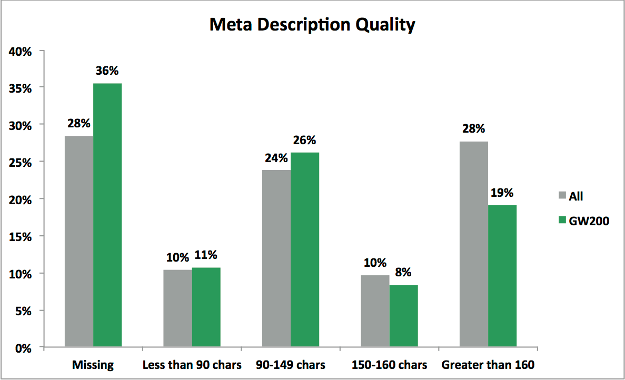

Even though homepage meta descriptions play an important role in getting people to your website, Rival IQ determined that 56% of the companies in our database had left their meta descriptions blank or had descriptions that were too long to be effective. (Read more at – Is Your Meta Description Working As Hard As Your Tagline?)

How did the tech companies compare?

Turns out 36% of the GeekWire 200 had missing meta descriptions and another 19% had written descriptions that were too long and therefore getting cut-off mid sentence in the search results. So 55% of the tech companies rated a fail.

Score: TIE

Keyword Savvy? Not so much.

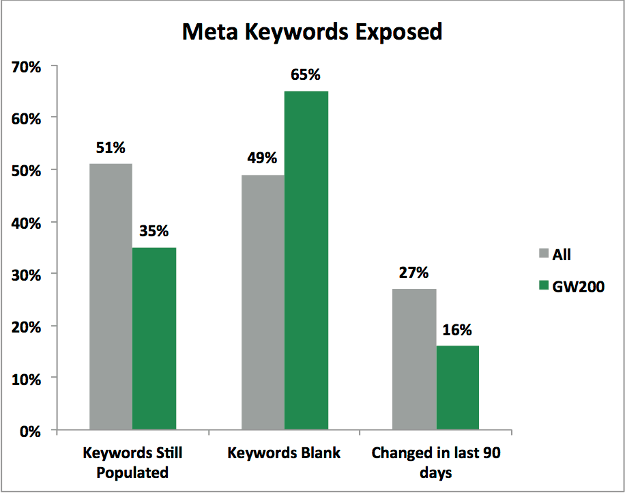

Even though the search engines no longer leverage meta keywords in their algorithms, quite a few companies, over 50% in our database, are still populating these fields on their website and 27% of those are optimizing their content. As a result, they’re exposing their keyword strategy to the world. (Read more at – Are you accidentally exposing your keyword strategy?!)

Are tech companies on the ball?

I’ll give this a qualified yes. Only 35% of the GeekWire 200 is sharing their keywords with the world and fewer are actively optimizing them. Better, but that’s still a lot of opportunity for market-watchers to gain valuable insight on how to compete against these market-leading tech companies.

Score: Point to the Tech Companies.

Conclusion? Technology DNA Doesn’t Necessarily Raise Your Digital IQ

Running With The Social Media Big Dogs

Many of the GeekWire 200 leverage social media in their marketing mix. Analyzing their activity on Twitter, Facebook and LinkedIn gave me a great opportunity to explore the strategic insights available to marketers, including:

- Channel choice

- Market movers

- Audience engagement

Let’s take a look. It’s time to get off the porch and run with the big dogs!

Twitter Standing, Movement & Engagement.

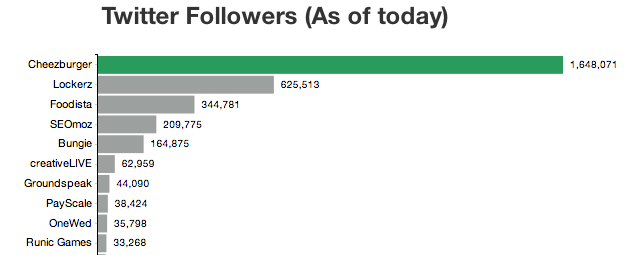

I always recommend having a baseline understanding of how your following on social media compares to others in your market. Here’s an example:

In terms of a raw following on Twitter, the humor site Cheezburger is the big dog in the GeekWire 200. Lockerz, the social commerce and sharing site, comes in second with less than half as many followers.

We also have two video game developers in this analysis⎯Bungie and Runic Games⎯with Bungie being the big dog with over 130,000 more followers.

Insight: As a marketer at Runic Games, I’d be looking more closely at Twitter. Assuming the companies have similar target audiences, Twitter could be a powerful channel to engage Runic’s customers and prospects.

Who’s Making a Play?

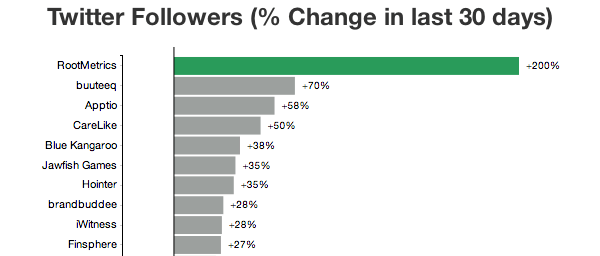

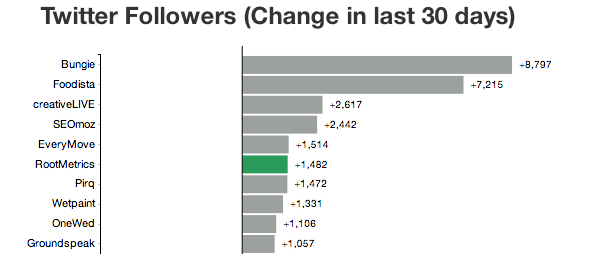

Benchmarking alone doesn’t provide insight on who’s achieving success via a specific channel. If we look at who gained followers in the last 30 days, we discover that RootMetrics, a company specializing in wireless coverage mapping, made the big play⎯increasing their followers by 200%.

If you’re looking at percentage increases, it’s important to confirm you’re beginning with a respectable base. Adding 20 new followers to a base of 10 is a 200% increase, but isn’t worth getting fired up over.

In the case of RootMetrics, they’ve grown from a base of 744 followers to 2,226 in 30 days. That’s 1,482 new followers. Movement worth watching and understanding.

Insight: A deeper look reveals that RootMetrics has upped their tweet volume and the number of audience retweets has also increased significantly.

As a marketer in the same industry, I’d be looking closely the level of my Twitter volume and investigating the RootMetric’s tweet topics that resonating enough to merit retweeting.

Insights from the Facebook Big Dogs.

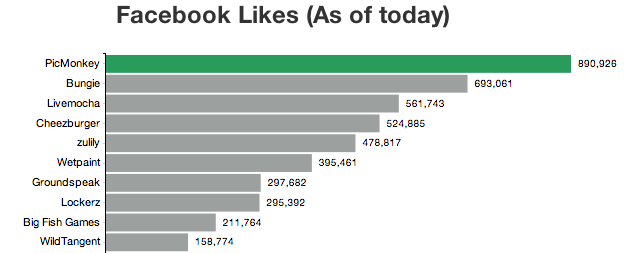

Again beginning with the benchmark view, we discover that among the GeekWire 200, free online photo editor PicMonkey is the biggest dog on Facebook. But there are several other big dogs nipping at their heels. It’s also interesting to note that the Facebook big dogs are all chasing consumers.

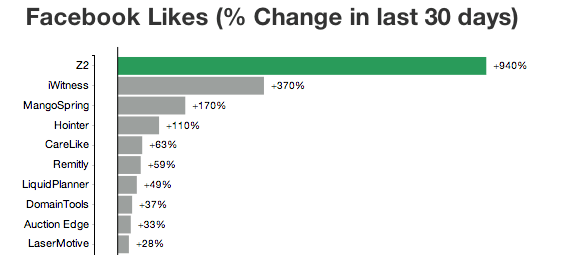

Z2 is making a Facebook play.

A look at the percentage change growth in Facebook Likes indicates mobile online game developer, Z2, is making a move.

Z2 chalked up a 9x growth spurt in Facebook followers, growing from 1,619 to 16,835 in the last 30 days. Definitely something to know if you’re competing for mobile gaming mind share.

But wait… there’s movement from the back of the pack.

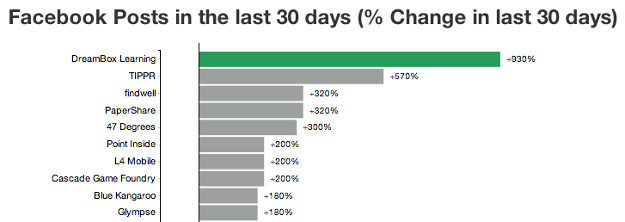

A check of posting activity for the month reveals that DreamBox Learning, creators of math learning games for kids K-5, has drastically increased their Facebook activity in March.

Dreambox Learning stands out in increase in posting activity with their recent concerted engagement on Facebook

Insight: Big changes in posting volume can highlight a shift in market strategy. If I were competing against DreamBox, I’d be watching their growth in engagement via Likes and Talking About numbers to determine if Facebook is a channel I should leverage more.

Tableau Dominates LinkedIn.

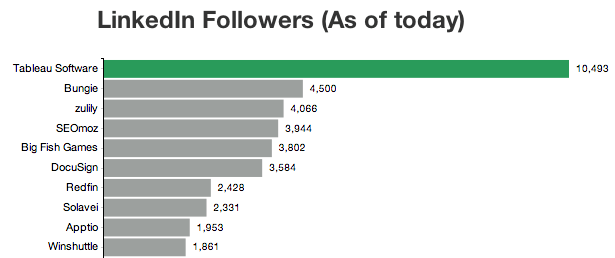

Unlike Facebook, there’s only one big dog in the GeekWire 200 when it comes leveraging LinkedIn. Tableau Software, developers of data visualization products for business intelligence, dominates this channel.

Domination requires dedication.

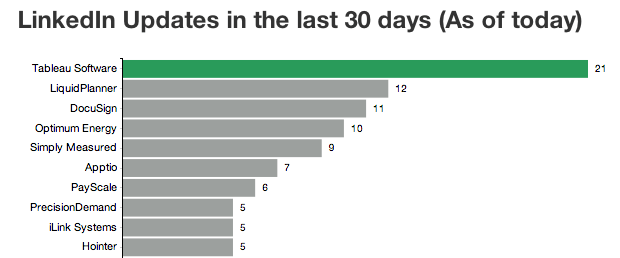

Tableau posted to LinkedIn twenty one times in March – approximately once every business day in the month. That’s nearly twice as often as the next tier of companies the pack.

Tableau’s is hitting their target audience.

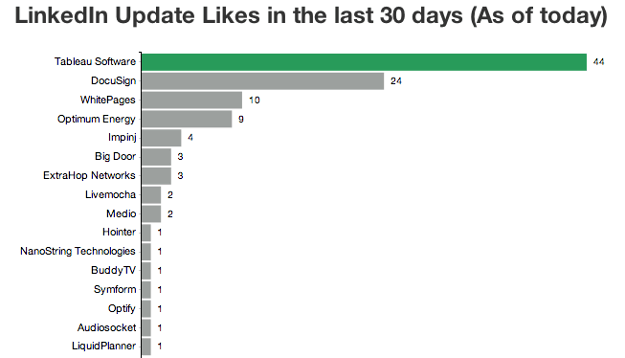

The content of Tableau’s posts on LinkedIn is resonating with their followers. In March, they received 44 LinkedIn Likes. That number may not seem significant, but it turns out only 16 companies in GeekWire 200 received Update Likes in March. Context is everything.

Insight: Tableau’s domination of LinkedIn stems from both the frequency and quality of their posts. If I were competing against them, I’d closely review Tableau’s LinkedIn content for insights on topics that are top of mind with my audience and use their post frequency to set my activity objectives.

Have we learned from Seattle’s Tech Community?

So while the GeekWire 200 failed to make the case that technology companies are better digital marketers, I think taking a closer look at their efforts yielded some important learning:

- Check Your Meta Description. Given that 50% of the companies in Rival IQs database are failing to optimize their homepage meta descriptions, you should probably confirm that yours is encouraging searchers to click-through to your site with a read-through.

- Don’t Broadcast Your Keywords. It’s also worth checking that you aren’t one of the 35% – 50% sharing your keyword strategy with the world.

- Monitoring Social Networks Informs Strategy. Knowing how your use of social media compares to others in your market sheds light on whether you should be leveraging a specific channel. It also provides insight on topics that resonate and the level of activity that will help you gain engagement with your audience. It also shines a light on activity that merits your attention⎯competitors who are upping their game or adopting new strategies for reaching your audience.

Want to Dig Deeper Into the GeekWire 200?

If you want to do your own deeper analysis, Rival IQ is happy to give you access to the data and our analysis tools. Click here to add the GeekWire 200 profile to your existing account or to signup and we will populate a profile with information on the 297 Seattle Tech companies monitored in this index.